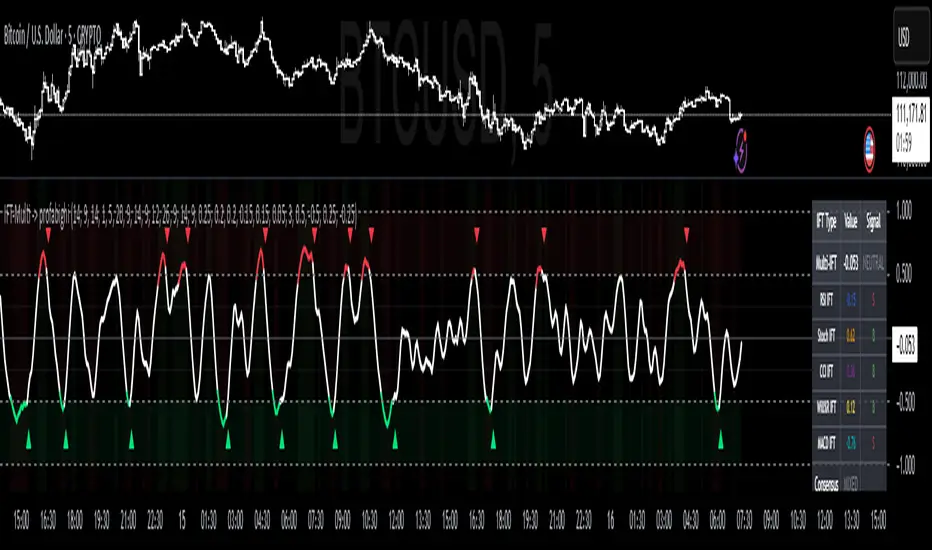

Inverse Fisher Transform Multi-Indicator -> PROFABIGHI_CAPITAL

The Inverse Fisher Transform Multi-Indicator → PROFABIGHI_CAPITAL applies the Inverse Fisher Transform to multiple oscillators like RSI, Stochastic, CCI, Williams %R, MACD, and MFI, creating a weighted composite signal for enhanced momentum detection. It helps traders identify overbought/oversold extremes, consensus alignments, and divergences through a smoothed, probabilistic view of market strength.

👁️ Indicator Selection

– Enable RSI IFT: Toggle to incorporate RSI-transformed signals into the composite.

– Enable Stochastic IFT: Toggle to include Stochastic %K-transformed signals.

– Enable CCI IFT: Toggle to add CCI-transformed signals for cycle analysis.

– Enable Williams %R IFT: Toggle to blend Williams %R-transformed signals for momentum extremes.

– Enable MACD IFT: Toggle to integrate MACD-transformed signals for trend convergence.

– Enable MFI IFT: Toggle to factor in MFI-transformed signals for volume-weighted flow.

📊 Oscillator Settings

– RSI Length & IFT Length: Periods for base RSI computation and its IFT smoothing.

– Stochastic %K Length, Smoothing & IFT Length: Periods for Stochastic %K, its smoothing, and IFT application.

– CCI Length & IFT Length: Periods for CCI base and its IFT refinement.

– Williams %R Length & IFT Length: Periods for Williams %R base and IFT smoothing.

– MACD Fast/Slow Length & IFT Length: EMA periods for MACD and its IFT smoothing.

– MFI Length & IFT Length: Periods for MFI base and IFT application.

⚖️ Weights

– RSI/Stochastic/CCI/Williams %R/MACD/MFI Weights: Adjustable contributions to the composite, normalized for balanced influence.

👁️ Display Settings

– Multi-IFT Smoothing: Period to smooth the overall composite line for cleaner trends.

– Show Individual IFTs: Toggle to overlay separate transformed lines for component review.

– Show Zero Line: Toggle the central reference line for positive/negative separation.

📏 Levels

– Overbought/Oversold Levels: Thresholds for extreme momentum zones.

– Neutral Upper/Lower: Boundaries defining the consolidation range.

🎨 Colors

– Overbought/Oversold/Neutral/Bullish/Bearish Colors: Custom hues for zones, signals, and backgrounds.

🔧 Inverse Fisher Transform

The core function normalizes an oscillator's values over a lookback, smooths them, clamps to avoid extremes, then applies the mathematical transform to output a sigmoid-like signal between -1 and 1, amplifying turning points for sharper reversals.

📈 Composite Calculation

– Base Indicators: Computes raw values from selected oscillators using price, volume, and range data.

– IFT Application: Transforms each enabled oscillator individually for bounded, noise-reduced outputs.

– Weighted Blend: Averages transformed values by user weights, then smooths the result for a unified momentum gauge.

📡 Signal Analysis

– Trend & Momentum: Tracks changes in the composite for directional bias and acceleration.

– Crossover Signals: Triggers buys on oversold breaks and sells on overbought drops.

– Zero Crosses: Flags bullish shifts above zero and bearish below for equilibrium changes.

– Momentum Cues: Confirms strength in neutral zones with positive/negative velocity.

– Extreme Alerts: Highlights deep oversold/overbought with turning momentum.

– Consensus Checks: Scans for aligned bullish/bearish readings across all active components.

– Divergence Scans: Detects price-IFT mismatches over lookback periods for reversal hints.

📉 Visualization

– Composite Line: Thick, color-shifting plot for the main Multi-IFT, tinting by zone.

– Individual Overlays: Faint lines for enabled IFTs when toggled, aiding comparison.

– Reference Lines: Dashed overbought/oversold, dotted neutrals, solid zero for quick reads.

– Zone Fills: Subtle shading in extreme areas for visual emphasis.

– Signal Markers: Tiny triangles at crossovers for buy/sell points.

– Consensus Background: Faint bullish/bearish tints when components align.

– Info Table: Top-right panel listing Multi-IFT value/signal, individual readings, consensus, and dominant component.

🔔 Alerts

– Crossover Notifications: For oversold buys or overbought sells.

– Zero Cross Warnings: On equilibrium shifts.

– Momentum Triggers: For neutral zone accelerations.

– Extreme Flags: On deep reversals with velocity.

– Consensus Alerts: When all components agree on direction.

– Divergence Notices: For hidden bullish/bearish setups.

✅ Key Takeaways

– Blends multiple IFT-transformed oscillators for robust, noise-filtered momentum consensus.

– Customizable weights and toggles allow tailored focus on preferred signals.

– Sharpens reversals via Fisher math while spotting divergences for early edges.

– Visual table and zones simplify multi-indicator harmony in any timeframe.

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente PROFABIGHI_CAPITAL.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.

Istruzioni dell'autore

Declinazione di responsabilità

Script su invito

Solo gli utenti approvati dall'autore possono accedere a questo script. È necessario richiedere e ottenere l'autorizzazione per utilizzarlo. Tale autorizzazione viene solitamente concessa dopo il pagamento. Per ulteriori dettagli, seguire le istruzioni dell'autore riportate di seguito o contattare direttamente PROFABIGHI_CAPITAL.

TradingView NON consiglia di pagare o utilizzare uno script a meno che non ci si fidi pienamente del suo autore e non si comprenda il suo funzionamento. Puoi anche trovare alternative gratuite e open-source nei nostri script della comunità.