OPEN-SOURCE SCRIPT

Mad Trading Scientist - Guppy MMA with Bollinger Bands

📘 Indicator Name:

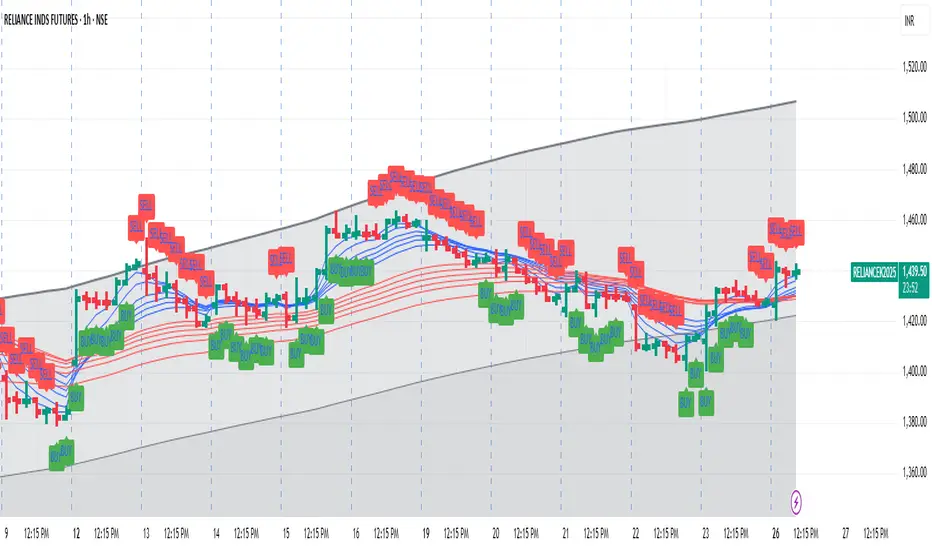

Guppy MMA with Bollinger Bands

🔍 What This Indicator Does:

This TradingView indicator combines Guppy Multiple Moving Averages (GMMA) with Bollinger Bands to help you identify trend direction and volatility zones, ideal for spotting pullback entries within trending markets.

🔵 1. Guppy Multiple Moving Averages (GMMA):

✅ Short-Term EMAs (Blue) — represent trader sentiment:

EMA 3, 5, 8, 10, 12, 15

✅ Long-Term EMAs (Red) — represent investor sentiment:

EMA 30, 35, 40, 45, 50, 60

Usage:

When blue (short) EMAs are above red (long) EMAs and spreading → Strong uptrend

When blue EMAs cross below red EMAs → Potential downtrend

⚫ 2. Bollinger Bands (Volatility Envelopes):

Length: 300 (captures the longer-term price range)

Basis: 300-period SMA

Upper & Lower Bands:

±1 Standard Deviation (light gray zone)

±2 Standard Deviations (dark gray zone)

Fill Zones:

Highlights standard deviation ranges

Emphasizes extreme vs. normal price moves

Usage:

Price touching ±2 SD bands signals potential exhaustion

Price reverting to the mean suggests pullback or re-entry opportunity

💡 Important Note: Use With Momentum Filter

✅ For superior accuracy, this indicator should be combined with your invite-only momentum filter on TradingView.

This filter helps confirm whether the trend has underlying strength or is losing momentum, increasing the probability of successful entries and exits.

🕒 Recommended Timeframe:

📆 1-Hour Chart (60m)

This setup is optimized for short- to medium-term swing trading, where Guppy structures and Bollinger reversion work best.

🔧 Practical Strategy Example:

Long Trade Setup:

Short EMAs are above long EMAs (strong uptrend)

Price pulls back to the lower 1 or 2 SD band

Momentum filter confirms bullish strength

Short Trade Setup:

Short EMAs are below long EMAs (strong downtrend)

Price rises to the upper 1 or 2 SD band

Momentum filter confirms bearish strength

Guppy MMA with Bollinger Bands

🔍 What This Indicator Does:

This TradingView indicator combines Guppy Multiple Moving Averages (GMMA) with Bollinger Bands to help you identify trend direction and volatility zones, ideal for spotting pullback entries within trending markets.

🔵 1. Guppy Multiple Moving Averages (GMMA):

✅ Short-Term EMAs (Blue) — represent trader sentiment:

EMA 3, 5, 8, 10, 12, 15

✅ Long-Term EMAs (Red) — represent investor sentiment:

EMA 30, 35, 40, 45, 50, 60

Usage:

When blue (short) EMAs are above red (long) EMAs and spreading → Strong uptrend

When blue EMAs cross below red EMAs → Potential downtrend

⚫ 2. Bollinger Bands (Volatility Envelopes):

Length: 300 (captures the longer-term price range)

Basis: 300-period SMA

Upper & Lower Bands:

±1 Standard Deviation (light gray zone)

±2 Standard Deviations (dark gray zone)

Fill Zones:

Highlights standard deviation ranges

Emphasizes extreme vs. normal price moves

Usage:

Price touching ±2 SD bands signals potential exhaustion

Price reverting to the mean suggests pullback or re-entry opportunity

💡 Important Note: Use With Momentum Filter

✅ For superior accuracy, this indicator should be combined with your invite-only momentum filter on TradingView.

This filter helps confirm whether the trend has underlying strength or is losing momentum, increasing the probability of successful entries and exits.

🕒 Recommended Timeframe:

📆 1-Hour Chart (60m)

This setup is optimized for short- to medium-term swing trading, where Guppy structures and Bollinger reversion work best.

🔧 Practical Strategy Example:

Long Trade Setup:

Short EMAs are above long EMAs (strong uptrend)

Price pulls back to the lower 1 or 2 SD band

Momentum filter confirms bullish strength

Short Trade Setup:

Short EMAs are below long EMAs (strong downtrend)

Price rises to the upper 1 or 2 SD band

Momentum filter confirms bearish strength

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.