OPEN-SOURCE SCRIPT

Pearsons R historic breaks ( for making strategy out of it )

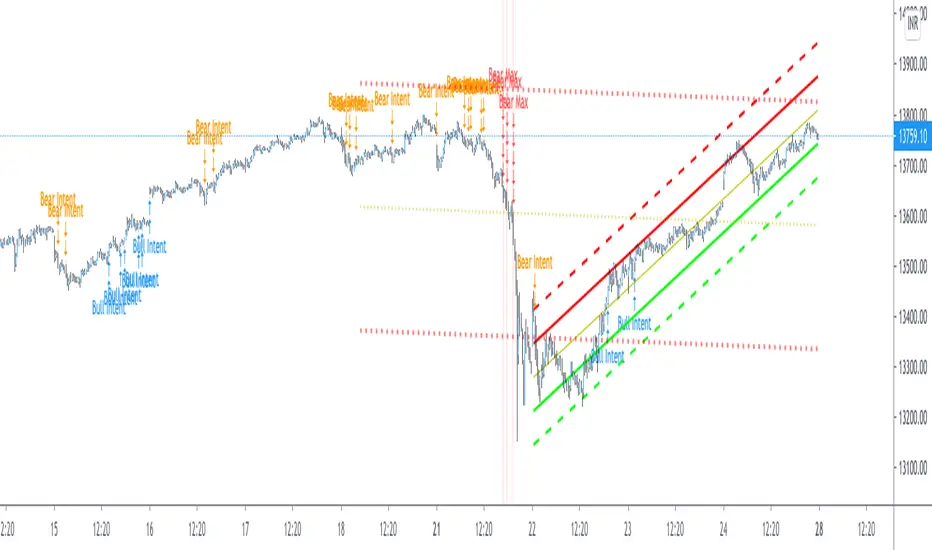

Pearsons R adjustments of linear regressions is a good tool to analyse visually the trend basis channeling of the market,

one of the common challenges in the scripts which i came across the tradingview community is the lack of the historic places put over the charts where the price actually crossed up/below the channel boundaries,

For me in order to do so we would have to replay the scripts over and over.

So I came up with an addon extension to a good script on the community (tradingview.com/script/FZXagyA6-Linear-Regression-Auto-Adjust-To-Ideal-Pearson-s-R-Min-Max/)

I have added the historic marks over the charts ( blue/green/red/orange Arrows which you see on the charts)

These arrows are the places where the price have crossed the channel boundaries historically

So,

Blue arrow = Bull Intent ,Place where the upper channel boundary line have been crossed

Orange arrow = Bear Intent , Place where the Lower channel boundary line have been crossed

Green arrow = Bull Max , Place where the Maximum Upper channel boundary line have been crossed

Red arrow = Bear Max , Place where the Minimum Lower channel boundary line have been crossed

For me this type of approach is good for making a strategy out of the concepts visually, in congestion to other indicators

I would suggest you guys to check this on alert basis with your setups to derive out the best from linear regressions

Lastly it would be a pleasure to give credits to the creators of Pearsons R scripts in Tradingview

@midtownsk8rguy

TradeBoneDogs

@x11joe [this code base is inspired from tradingview.com/script/FZXagyA6-Linear-Regression-Auto-Adjust-To-Ideal-Pearson-s-R-Min-Max/]

Also thanking Tradingview for providing us such an awesome community and platform :)

one of the common challenges in the scripts which i came across the tradingview community is the lack of the historic places put over the charts where the price actually crossed up/below the channel boundaries,

For me in order to do so we would have to replay the scripts over and over.

So I came up with an addon extension to a good script on the community (tradingview.com/script/FZXagyA6-Linear-Regression-Auto-Adjust-To-Ideal-Pearson-s-R-Min-Max/)

I have added the historic marks over the charts ( blue/green/red/orange Arrows which you see on the charts)

These arrows are the places where the price have crossed the channel boundaries historically

So,

Blue arrow = Bull Intent ,Place where the upper channel boundary line have been crossed

Orange arrow = Bear Intent , Place where the Lower channel boundary line have been crossed

Green arrow = Bull Max , Place where the Maximum Upper channel boundary line have been crossed

Red arrow = Bear Max , Place where the Minimum Lower channel boundary line have been crossed

For me this type of approach is good for making a strategy out of the concepts visually, in congestion to other indicators

I would suggest you guys to check this on alert basis with your setups to derive out the best from linear regressions

Lastly it would be a pleasure to give credits to the creators of Pearsons R scripts in Tradingview

@midtownsk8rguy

TradeBoneDogs

@x11joe [this code base is inspired from tradingview.com/script/FZXagyA6-Linear-Regression-Auto-Adjust-To-Ideal-Pearson-s-R-Min-Max/]

Also thanking Tradingview for providing us such an awesome community and platform :)

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Get Ocs Ai Trader, Your personal Ai Trade Assistant here

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

→ ocstrader.com

About me

AlgoTrading Certification, ( University of Oxford, Säid Business School )

PGP Research Analysis, ( NISM, SEBI )

Electronics Engineer

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.