OPEN-SOURCE SCRIPT

Normalized Jurik Moving Average [QuantAlgo]

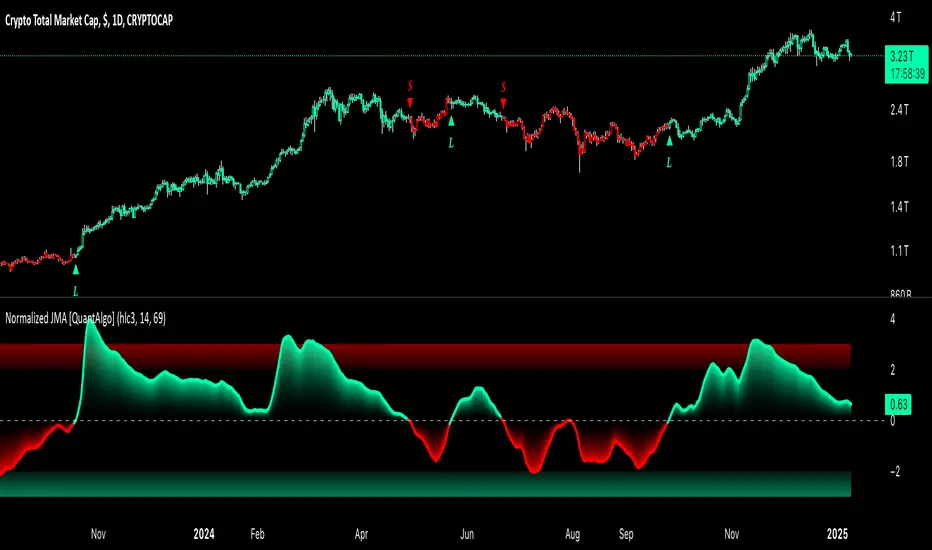

Upgrade your investing and trading strategy with the Normalized Jurik Moving Average (JMA), a sophisticated oscillator that combines adaptive smoothing with statistical normalization to deliver high-quality signals! Whether you're a swing trader looking for momentum shifts or a medium- to long-term investor focusing on trend validation, this indicator's statistical approach offers valuable analytical advantages that can enhance your trading and investing decisions!

🟢 Core Architecture

The foundation of this indicator lies in its unique dual-layer calculation system. The first layer implements the Jurik Moving Average, known for its superior noise reduction and responsiveness, while the second layer applies statistical normalization (Z-Score) to create standardized readings. This sophisticated approach helps identify significant price movements while filtering out market noise across various timeframes and instruments.

🟢 Technical Foundation

Three key components power this indicator are:

🟢 Key Features & Signals

The Normalized JMA delivers market insights through:

🟢 Practical Usage Tips

Here's how to maximize your use of the Normalized JMA:

1/ Setup:

2/ Reading Signals:

🟢 Pro Tips

🟢 Core Architecture

The foundation of this indicator lies in its unique dual-layer calculation system. The first layer implements the Jurik Moving Average, known for its superior noise reduction and responsiveness, while the second layer applies statistical normalization (Z-Score) to create standardized readings. This sophisticated approach helps identify significant price movements while filtering out market noise across various timeframes and instruments.

🟢 Technical Foundation

Three key components power this indicator are:

- Jurik Moving Average (JMA): An advanced moving average calculation that provides superior smoothing with minimal lag

- Statistical Normalization: Z-Score based scaling that creates consistent, comparable readings across different market conditions

- Dynamic Zone Detection: Automatically identifies overbought and oversold conditions based on statistical deviations

🟢 Key Features & Signals

The Normalized JMA delivers market insights through:

- Color-adaptive oscillator line that reflects momentum strength and direction

- Statistically significant overbought/oversold zones for trade validation

- Smart gradient fills between signal line and zero level for enhanced visualization

- Clear long (L) and short (S) markers for validated momentum shifts

- Intelligent bar coloring that highlights the current market state

- Customizable alert system for both bullish and bearish setups

🟢 Practical Usage Tips

Here's how to maximize your use of the Normalized JMA:

1/ Setup:

- Add the indicator to your favorites, then apply it to your chart ⭐️

- Begin with the default smoothing period for balanced analysis

- Use the default normalization period for optimal signal generation

- Start with standard visualization settings

- Customize colors to match your chart preferences

- Enable both bar coloring and signal markers for complete visual feedback

2/ Reading Signals:

- Watch for L/S markers - they indicate validated momentum shifts

- Monitor oscillator line color changes for direction confirmation

- Use the built-in alert system to stay informed of potential trend changes

🟢 Pro Tips

- Adjust Smoothing Period based on your trading style:

→ Lower values (8-12) for more responsive signals

→ Higher values (20-30) for more stable trend identification

- Fine-tune Normalization Period based on market conditions:

→ Shorter periods (20-25) for more dynamic markets

→ Longer periods (40-50) for more stable markets

- Optimize your analysis by:

→ Using +2/-2 zones for primary trade signals

→ Using +3/-3 zones for extreme market conditions

→ Combining with volume analysis for trade confirmation

→ Using multiple timeframe analysis for strategic context

- Combine with:

→ Volume indicators for trade validation

→ Price action for entry timing

→ Support/resistance levels for profit targets

→ Trend-following indicators for directional bias

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

👉 Access our best trading & investing tools here (3-day FREE trial): whop.com/quantalgo/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

👉 Access our best trading & investing tools here (3-day FREE trial): whop.com/quantalgo/

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.