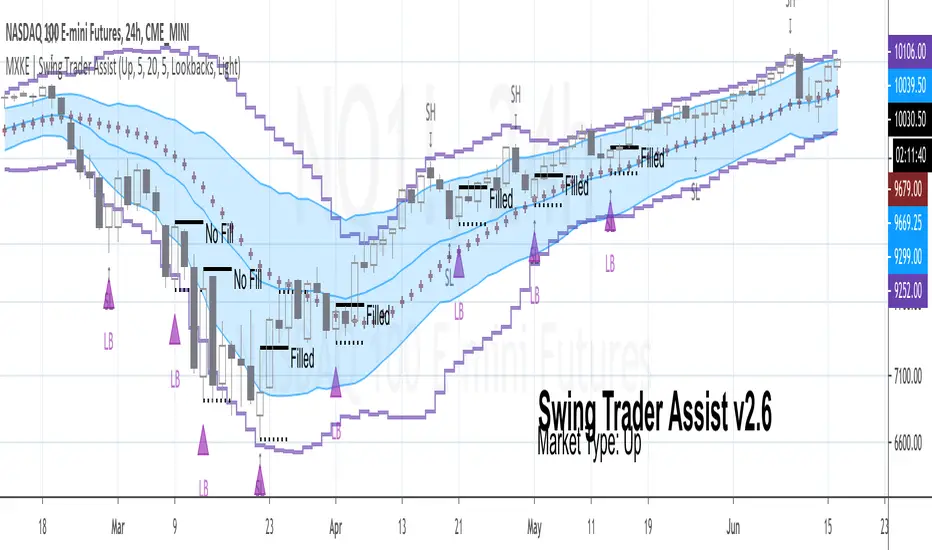

MXKE | Swing Trader Assist

Swing Trader Assist indicator is designed to assist in the systematic identification of Hammers & Lookback signals within Uptrending markets, Stars & Lookback signals within Downtrending markets, and Mean Reversion signals within Sideways markets. The trader must first identify a strong market trend, then apply the indicator. Application of the indicator to weak trends will render equally weak signals. Application of the indicator to strong trends will render equally strong signals. Identification of strong trends is the responsibility of the individual trader and is instrumental to the successful deployment of this indicator and accompanying trading plan.

*Please comment below to request access*

*Please share with me on Twitter your usage and/or ideas for improvement so that I may improve this indicator in the future*

Market Types

Uptrend: Higher highs + Higher lows

Downtrend: Lower highs + Lower lows

Sideways: Higher highs + Lower lows (Expanding Range) or Lower highs + Higher lows (Narrowing Range)

Position Sizing

1R = .25%-2% of total nominal capital dependent upon timeframe and risk appetite

Order Types

Entry: Buy Stop 1 tick above High of “Up” Signal Bars; Sell Stop 1 tick below Low of “Down” Signal Bars

Stop: Bar Close <= 1 tick below Low of “Up” Signal Bar; Bar Close >= 1 tick above High of “Down” Signal Bar

Profit Target: 1.5R distance from “Up” or “Down” fill level with the option to trail stop on each new swing high/low; Bollinger Band Midline minimum 1.5R distance from “Sideways” fill level with option to trail stop on continuation to the opposite end of the range (opposite Bollinger Band)

Trading Plan

❑ Market Type is clearly identifiable as Up, Down or Sideways

❑ Swing Trader Assist indicator is set to the corresponding Market Type: Up, Down or Sideways

❑ Position size is no more than .25%-2% of total nominal capital (based on distance from Signal Bar fill level to Signal Bar stop level as 1R)

❑ Distance from Signal Bar fill level to potential Profit Target is minimum 1.5R

❑ On Hammer or Star fill: close position into trend extension at 1.5R+ or adjust trailing stop on each new swing high/low

❑ On Mean Reversion fill: close position at midline or adjust trailing stop on each continuation to opposite end of range

Usage Notes

The indicator will display developing signals intrabar and it is therefore suggested to wait until bar close to act on any signals. “Autodetect” setting under “Market Type” is currently in beta mode. While it is designed to reveal only relevant signals within strong trends based on a series of EMAs, this setting has not been extensively tested. Use with caution.

The indicator is not meant to be a mechanical trading system. It is designed to assist the trader in objectively and systematically identifying signal bars during the execution of the below swing trading plan. It is up to the trader to determine if overall price action warrants acting upon the signal bars or not.

Case Studies

Additional updates include:

—Enhanced Lookback definitions which add the requirement of closing above (below) the preceding countertrend bar

—Improved Autodetect which better handles false trend turns

—Implementation of Autodetect as the default Trend Type for faster identification of trade ideas

—Behind-the-scenes monitoring of bullish (bearish) candle patterns which will override contradictory Lookback signals

—New "Bars Required To Confirm Trend" input to help limit poor-quality signals during trend false starts (does not apply to VBO signals)

Plus many more under-the-hood improvements which will make refining signal definitions easier to implement moving forward 🖖🏼

— Removed need for Signals to be above/below Bollinger Band Midline when Market Type is placed into a manual trend mode (go catch those knifes!)

— Mean Reversion signals now require just one neutral EMA reading over the past "Bars Required to Confirm Trend" (as opposed to all bars reading neutral which rarely occurs using speedy EMAs)

Additional updates include:

— Simplified Inputs menu

— VBOs can no longer be inside bars

— Hammers must be above Midline (and Stars below Midline) on Autodetect

— Removed low-quality asymmetrical compression signals

— And lots more under the hood!

— Swing Trader Assist's signals can now be turned into TradingView Alerts! ⏰

— Dark Mode color theme for you night owls 🦉

— Signal Isolation mode for when you know the specific signals you want to focus on 🎯

Thank you to everyone who let me know Swing Trader Assist is useful to your trading and sent in these feature requests!

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente mikegyulai.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente mikegyulai.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.