OPEN-SOURCE SCRIPT

Aggiornato Options Volume Profile

Options Volume Profile

Introduction

Unlock institutional-level options analysis directly on your charts with Options Volume Profile - a powerful tool designed to visualize and analyze options market activity with precision and clarity. This indicator bridges the gap between technical price action and options flow, giving you a comprehensive view of market sentiment through the lens of options activity.

What Is Options Volume Profile?

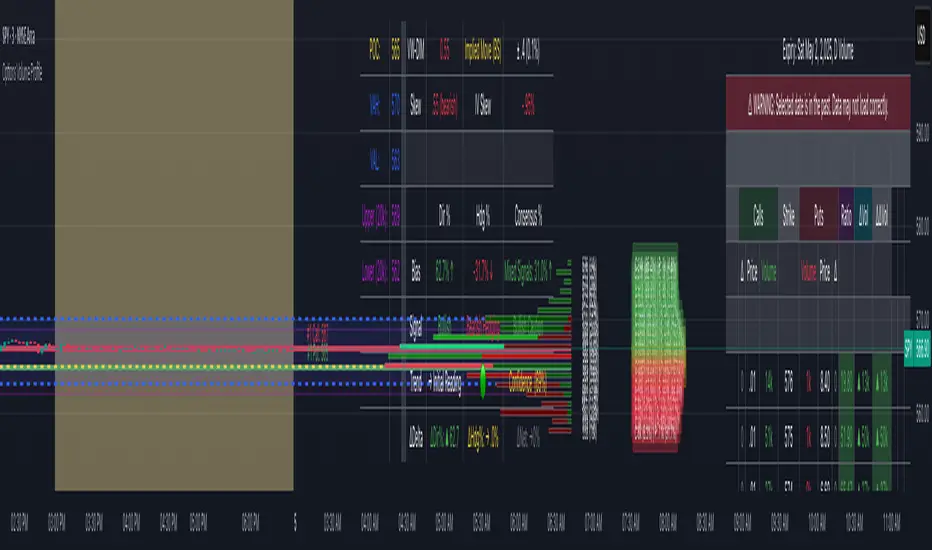

Options Volume Profile is an advanced indicator that analyzes call and put option volumes across multiple strikes for any symbol and expiration date available on TradingView. It provides a real-time visual representation of where money is flowing in the options market, helping identify potential support/resistance levels, market sentiment, and possible price targets.

Key Features

Comprehensive Options Data Visualization

Dynamic strike-by-strike volume profile displayed directly on your chart

Real-time tracking of call and put volumes with custom visual styling

Clear display of important value areas including POC (Point of Control)

Value Area High/Low visualization with customizable line styles and colors

BK Daily Range Identification

Secondary lines marking significant volume thresholds

Visual identification of key strike prices with substantial options activity

Value Area Cloud Visualization

Configurable cloud overlays for value areas

Enhanced visual identification of high-volume price zones

Detailed Summary Table

Complete breakdown of call and put volumes per strike

Percentage analysis of call vs put activity for sentiment analysis

Color-coded volume data for instant pattern recognition

Price data for both calls and puts at each strike

Custom Strike Selection

Configure strikes above and below ATM (At The Money)

Flexible strike spacing and rounding options

Custom base symbol support for various options markets

Use Cases

1. Identifying Key Support & Resistance

Visualize where major options activity is concentrated to spot potential support and resistance zones. The POC and Value Area lines often act as magnets for price.

2. Analyzing Market Sentiment

Compare call versus put volume distribution to gauge directional bias. Heavy call volume suggests bullish sentiment, while heavy put volume indicates bearish positioning.

3. Planning Around Institutional Activity

Volume profile analysis reveals where professional traders are positioning themselves, allowing you to align with or trade against smart money.

4. Setting Precise Targets

Use the POC and Value Area High/Low lines as potential profit targets when planning your trades.

5. Spotting Unusual Options Activity

The color-coded volume table instantly highlights anomalies in options flow that may signal upcoming price movements.

Customization Options

The indicator offers extensive customization capabilities:

Symbol & Data Settings: Configure base symbol and data aggregation

Strike Selection: Define number of strikes above/below ATM

Expiration Date Settings: Set specific expiry dates for analysis

Strike Configuration: Customize strike spacing and rounding

Profile Visualization: Adjust offset, width, opacity, and height

Labels & Line Styles: Fully configurable text and visual elements

Value Area Settings: Customize POC and Value Area visualization

Secondary Line Settings: Configure the BK Daily Range appearance

Cloud Visualization: Add colored overlays for enhanced visibility

How to Use

Apply the indicator to your chart

Configure the expiration date to match your trading timeframe

Adjust strike selection and spacing to match your instrument

Use the volume profile and summary table to identify key levels

Trade with confidence knowing where the real money is positioned

Perfect for options traders, futures traders, and anyone who wants to incorporate institutional-level options analysis into their trading strategy.

Take your trading to the next level with Options Volume Profile - where price meets institutional positioning.

Introduction

Unlock institutional-level options analysis directly on your charts with Options Volume Profile - a powerful tool designed to visualize and analyze options market activity with precision and clarity. This indicator bridges the gap between technical price action and options flow, giving you a comprehensive view of market sentiment through the lens of options activity.

What Is Options Volume Profile?

Options Volume Profile is an advanced indicator that analyzes call and put option volumes across multiple strikes for any symbol and expiration date available on TradingView. It provides a real-time visual representation of where money is flowing in the options market, helping identify potential support/resistance levels, market sentiment, and possible price targets.

Key Features

Comprehensive Options Data Visualization

Dynamic strike-by-strike volume profile displayed directly on your chart

Real-time tracking of call and put volumes with custom visual styling

Clear display of important value areas including POC (Point of Control)

Value Area High/Low visualization with customizable line styles and colors

BK Daily Range Identification

Secondary lines marking significant volume thresholds

Visual identification of key strike prices with substantial options activity

Value Area Cloud Visualization

Configurable cloud overlays for value areas

Enhanced visual identification of high-volume price zones

Detailed Summary Table

Complete breakdown of call and put volumes per strike

Percentage analysis of call vs put activity for sentiment analysis

Color-coded volume data for instant pattern recognition

Price data for both calls and puts at each strike

Custom Strike Selection

Configure strikes above and below ATM (At The Money)

Flexible strike spacing and rounding options

Custom base symbol support for various options markets

Use Cases

1. Identifying Key Support & Resistance

Visualize where major options activity is concentrated to spot potential support and resistance zones. The POC and Value Area lines often act as magnets for price.

2. Analyzing Market Sentiment

Compare call versus put volume distribution to gauge directional bias. Heavy call volume suggests bullish sentiment, while heavy put volume indicates bearish positioning.

3. Planning Around Institutional Activity

Volume profile analysis reveals where professional traders are positioning themselves, allowing you to align with or trade against smart money.

4. Setting Precise Targets

Use the POC and Value Area High/Low lines as potential profit targets when planning your trades.

5. Spotting Unusual Options Activity

The color-coded volume table instantly highlights anomalies in options flow that may signal upcoming price movements.

Customization Options

The indicator offers extensive customization capabilities:

Symbol & Data Settings: Configure base symbol and data aggregation

Strike Selection: Define number of strikes above/below ATM

Expiration Date Settings: Set specific expiry dates for analysis

Strike Configuration: Customize strike spacing and rounding

Profile Visualization: Adjust offset, width, opacity, and height

Labels & Line Styles: Fully configurable text and visual elements

Value Area Settings: Customize POC and Value Area visualization

Secondary Line Settings: Configure the BK Daily Range appearance

Cloud Visualization: Add colored overlays for enhanced visibility

How to Use

Apply the indicator to your chart

Configure the expiration date to match your trading timeframe

Adjust strike selection and spacing to match your instrument

Use the volume profile and summary table to identify key levels

Trade with confidence knowing where the real money is positioned

Perfect for options traders, futures traders, and anyone who wants to incorporate institutional-level options analysis into their trading strategy.

Take your trading to the next level with Options Volume Profile - where price meets institutional positioning.

Note di rilascio

Release NotesMInor bug fix

- bar lengths were based on single largest volume not largest total volume at strike so fixed that calculation and a few other minor cosmetic bugs

Note di rilascio

Added some more cosmetic changes to the chart.Added total volume next to the strike price of the volume bars

Note di rilascio

Added ability to be used on SPXupdated more color schemes

Note di rilascio

Whoops last update made it so it ONLY worked on SPX. Fixed that so now it works on all tickersNote di rilascio

Made a lot of cosmetic changes to the table as well as the volume bars. Worked on the usability on SPX still a little bit of a ways to go some issues there. Note di rilascio

Didn't realize it would take on the testing name as the short title. Same code just different short titleNote di rilascio

Added new column to show POC and ATM and took of row highlighting so we can see the visual of the colors on those rowsNote di rilascio

Complete revamp of the summary tableNote di rilascio

Some cosmetic changes. Moved the labels next to volume bars closer so easier to see. Fixed the conditional coloring in the tableNote di rilascio

Added functionality to select to automatically use the current day for expiryNote di rilascio

Added market sentiment to the volume tableNote di rilascio

Provided functionality to change the size of the tables and also move some of the info out of the volume table to be easier to readNote di rilascio

Updated the Skew calculationNote di rilascio

Updated the market sentiment calculationNote di rilascio

Revamped Total Implied MoveNote di rilascio

Added functionality to show or hide each table separately and changed formula for total implied moveNote di rilascio

Added a horizontal line for #1 call and #1 putNote di rilascio

Updated the background of top call and top put in volume table to be more readable. Also worked on market sentiment calculationNote di rilascio

Added a lot more points of data into the info table. I also added lines for expected move but I can't test them since market isn't open and they won't work on historical data so may need to debug in the morning. Setting default to falseNote di rilascio

Some bug fixes to info table as well as adding net change to bias Note di rilascio

Some bug fixesNote di rilascio

working on bug with tables not showing when unchecking good for now but need to fix moreNote di rilascio

Added functionality to be able to be used on white backgroundNote di rilascio

Changed up the organization of the info table and modified some calcs slightlyNote di rilascio

quick bug fix had to refix the table toggle settingsScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.