🔵 OVERVIEW

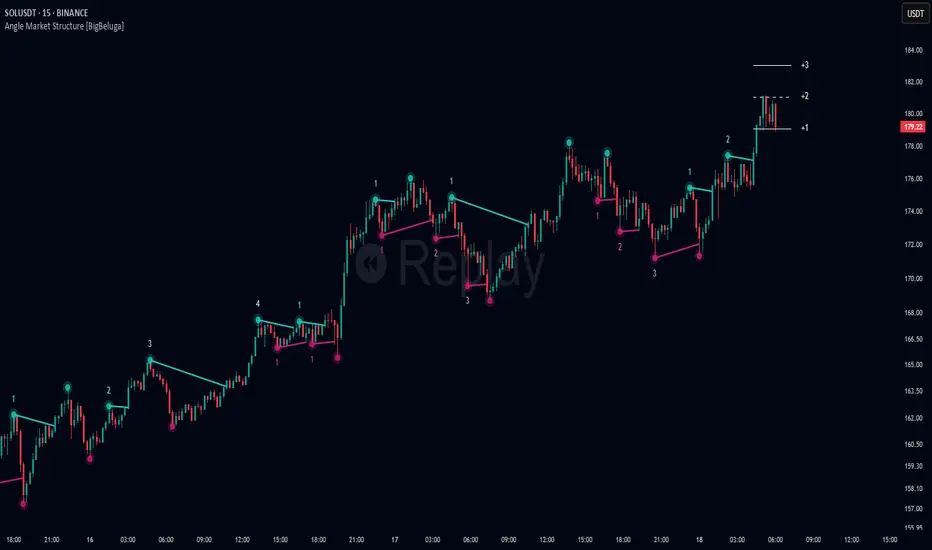

Angle Market Structure [BigBeluga] is a smart pivot-based tool that dynamically adapts to price action by accelerating breakout and breakdown detection. It draws market structure levels based on pivot highs/lows and gradually adjusts those levels closer to price using an angle threshold. Upon breakout, the indicator projects deviation zones with labeled levels (+1, +2, +3 or −1, −2, −3) to track price extension beyond structure.

🔵 CONCEPTS

🔵 FEATURES

🔵 HOW TO USE

🔵 CONCLUSION

Angle Market Structure [BigBeluga] enhances traditional pivot-based analysis by introducing breakout acceleration and structured deviation tracking. It’s a powerful tool for traders seeking a cleaner, faster read on market structure and momentum strength—especially during impulsive price moves or structural transitions.

Angle Market Structure [BigBeluga] is a smart pivot-based tool that dynamically adapts to price action by accelerating breakout and breakdown detection. It draws market structure levels based on pivot highs/lows and gradually adjusts those levels closer to price using an angle threshold. Upon breakout, the indicator projects deviation zones with labeled levels (+1, +2, +3 or −1, −2, −3) to track price extension beyond structure.

🔵 CONCEPTS

- Adaptive Market Structure: Uses pivots to define structure levels, which dynamically angle closer to price over time to capture breakouts sooner.

- Breakout Acceleration: Pivot high levels decrease and pivot low levels increase each bar using a user-defined angle (based on ATR), improving reactivity.

- Deviation Zones: Once a breakout or breakdown occurs, 3 deviation levels are projected to show how far price extends beyond the breakout point.

- Count Labels: Each successful structure break is numbered sequentially, giving traders insight into momentum and trend persistence.

- Visual Clarity: The script uses colored pivot points, trend lines, and extension labels for easy structural interpretation.

🔵 FEATURES

- Calculates pivot highs and lows using a customizable length.

- Applies an angle modifier (ATR-based) to gradually pull levels closer to price.

- Plots breakout and breakdown lines in distinct colors with automatic extension.

- Shows deviation zones (+1, +2, +3 or −1, −2, −3) after breakout with customizable size.

- Color-coded labels for trend break count (bullish or bearish).

- Dynamic label sizing and theme-aware colors.

- Smart label positioning to avoid chart clutter.

- Built-in limit for deviation zones to maintain clarity and performance.

🔵 HOW TO USE

- Use pivot-based market structure to identify breakout and breakdown zones.

- Watch for crossover (up) or crossunder (down) events as trend continuation or reversal signals.

- Observe +1/+2/+3 or -1/-2/-3 levels for overextension opportunities or trailing stop ideas.

- Use breakout count as a proxy for trend strength—multiple counts suggest momentum.

- Combine with volume or order flow tools for higher confidence entries at breakout points.

- Adjust the angle setting to fine-tune sensitivity based on market volatility.

🔵 CONCLUSION

Angle Market Structure [BigBeluga] enhances traditional pivot-based analysis by introducing breakout acceleration and structured deviation tracking. It’s a powerful tool for traders seeking a cleaner, faster read on market structure and momentum strength—especially during impulsive price moves or structural transitions.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

🔵Gain access to our powerful tools : bigbeluga.com/tv

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

🔵Join our free discord for updates : bigbeluga.com/discord

All scripts & content provided by BigBeluga are for informational & educational purposes only.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.