OPEN-SOURCE SCRIPT

HeikinAshi_Point (HA-P)

Hello?

Traders, welcome.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

Following the previously published MACD-Total indicator, we are releasing the second indicator.

- index -

1. HA-P Indicator Description

2. Chart interpretation using HA-P indicators

3. More important than indicators is creating a trading strategy

(1. HA-P Indicator Description)

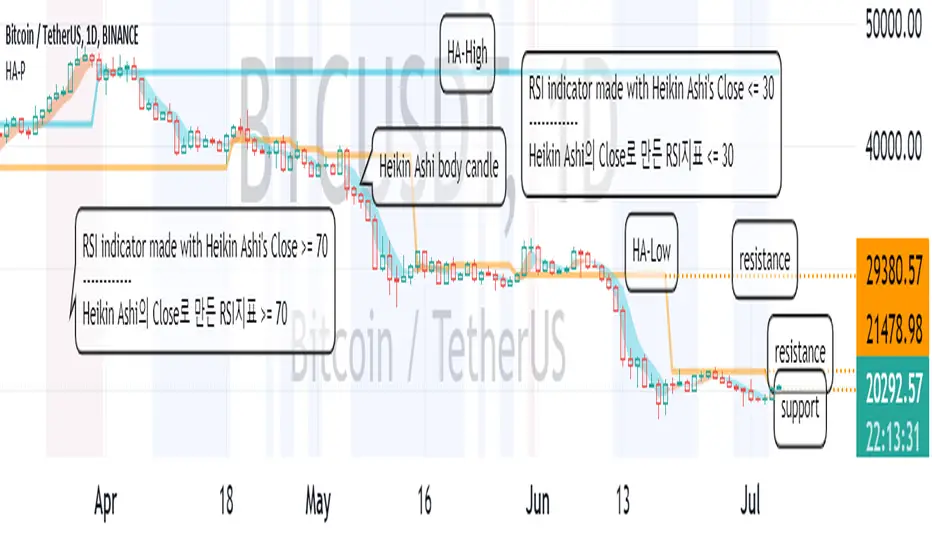

The Heikin Ashi candle chart is a very good way to see trends.

However, it is a pity that the actual price is not known on the chart made of Heikin Ashi candles.

To compensate for this, the body candle part (Open~Close) of the Heikin Ashi candle was filled with the background of the normal candle.

If you see more candles below the bottom of the body candle, you know the strength of the downtrend is high.

Conversely, if more candles are displayed above their body candles equivalent, you can tell that the bullish strength is high.

It can be seen that when the body candle color is displayed in blue, it is more likely to decline, and when it is in yellow, it is more likely to rise.

The Heikin Ashi candle is a trending candle.

Therefore, Heikin Ashi candles cannot be traded on their own.

To complement this, HA-Low and HA-High indicators were created.

The point where the HA-Low and HA-High indicators are leveled serves as support and resistance.

So, the longer the horizontal line, the stronger the support and resistance role.

A typical RSI is usually expressed as Close.

Since the Close of the Heikin Ashi candle is different from the normal Close, we made it to display when the RSI is oversold and overbought as the background of the price chart.

You cannot trade with the RSI indicator and the Heikin Ashi candle.

However, it can be used to detect a change in trend.

This gives you time to react to trend changes.

In order to trade, it is possible to find support and resistance at the HA-Low and HA-High indicators.

------------------------------------------------------------ ------

(2. Chart interpretation using HA-P indicator)

Let's interpret the BTCUSDT 1D chart using the HA-P indicator.

Primary resistance: around 21478.98

Secondary resistance: around 29380.57

It moved higher on the 4th of July, breaking out of the RSI oversold zone.

If it rises above the 19946.21 point and finds support, it is expected to lead to further upside.

However, it needs to rise above 21478.98 for support to lead to further upside.

---------------------------------

(3. More important than indicators is creating a trading strategy)

In order to trade using these indicators, you need to invest a lot of time and observe.

Whether you use an indicator or not, the most important thing in trading is whether you have many trading strategies.

No matter how good indicators and signals are, if you do not have a trading strategy, you will not be able to properly trade due to psychological pressure.

Therefore, it is most important to plan a trading strategy in advance before proceeding with a trade.

- How much money to invest

- How to set up a rough plan for buying in installments and selling in installments

- How to set the Stop Loss point

- How long will the investment be (short-term, medium-term, long-term, etc.)

Basically, the above thoughts must be concretely thought out before proceeding with the investment.

Otherwise, if you buy blindly when the price rises, there is a high possibility that you will end up incurring a loss due to psychological anxiety due to the volatility of the price.

----------------------------------

Traders, welcome.

If you "follow", you can always get new information quickly.

Please also click "Like".

Have a good day.

-------------------------------------

Following the previously published MACD-Total indicator, we are releasing the second indicator.

- index -

1. HA-P Indicator Description

2. Chart interpretation using HA-P indicators

3. More important than indicators is creating a trading strategy

(1. HA-P Indicator Description)

The Heikin Ashi candle chart is a very good way to see trends.

However, it is a pity that the actual price is not known on the chart made of Heikin Ashi candles.

To compensate for this, the body candle part (Open~Close) of the Heikin Ashi candle was filled with the background of the normal candle.

If you see more candles below the bottom of the body candle, you know the strength of the downtrend is high.

Conversely, if more candles are displayed above their body candles equivalent, you can tell that the bullish strength is high.

It can be seen that when the body candle color is displayed in blue, it is more likely to decline, and when it is in yellow, it is more likely to rise.

The Heikin Ashi candle is a trending candle.

Therefore, Heikin Ashi candles cannot be traded on their own.

To complement this, HA-Low and HA-High indicators were created.

The point where the HA-Low and HA-High indicators are leveled serves as support and resistance.

So, the longer the horizontal line, the stronger the support and resistance role.

A typical RSI is usually expressed as Close.

Since the Close of the Heikin Ashi candle is different from the normal Close, we made it to display when the RSI is oversold and overbought as the background of the price chart.

You cannot trade with the RSI indicator and the Heikin Ashi candle.

However, it can be used to detect a change in trend.

This gives you time to react to trend changes.

In order to trade, it is possible to find support and resistance at the HA-Low and HA-High indicators.

------------------------------------------------------------ ------

(2. Chart interpretation using HA-P indicator)

Let's interpret the BTCUSDT 1D chart using the HA-P indicator.

Primary resistance: around 21478.98

Secondary resistance: around 29380.57

It moved higher on the 4th of July, breaking out of the RSI oversold zone.

If it rises above the 19946.21 point and finds support, it is expected to lead to further upside.

However, it needs to rise above 21478.98 for support to lead to further upside.

---------------------------------

(3. More important than indicators is creating a trading strategy)

In order to trade using these indicators, you need to invest a lot of time and observe.

Whether you use an indicator or not, the most important thing in trading is whether you have many trading strategies.

No matter how good indicators and signals are, if you do not have a trading strategy, you will not be able to properly trade due to psychological pressure.

Therefore, it is most important to plan a trading strategy in advance before proceeding with a trade.

- How much money to invest

- How to set up a rough plan for buying in installments and selling in installments

- How to set the Stop Loss point

- How long will the investment be (short-term, medium-term, long-term, etc.)

Basically, the above thoughts must be concretely thought out before proceeding with the investment.

Otherwise, if you buy blindly when the price rises, there is a high possibility that you will end up incurring a loss due to psychological anxiety due to the volatility of the price.

----------------------------------

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

※ Follow X to check out the posts.

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

※ X를 팔로우하고 게시물을 확인하세요.

◆ t.me/readCryptoChannel

[HA-MS Indicator]

bit.ly/3YxHgvN

[OBV Indicator]

bit.ly/4dcyny3

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.