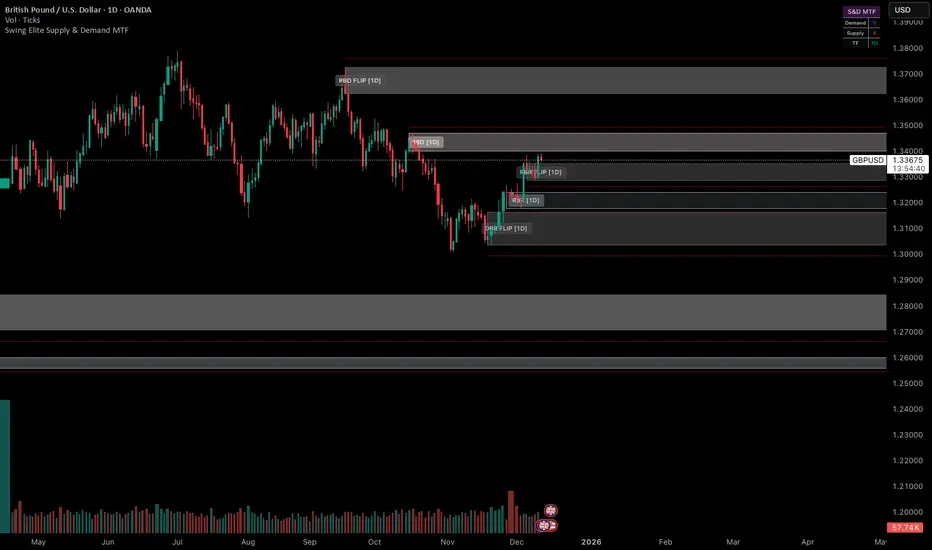

Swing Elite Supply & Demand MTF

Institutional-grade multi-timeframe Supply & Demand system with FLIP logic, Level-on-Level detection, stop-loss padding, and advanced zone mitigation.

This tool automatically detects RBR / DBR / RBD / DBD patterns on any timeframe and plots refined demand & supply zones based on explosive candles, base structure, and smart-money logic.

🔥 Core Features

• Multi-Timeframe Zone Detection

Detect supply/demand zones from any higher timeframe (HTF) and project them onto your chart.

Perfect for aligning low-timeframe entries with institutional HTF levels.

• Preferred vs Wider Zone Width

Switch between:

Preferred → body-based, tighter zones (institutional quality)

Wider → wick+body zones for more tolerance

• Level-on-Level (LOL) Zones

Automatically merges overlapping zones and builds stronger multi-layered zones, indicating repeated institutional accumulation or distribution.

• FLIP Zones (Support → Resistance / Resistance → Support)

FLIP zones are detected when the market breaks a key swing and returns to retest the zone.

These are premium continuation levels.

• Automatic Mitigation Logic

Zones are removed when:

price mitigates enough (% based)

LOL zones get fully closed through

price travels too far away after touch (invalidates the setup)

• Stop-Loss Padding System

Auto-calculates SL levels (optional) based on zone height and custom padding %.

• Clean HTF Visualization

Displays:

zone type (RBR, DBR, RBD, DBD)

LOL / FLIP

timeframe source (e.g., 4H, 1D)

automatic color coding

📊 Alerts Included

Price entering a Demand Zone

Price entering a Supply Zone

Use them for automation or high-probability entries.

🎯 Best For

SMC / ICT style trading

Order block & zone traders

Intraday HTF bias alignment

Swing trading

Algorithmic filtering (EA/strategy integration)

🚀 Why It Works

This indicator is built on institutional logic:

explosive displacement

indecisive bases

mitigation and market structure

multi-zone stacking (LOL)

HTF contextual zones

swing high/low breaks (FLIP logic)

It produces clean, high-probability zones with no repainting of the explosive candle signal.

Institutional-grade multi-timeframe Supply & Demand system with FLIP logic, Level-on-Level detection, stop-loss padding, and advanced zone mitigation.

This tool automatically detects RBR / DBR / RBD / DBD patterns on any timeframe and plots refined demand & supply zones based on explosive candles, base structure, and smart-money logic.

🔥 Core Features

• Multi-Timeframe Zone Detection

Detect supply/demand zones from any higher timeframe (HTF) and project them onto your chart.

Perfect for aligning low-timeframe entries with institutional HTF levels.

• Preferred vs Wider Zone Width

Switch between:

Preferred → body-based, tighter zones (institutional quality)

Wider → wick+body zones for more tolerance

• Level-on-Level (LOL) Zones

Automatically merges overlapping zones and builds stronger multi-layered zones, indicating repeated institutional accumulation or distribution.

• FLIP Zones (Support → Resistance / Resistance → Support)

FLIP zones are detected when the market breaks a key swing and returns to retest the zone.

These are premium continuation levels.

• Automatic Mitigation Logic

Zones are removed when:

price mitigates enough (% based)

LOL zones get fully closed through

price travels too far away after touch (invalidates the setup)

• Stop-Loss Padding System

Auto-calculates SL levels (optional) based on zone height and custom padding %.

• Clean HTF Visualization

Displays:

zone type (RBR, DBR, RBD, DBD)

LOL / FLIP

timeframe source (e.g., 4H, 1D)

automatic color coding

📊 Alerts Included

Price entering a Demand Zone

Price entering a Supply Zone

Use them for automation or high-probability entries.

🎯 Best For

SMC / ICT style trading

Order block & zone traders

Intraday HTF bias alignment

Swing trading

Algorithmic filtering (EA/strategy integration)

🚀 Why It Works

This indicator is built on institutional logic:

explosive displacement

indecisive bases

mitigation and market structure

multi-zone stacking (LOL)

HTF contextual zones

swing high/low breaks (FLIP logic)

It produces clean, high-probability zones with no repainting of the explosive candle signal.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Swing_elite.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente Swing_elite.

TradingView NON consiglia di acquistare o utilizzare uno script a meno che non si abbia piena fiducia nel suo autore e se ne comprenda il funzionamento. È inoltre possibile trovare alternative gratuite e open source nei nostri script della community.