OPEN-SOURCE SCRIPT

Aggiornato [blackcat] L2 Kiosotto Indicator

OVERVIEW

The Kiosotto Indicator is a versatile technical analysis tool designed for forex trading but applicable to other financial markets. It excels in detecting market reversals and trends without repainting, ensuring consistent and reliable signals. The indicator has evolved over time, with different versions focusing on specific aspects of market analysis.

KEY FEATURES

Reversal Detection: Identifies potential market reversals, crucial for traders looking to capitalize on turning points.

Trend Detection: Earlier versions focused on detecting trends, useful for traders who prefer to follow the market direction.

Non-Repainting: Signals remain consistent on the chart, providing reliable and consistent signals.

Normalization: Later versions, such as Normalized Kiosotto and Kiosotto_2025, incorporate normalization to assess oversold and overbought conditions, enhancing interpretability.

VERSIONS AND EVOLUTION

Early Versions: Focused on trend detection, useful for following market direction.

2 in 1 Kiosotto: Emphasizes reversal detection and is considered an improvement by users.

Normalized Versions (e.g., Kiosotto_2025, Kiosotto_3_2025): Introduce normalization to assess oversold and overbought conditions, enhancing interpretability.

HOW TO USE THE KIOSOTTO INDICATOR

Understanding Signals:

Reversals: Look for the indicator's signals that suggest a potential reversal, indicated by color changes, line crossings, or other visual cues.

Trends: Earlier versions might show stronger trending signals, indicated by the direction or slope of the indicator's lines.

Normalization Interpretation (for normalized versions):

Oversold: When the indicator hits the lower boundary, it might indicate an oversold condition, suggesting a potential buy signal.

Overbought: Hitting the upper boundary could signal an overbought condition, suggesting a potential sell signal.

PINE SCRIPT IMPLEMENTATION

The provided Pine Script code is a version of the Kiosotto indicator. Here's a detailed explanation of the code:

Pine Script®

The Kiosotto Indicator is a versatile technical analysis tool designed for forex trading but applicable to other financial markets. It excels in detecting market reversals and trends without repainting, ensuring consistent and reliable signals. The indicator has evolved over time, with different versions focusing on specific aspects of market analysis.

KEY FEATURES

Reversal Detection: Identifies potential market reversals, crucial for traders looking to capitalize on turning points.

Trend Detection: Earlier versions focused on detecting trends, useful for traders who prefer to follow the market direction.

Non-Repainting: Signals remain consistent on the chart, providing reliable and consistent signals.

Normalization: Later versions, such as Normalized Kiosotto and Kiosotto_2025, incorporate normalization to assess oversold and overbought conditions, enhancing interpretability.

VERSIONS AND EVOLUTION

Early Versions: Focused on trend detection, useful for following market direction.

2 in 1 Kiosotto: Emphasizes reversal detection and is considered an improvement by users.

Normalized Versions (e.g., Kiosotto_2025, Kiosotto_3_2025): Introduce normalization to assess oversold and overbought conditions, enhancing interpretability.

HOW TO USE THE KIOSOTTO INDICATOR

Understanding Signals:

Reversals: Look for the indicator's signals that suggest a potential reversal, indicated by color changes, line crossings, or other visual cues.

Trends: Earlier versions might show stronger trending signals, indicated by the direction or slope of the indicator's lines.

Normalization Interpretation (for normalized versions):

Oversold: When the indicator hits the lower boundary, it might indicate an oversold condition, suggesting a potential buy signal.

Overbought: Hitting the upper boundary could signal an overbought condition, suggesting a potential sell signal.

PINE SCRIPT IMPLEMENTATION

The provided Pine Script code is a version of the Kiosotto indicator. Here's a detailed explanation of the code:

//@version=5

indicator("[blackcat] L2 Kiosotto Indicator", overlay=false)

//Pine version of Kiosotto 2015 v4 Alert [mobidik]ms-nrp

// Input parameters

dev_period = input.int(150, "Dev Period")

alerts_level = input.float(15, "Alerts Level")

tsbul = 0.0

tsber = 0.0

hpres = 0.0

lpres = 9999999.0

for i = 0 to dev_period - 1

rsi = ta.rsi(close, dev_period)

if high > hpres

hpres := high

tsbul := tsbul + rsi * close

if low < lpres

lpres := low

tsber := tsber + rsi * close

buffer1 = tsber != 0 ? tsbul / tsber : 0

buffer2 = tsbul != 0 ? tsber / tsbul : 0

// Plotting

plot(buffer1, color=color.aqua, linewidth=3, style=plot.style_histogram)

plot(buffer2, color=color.fuchsia, linewidth=3, style=plot.style_histogram)

hline(alerts_level, color=color.silver)

EXPLANATION OF THE CODE

Indicator Definition:

indicator("[blackcat] L2 Kiosotto Indicator", overlay=false): Defines the indicator with the name "[blackcat] L2 Kiosotto Indicator" and specifies that it should not be overlaid on the price chart.

Input Parameters:

dev_period = input.int(150, "Dev Period"): Allows users to set the period for the deviation calculation.

alerts_level = input.float(15, "Alerts Level"): Allows users to set the level for alerts.

Initialization:

tsbul = 0.0: Initializes the tsbul variable to 0.0.

tsber = 0.0: Initializes the tsber variable to 0.0.

hpres = 0.0: Initializes the hpres variable to 0.0.

lpres = 9999999.0: Initializes the lpres variable to a very high value.

Loop for Calculation:

The for loop iterates over the last dev_period bars.

rsi = ta.rsi(close, dev_period): Calculates the RSI for the current bar.

if high > hpres: If the high price of the current bar is greater than hpres, update hpres and add the product of RSI and close price to tsbul.

if low < lpres: If the low price of the current bar is less than lpres, update lpres and add the product of RSI and close price to tsber.

Buffer Calculation:

buffer1 = tsber != 0 ? tsbul / tsber : 0: Calculates the first buffer as the ratio of tsbul to tsber if tsber is not zero.

buffer2 = tsbul != 0 ? tsber / tsbul : 0: Calculates the second buffer as the ratio of tsber to tsbul if tsbul is not zero.

Plotting:

plot(buffer1, color=color.aqua, linewidth=3, style=plot.style_histogram): Plots the first buffer as a histogram with an aqua color.

plot(buffer2, color=color.fuchsia, linewidth=3, style=plot.style_histogram): Plots the second buffer as a histogram with a fuchsia color.

hline(alerts_level, color=color.silver): Draws a horizontal line at the alerts_level with a silver color.

FUNCTIONALITY

The Kiosotto indicator calculates two buffers based on the RSI and price levels over a specified period. The buffers are plotted as histograms, and a horizontal line is drawn at the alerts level. The indicator helps traders identify potential reversals and trends by analyzing the relationship between the RSI and price levels.

ALGORITHMS

RSI Calculation:

The Relative Strength Index (RSI) measures the speed and change of price movements. It is calculated using the formula:

RSI=100− (1+RS) / 100

where RS is the ratio of the average gain to the average loss over the specified period.

Buffer Calculation:

The buffers are calculated as the ratio of the sum of RSI multiplied by the close price for high and low price conditions. This helps in identifying the balance between buying and selling pressure.

Signal Generation:

The indicator generates signals based on the values of the buffers and the alerts level. Traders can use these signals to make informed trading decisions, such as entering or exiting trades based on potential reversals or trends.

APPLICATION SCENARIOS

Reversal Trading: Traders can use the Kiosotto indicator to identify potential reversals by looking for significant changes in the buffer values or crossings of the alerts level.

Trend Following: The indicator can also be used to follow trends by analyzing the direction and slope of the buffer lines.

Oversold/Overbought Conditions: For normalized versions, traders can use the indicator to identify oversold and overbought conditions, which can provide buy or sell signals.

THANKS

Special thanks to the TradingView community and the original developers for their contributions and support in creating and refining the Kiosotto Indicator.

Note di rilascio

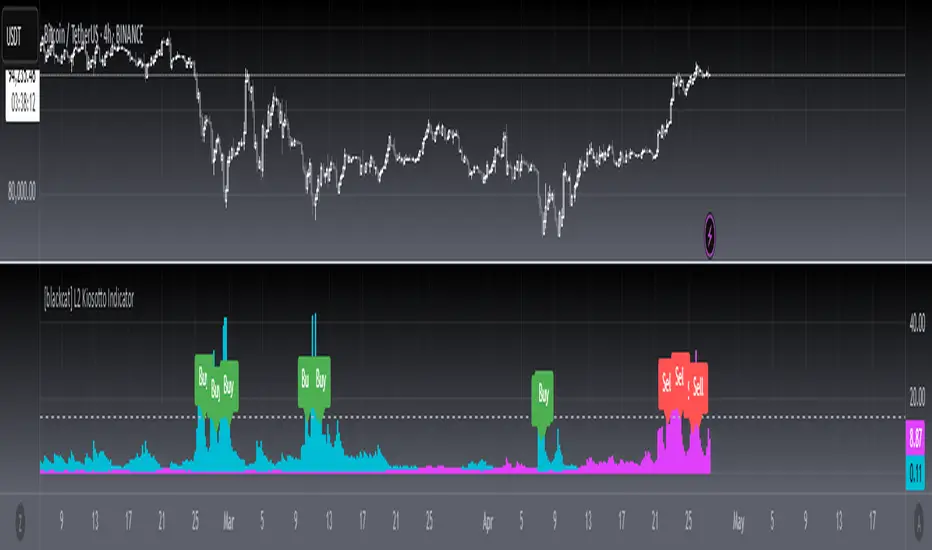

OVERVIEW The L2 Kiosotto Indicator combines RSI-based momentum measurements with historical price extremes to identify potential buying and selling opportunities in the markets.FEATURES

• Dynamic Momentum Measurement:

Bullish/Bearish ratio calculation using weighted RSI values

Historical high-low price range consideration

Customizable deviation period and alert thresholds

• Visual Representation:

Aqua-colored bullish histograms

Fuchsia-colored bearish histograms

Silver horizontal threshold line for alerts

INPUT PARAMETERS

• Deviation Period:

Default value of 150 bars

Determines lookback window for calculations

• Alerts Threshold:

User-defined level for generating notifications

Helps filter significant divergences from noise

CALCULATION METHODOLOGY

For each bar within the specified period:

Calculates RSI at that point

Tracks new highs/lows

Accumulates weighted ratios based on price action

Final Ratios Computed As:

Bullish Ratio: Weighted sum of bull phases divided by bear phase total

Bearish Ratio: Weighted sum of bear phases divided by bull phase total

TRADING SIGNALS

[bu]BULLISH CONDITION:[/bu]

When bullish ratio exceeds user-specified alert level

Generates green "Buy" labels below chart

[bu]BEARISH CONDITION:[/bu]

When bearish ratio surpasses alert threshold

Creates red "Sell" markers beneath graph

HOW TO USE

Adjust 'Dev Period' to match your preferred time horizon

Set 'Alerts Level' according to risk tolerance or strategy requirements

Monitor histogram divergence patterns relative to the threshold line

Utilize both visual indicators and alert messages for confirmation

NOTES

This indicator works best as part of a comprehensive trading system rather than standalone decisions. Consider backtesting configurations before live application.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.