OPEN-SOURCE SCRIPT

Aggiornato Turtle Trade Channels Indicator TUTCI

Legendary trade system which proved that great traders can be made, not born.

Turtle Trade Experiment made 80% annual return for 4 years and made 150 million $

Turtle Trade trend following system is a complete opposite to the "buy low and sell high" approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

They used the basis logic of well known DONCHIAN CHANNELS which developed by Richard Donchian.

The main rule is "Trade an 20-day breakout and take profits when an 10-day high or low is breached ". Examples:

Buy a 20-day breakout and close the trade when price action reaches a 10-day low.

Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

In this indicator,

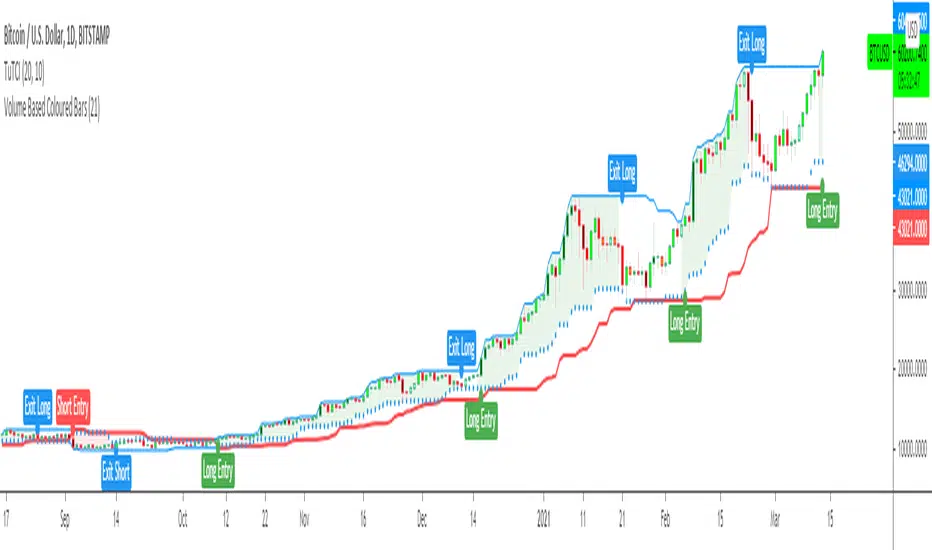

The red line is the trading line which indicates the trend direction:

Price bars over the trend line indicates uptrend

Price bars under the trend line means downtrend

The dotted blue line is the exit line.

Original system is:

Go long when the price High is equal to or above previous 20 day Highest price.

Go short when the price Low is equal to or below previous 20 day Lowest price.

Exit long positions when the price touches the exit line

Exit short positions when the price touches the exit line

Recommended initial stop-loss is ATR * 2 from the opening price.

Default system parameters were 20,10 and 55,20.

Original Turtle Rules:

To trade exactly like the turtles did, you need to set up two indicators representing the main and the failsafe system.

Set up the main indicator with EntryPeriod = 20 and ExitPeriod = 10 (A.k.a S1)

Set up the failsafe indicator with EntryPeriod = 55 and ExitPeriod = 20 using a different color. (A.k.a S2)

The entry strategy using S1 is as follows

Buy 20-day breakouts using S1 only if last signaled trade was a loss.

Sell 20-day breakouts using S1 only if last signaled trade was a loss.

If last signaled trade by S1 was a win, you shouldn't trade -Irregardless of the direction or if you traded last signal it or not-

The entry strategy using S2 is as follows:

Buy 55-day breakouts only if you ignored last S1 signal and the market is rallying without you

Sell 55-day breakouts only if you ignored last S1 signal and the market is pluging without you

You can Highlight the chart with provided trade signals:

Green background color when Long

Red background color when Short

No background color when flat

WARNING: TURTLE TRADE STOP or ADDING more UNITS RULES ARE NOT INCLUDED.

Author: Kıvanç Özbilgiç

Also you can show or hide trade signals with the button on the settings menu

Turtle Trade Experiment made 80% annual return for 4 years and made 150 million $

Turtle Trade trend following system is a complete opposite to the "buy low and sell high" approach.

This trend following system was taught to a group of average and normal individuals, and almost everyone turned into a profitable trader.

They used the basis logic of well known DONCHIAN CHANNELS which developed by Richard Donchian.

The main rule is "Trade an 20-day breakout and take profits when an 10-day high or low is breached ". Examples:

Buy a 20-day breakout and close the trade when price action reaches a 10-day low.

Go short a 20-day breakout and close the trade when price action reaches a 10-day high.

In this indicator,

The red line is the trading line which indicates the trend direction:

Price bars over the trend line indicates uptrend

Price bars under the trend line means downtrend

The dotted blue line is the exit line.

Original system is:

Go long when the price High is equal to or above previous 20 day Highest price.

Go short when the price Low is equal to or below previous 20 day Lowest price.

Exit long positions when the price touches the exit line

Exit short positions when the price touches the exit line

Recommended initial stop-loss is ATR * 2 from the opening price.

Default system parameters were 20,10 and 55,20.

Original Turtle Rules:

To trade exactly like the turtles did, you need to set up two indicators representing the main and the failsafe system.

Set up the main indicator with EntryPeriod = 20 and ExitPeriod = 10 (A.k.a S1)

Set up the failsafe indicator with EntryPeriod = 55 and ExitPeriod = 20 using a different color. (A.k.a S2)

The entry strategy using S1 is as follows

Buy 20-day breakouts using S1 only if last signaled trade was a loss.

Sell 20-day breakouts using S1 only if last signaled trade was a loss.

If last signaled trade by S1 was a win, you shouldn't trade -Irregardless of the direction or if you traded last signal it or not-

The entry strategy using S2 is as follows:

Buy 55-day breakouts only if you ignored last S1 signal and the market is rallying without you

Sell 55-day breakouts only if you ignored last S1 signal and the market is pluging without you

You can Highlight the chart with provided trade signals:

Green background color when Long

Red background color when Short

No background color when flat

WARNING: TURTLE TRADE STOP or ADDING more UNITS RULES ARE NOT INCLUDED.

Author: Kıvanç Özbilgiç

Also you can show or hide trade signals with the button on the settings menu

Note di rilascio

background color updatedNote di rilascio

code updated due to TradingView errorScript open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Telegram t.me/AlgoRhytm

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

YouTube (Turkish): youtube.com/c/kivancozbilgic

YouTube (English): youtube.com/c/AlgoWorld

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.