Multi-Timeframe RSI Oscillator -> PROFABIGHI_CAPITAL

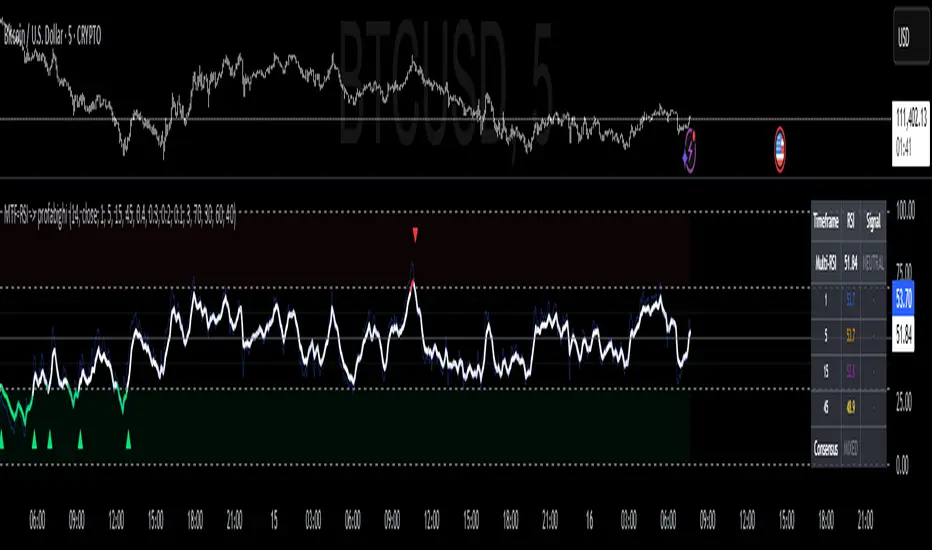

The Multi-Timeframe RSI Oscillator → PROFABIGHI_CAPITAL aggregates RSI signals from multiple timeframes into a weighted composite for layered momentum analysis, helping traders spot overbought/oversold alignments across scales without single-frame bias.

It smooths the blend for clearer trends, with optional overlays for individual readings and consensus checks to confirm directional strength.

📊 RSI Settings

– RSI Length: Adjustable lookback for computing relative strength on all selected timeframes.

– RSI Source: Data input, such as closing prices, for RSI base calculations.

⏰ Timeframes

– Timeframe 1 (Fast): Quickest scale for capturing short-term price swings and early signals.

– Timeframe 2 (Medium): Balanced scale for intermediate momentum without excessive noise.

– Timeframe 3 (Slow): Slower scale for validating trends over extended periods.

– Timeframe 4 (Ultra Slow): Longest scale for overarching market regime insights.

⚖️ Weights

– Weight 1 (Fast): Emphasis on the fastest timeframe's RSI in the overall blend.

– Weight 2 (Medium): Contribution from the medium timeframe for steady influence.

– Weight 3 (Slow): Role of the slow timeframe in anchoring the composite.

– Weight 4 (Ultra Slow): Impact of the ultra-slow timeframe for long-view stability.

👁️ Display Settings

– Smoothing Length: Period to refine the composite line via exponential averaging.

– Show Individual RSIs: Toggle to reveal separate timeframe lines for detailed comparison.

– Show Current Timeframe RSI: Option to include the chart's native RSI for reference.

📏 Levels

– Overbought Level: Upper threshold flagging potential exhaustion from buying pressure.

– Oversold Level: Lower threshold indicating possible rebound from selling fatigue.

– Neutral Upper/Lower: Inner boundaries defining the range for mild bullish or bearish tilts.

🎨 Colors

– Overbought Color: Hue for extreme upper zones and sell warnings.

– Oversold Color: Shade for deep lower zones and buy cues.

– Neutral Color: Tint for balanced readings in consolidation.

– Current TF Color: Distinct shade for the active chart's RSI line.

📈 Calculations

– Multi-Timeframe RSIs: Fetches RSI values from each selected scale, falling back to current if invalid.

– Weighted Blend: Combines readings proportionally by user weights for a unified momentum score.

– Smoothing Application: Applies exponential average to the mix for trend-smoothing without lag.

📡 Signals

– Crossover Triggers: Bullish on upward breaks from oversold; bearish on downward from overbought for reversal plays.

– Consensus Alignment: All timeframes above midline for bullish harmony; below for bearish.

– Strength Gauge: Absolute composite value measures overall conviction across scales.

📉 Visualization

– Composite Line: Prominent plot that shifts hues by zone for quick momentum assessment.

– Individual Overlays: Subtle lines for enabled timeframes, highlighting divergences when shown.

– Current TF Line: Dedicated trace for the chart's RSI to anchor analysis.

– Reference Lines: Dashed extremes, dotted neutrals, solid midline for level guidance.

– Zone Fills: Gentle shading in overbought/oversold regions for visual alerts.

– Signal Markers: Minimal triangles at crossovers for non-cluttered buy/sell hints.

– Info Table: Compact top-right summary of composite and timeframe values, signals, and consensus.

🔔 Alerts

– Buy Crossover: Notification when composite rises above oversold for potential longs.

– Sell Crossover: Warning when composite falls below overbought for potential shorts.

✅ Key Takeaways

– Layers timeframes for robust RSI without isolated-frame pitfalls.

– Weighting tunes sensitivity from aggressive to conservative views.

– Consensus and visuals unify multi-scale insights for confident trades.

– Adaptable smoothing and toggles suit any chart speed or style.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente PROFABIGHI_CAPITAL.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente PROFABIGHI_CAPITAL.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.