OPEN-SOURCE SCRIPT

Aggiornato Fair Value Calculator V 1.0

Fair Value Calculator V 1.0

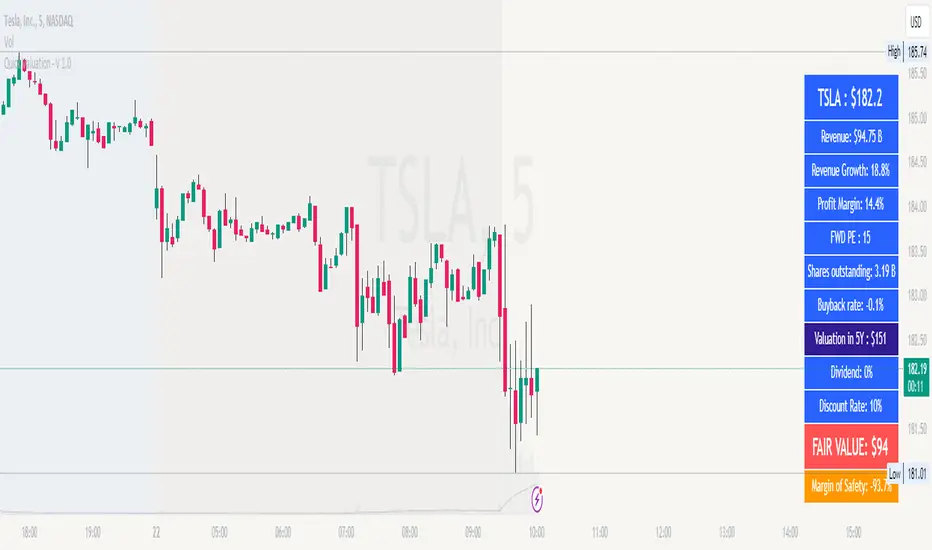

This indicator calculates the fair value of a stock based on the revenue growth rate and net profit margin of a company, providing a quick estimate of its intrinsic worth. The calculation takes into account:

Using these inputs, the indicator estimates the fair value of the stock, providing a valuable tool for investors and traders to make informed decisions.

Note: all values can be adjusted by the user by entering the desired value and selecting the item in the setup menu.

How it works

Benefits

Note

This indicator is for informational purposes only and should not be considered as investment advice. Always do your own research and consider multiple perspectives before making investment decisions.

This indicator calculates the fair value of a stock based on the revenue growth rate and net profit margin of a company, providing a quick estimate of its intrinsic worth. The calculation takes into account:

- Current Revenue: The company's current revenue

- 5-Year Growth Rate: Expected revenue annual growth rate (CAGR) over the next 5 years

- Average PE Ratio: The average Price-to-Earnings ratio for the next 5 years

- Average Profit Margin: The average profit margin for the next 5 years

- Share Outstanding: The total number of shares outstanding

- Yearly Share Buyback Rate: The percentage of shares bought back by the company each year

- Discount Rate: The rate used to calculate the present value of the fair value

Using these inputs, the indicator estimates the fair value of the stock, providing a valuable tool for investors and traders to make informed decisions.

Note: all values can be adjusted by the user by entering the desired value and selecting the item in the setup menu.

How it works

- The indicator calculates the future revenue based on the current revenue and the expected revenue annual growth rate (CAGR).

- It then estimates the future earnings using the average profit margin.

- The future price is calculated using the exit value of the PE ratio.

- The present value of the fair value is calculated using the discount rate.

- The indicator adjusts the fair value based on the yearly share buyback rate.

Benefits

- Provides a quick but valuable estimate of a stock's fair value based on the revenue growth and the expected profit.

- Helps investors and traders identify undervalued or overvalued stocks.

- Allows users to adjust inputs to suit their own assumptions and scenarios.

Note

This indicator is for informational purposes only and should not be considered as investment advice. Always do your own research and consider multiple perspectives before making investment decisions.

Note di rilascio

- Corrected the negative valuation issue.Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.