OPEN-SOURCE SCRIPT

Aggiornato [blackcat] L2 Ehlers Two Pole Super Smoother

Level: 2

Background

John F. Ehlers introuced Two Pole Super Smoother in his "Cybernetic Analysis for Stocks and Futures" chapter 13 on 2004.

Function

The transfer response of the two-pole Super Smoother is almost identical to the transfer response of the Regularized filter. The difference between the two is that the characteristics of the Super Smoother are determined by a single parameter and the flatness of the passband response is guaranteed. The order of Super Smoother filters can be increased indefinitely to increase the sharpness of the filter rejection, just as with Butterworth filters.

Key Signal

Filt2 ---> Two Pole Super Smoother fast line

Trigger ---> Two Pole Super Smoother slow line

Pros and Cons

100% John F. Ehlers definition translation of original work, even variable names are the same. This help readers who would like to use pine to read his book. If you had read his works, then you will be quite familiar with my code style.

Remarks

The 31th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Background

John F. Ehlers introuced Two Pole Super Smoother in his "Cybernetic Analysis for Stocks and Futures" chapter 13 on 2004.

Function

The transfer response of the two-pole Super Smoother is almost identical to the transfer response of the Regularized filter. The difference between the two is that the characteristics of the Super Smoother are determined by a single parameter and the flatness of the passband response is guaranteed. The order of Super Smoother filters can be increased indefinitely to increase the sharpness of the filter rejection, just as with Butterworth filters.

Key Signal

Filt2 ---> Two Pole Super Smoother fast line

Trigger ---> Two Pole Super Smoother slow line

Pros and Cons

100% John F. Ehlers definition translation of original work, even variable names are the same. This help readers who would like to use pine to read his book. If you had read his works, then you will be quite familiar with my code style.

Remarks

The 31th script for Blackcat1402 John F. Ehlers Week publication.

Readme

In real life, I am a prolific inventor. I have successfully applied for more than 60 international and regional patents in the past 12 years. But in the past two years or so, I have tried to transfer my creativity to the development of trading strategies. Tradingview is the ideal platform for me. I am selecting and contributing some of the hundreds of scripts to publish in Tradingview community. Welcome everyone to interact with me to discuss these interesting pine scripts.

The scripts posted are categorized into 5 levels according to my efforts or manhours put into these works.

Level 1 : interesting script snippets or distinctive improvement from classic indicators or strategy. Level 1 scripts can usually appear in more complex indicators as a function module or element.

Level 2 : composite indicator/strategy. By selecting or combining several independent or dependent functions or sub indicators in proper way, the composite script exhibits a resonance phenomenon which can filter out noise or fake trading signal to enhance trading confidence level.

Level 3 : comprehensive indicator/strategy. They are simple trading systems based on my strategies. They are commonly containing several or all of entry signal, close signal, stop loss, take profit, re-entry, risk management, and position sizing techniques. Even some interesting fundamental and mass psychological aspects are incorporated.

Level 4 : script snippets or functions that do not disclose source code. Interesting element that can reveal market laws and work as raw material for indicators and strategies. If you find Level 1~2 scripts are helpful, Level 4 is a private version that took me far more efforts to develop.

Level 5 : indicator/strategy that do not disclose source code. private version of Level 3 script with my accumulated script processing skills or a large number of custom functions. I had a private function library built in past two years. Level 5 scripts use many of them to achieve private trading strategy.

Note di rilascio

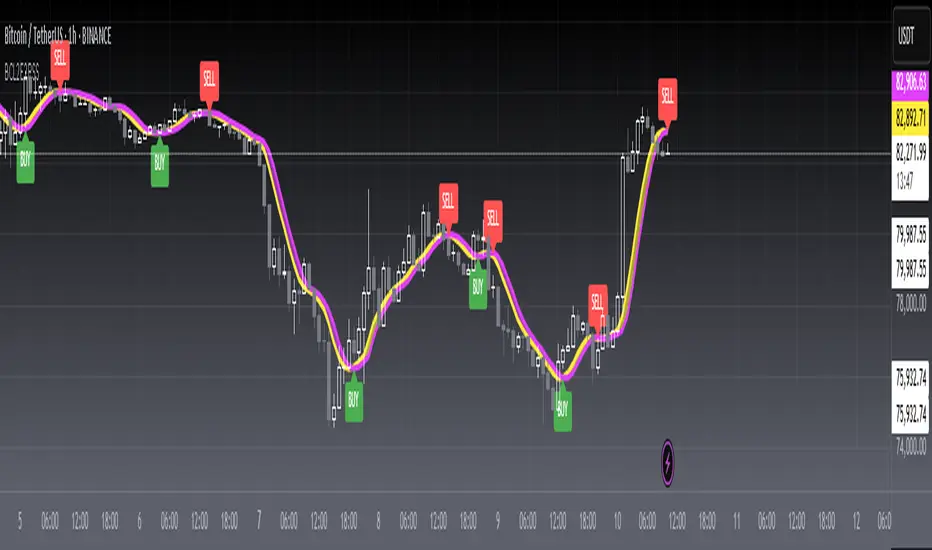

OVERVIEW This indicator implements the Ehlers Two Pole Super Smoother (TPSS) algorithm with Level 2 enhancements, providing smoothed price data and divergence detection capabilities for technical analysis.FEATURES

• Advanced smoothing using Ehlers' proprietary filter algorithm

• Visual representation of filtered price and trigger lines

• Real-time BUY/SELL signal labels

• Comprehensive divergence detection:

Regular bullish and bearish divergences

Hidden bullish and bearish divergences • Customizable alert conditions for all divergence types • Adjustable lookback periods and sensitivity settings

HOW TO USE

Add the indicator to your chart

Configure the following inputs: • Price: Select the price source (default: HL2) • Period: Set the smoothing period (default: 15) • Pivot Lookback Right/Left: Adjust pivot detection range • Max/Min Lookback Range: Define the divergence search window • Plot options: Enable/disable specific divergence types

LIMITATIONS

• Requires sufficient historical data for accurate calculations

• Performance may vary in highly volatile markets

• Divergence detection is based on user-defined parameters

NOTES

• The indicator uses a proprietary smoothing algorithm developed by John Ehlers

• Color coding: Yellow represents filtered price above trigger, Fuchsia below

• Alert conditions are available for all divergence types

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.