OPEN-SOURCE SCRIPT

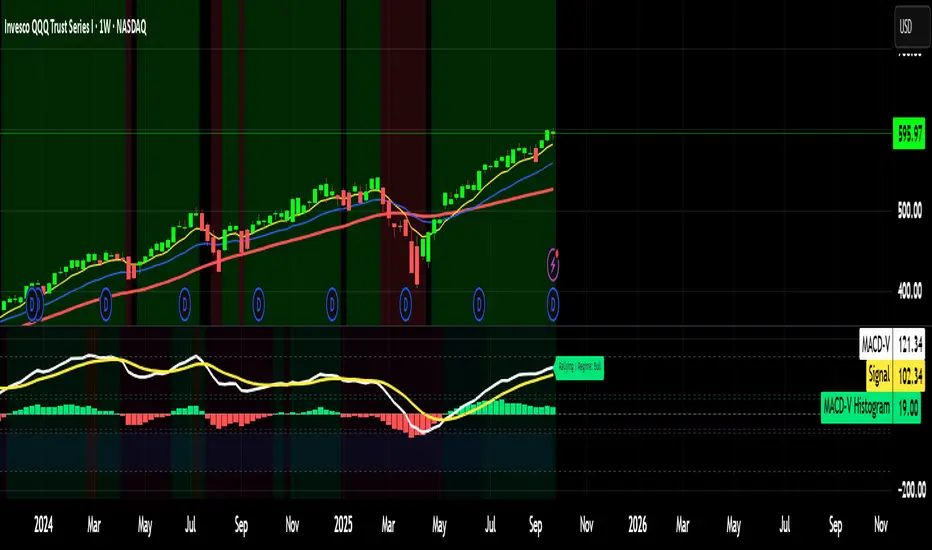

MACD-V Momentum

The MACD-V (Moving Average Convergence Divergence – Volatility Normalized) is an award-winning momentum indicator created by Alex Spiroglou, CFTe, DipTA (ATAA). It improves on the traditional MACD by normalizing momentum with volatility, solving several well-known limitations of classic indicators:

✅ Time stability – readings are consistent across history

✅ Cross-market comparability – works equally on stocks, crypto, forex, and commodities

✅ Objective momentum framework – universal thresholds at +150 / -150, +50 / -50

✅ Cleaner signals – reduces false signals in ranges and lag in high momentum

By dividing the MACD spread by ATR, the indicator expresses momentum in volatility units, allowing meaningful comparison across timeframes and markets.

MACD-V defines seven objective momentum states:

Risk (Oversold): below -150

Rebounding: -150 to +50 and above signal

Rallying: +50 to +150 and above signal

Risk (Overbought): above +150

Retracing: above -50 and below signal

Reversing: -150 to -50 and below signal

Ranging: between -50 and +50 for N bars

Optional background tints highlight the active regime (Bull above 200-MA, Bear below 200-MA).

Rare extremes (e.g., MACD-V < -100 in a bull regime) are tagged for additional context.

Use Cases

Identify and track momentum lifecycles across any market

Spot rare extremes for potential reversal opportunities

Filter out low-momentum whipsaws in ranging conditions

Compare momentum strength across multiple symbols

Support systematic and rule-based strategy development

✅ Time stability – readings are consistent across history

✅ Cross-market comparability – works equally on stocks, crypto, forex, and commodities

✅ Objective momentum framework – universal thresholds at +150 / -150, +50 / -50

✅ Cleaner signals – reduces false signals in ranges and lag in high momentum

By dividing the MACD spread by ATR, the indicator expresses momentum in volatility units, allowing meaningful comparison across timeframes and markets.

MACD-V defines seven objective momentum states:

Risk (Oversold): below -150

Rebounding: -150 to +50 and above signal

Rallying: +50 to +150 and above signal

Risk (Overbought): above +150

Retracing: above -50 and below signal

Reversing: -150 to -50 and below signal

Ranging: between -50 and +50 for N bars

Optional background tints highlight the active regime (Bull above 200-MA, Bear below 200-MA).

Rare extremes (e.g., MACD-V < -100 in a bull regime) are tagged for additional context.

Use Cases

Identify and track momentum lifecycles across any market

Spot rare extremes for potential reversal opportunities

Filter out low-momentum whipsaws in ranging conditions

Compare momentum strength across multiple symbols

Support systematic and rule-based strategy development

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.