MP Master VWAP [BackQuant]

Overview

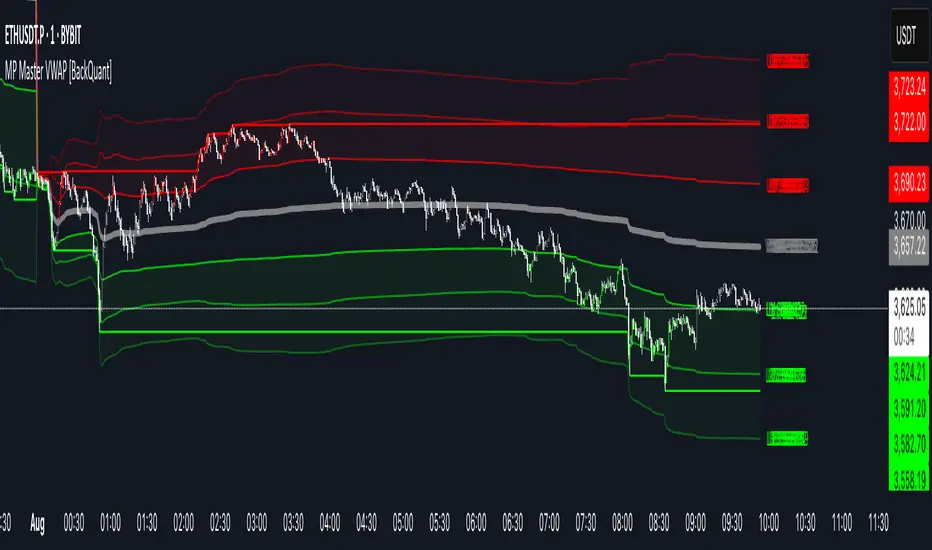

MP Master VWAP is an, volume-weighted average price suite. It re-anchors automatically to any time partition you select—Day, Week, Month, Quarter or Year—and builds an adaptive standard-deviation envelope, optional pivot clusters and context-aware candle colouring so you can read balance, imbalance and auction edges in a single glance. We use private methods on calculating key levels, making them adaptive and more responsive. This is not just a plain VWAP.

Key Components

• Anchored VWAP core – The engine resets VWAP the instant a new session for the chosen anchor begins. Separator lines and a live high–low box make those rotations obvious.

• Dynamic sigma bands – Three upper and three lower bands, scaled by real-time standard deviation. 1-σ filters noise, 2-σ marks momentum, 3-σ flags exhaustion.

• Previous-period memory – The prior session’s VWAP and bands stay on-screen in a muted style so you can trade retests of last month’s value without clutter.

• High-precision price labels – VWAP and every active band print their prices on the hard right edge; labels vanish if you want a cleaner chart.

• Pivot package – Choose Traditional, Fibonacci or Camarilla calculations on a Daily, Weekly or Monthly look-back. Levels plot as subtle circles that complement, not compete with, the VWAP map.

• Context candles – Bars tint relative to their location: vivid red above U2, soft red between U1-U2, neutral grey inside value, soft green between L2-L1, vivid green below L2.

Customisation Highlights

Period section

• Anchor reset drop-down [Day, Week, Month, Quarter, Year]

• Toggles for separator lines and period high/low

Band section

• Independent visibility for L1/U1, L2/U2, L3/U3

• Individual multipliers to fit any volatility profile

• Optional real-time price labels

Pivot section

• Three formula choices

• Independent timeframe—mix a Monthly VWAP with Weekly Camarilla for confluence

Visual section

• Separate switches for current vs previous envelopes

• Candle-colour toggle for traders who prefer raw price bars

Colour section

• Full palette selectors to match dark or light themes instantly

Some Potential Ways it can be used:

Mean-reversion fade – Price spikes into U2 or U3 and stalls (especially at a pivot). Fade back toward VWAP; scale out at U1 and VWAP.

Trend continuation – Close above U1 on rising volume; trail a stop behind U1. Mirror setup for shorts under L1.

Breakout validation – Session gaps below previous VWAP but quickly reclaims it. Use the cross-above alert to automate entry and target U1 / U2.

Overnight inventory flush – Globex extremes that tag L2 / U2 often reverse at the cash open; scalp rotations back to VWAP.

Risk framing – Let the gap between VWAP and L2 / U2 dictate position size, keeping reward-to-risk consistent across assets.

Alerts Included

• Cross above / below current VWAP

• Cross first sigma bands (U1 / L1)

• Break above second sigma bands (U2) or below L2

• Touch of third sigma bands (U3 / L3)

• Cross of previous-period VWAP

• New period high or low

Best Practices

• Tighten sigma multipliers on thin-liquidity symbols; widen them on index futures or high-cap crypto.

• Pair the envelope with order-flow or footprint tools to confirm participation at band edges.

• On intraday charts, anchor a higher-timeframe VWAP (e.g., Monthly on a 15-minute) to reveal institutional accumulation.

• Treat the previous period’s VWAP as yesterday’s fair value—gaps that never revisit it often morph into trend days.

Final Notes

MP Master VWAP condenses auction-market theory into one readable overlay: automatic period resets, adaptive deviation bands, historical memory, multi-style pivots and self-explanatory colour coding. You can deploy it on equities, futures, crypto or FX—wherever volume meets time, VWAP remains the benchmark of true price discovery.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente BackQuant.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente BackQuant.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.