OPEN-SOURCE SCRIPT

KASPA Slope Oscillator

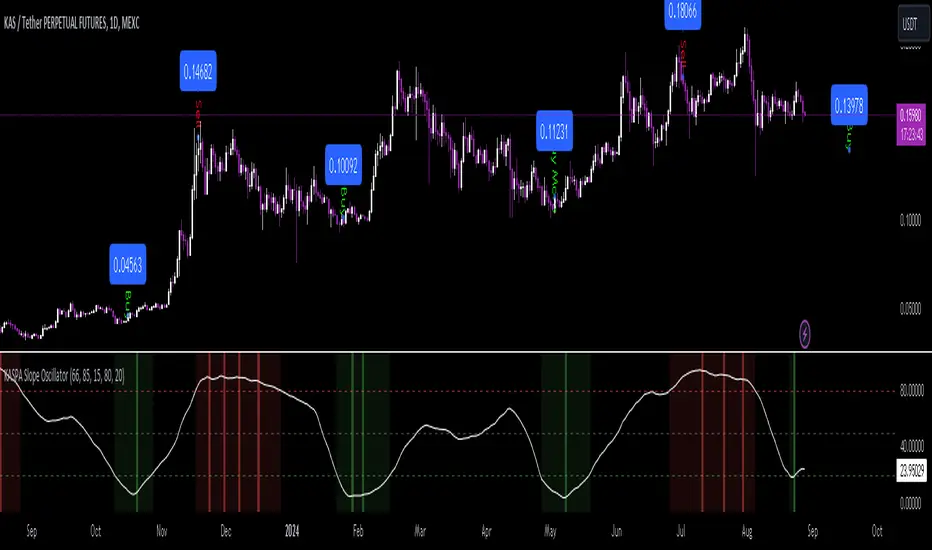

KASPA [KAS] Slope Oscillator for analyzing KASPA on the 1D (daily) chart.

The indicator is plotted in a separate pane below the price chart and uses a mathematical approach to calculate and visualize the momentum or "slope" of KASPA's price movements.

Input Parameters:

Slope Window (days):

Defines the period (66 days by default) over which the slope is calculated.

Normalization Window (days):

The window size (85 days) for normalizing the slope values between 0 and 100.

Smoothing Period:

The number of days (15 days) over which the slope values are smoothed to reduce noise.

Overbought and Oversold Levels:

Threshold levels set at 80 (overbought) and 20 (oversold), respectively.

Calculation of the Slope:

Logarithmic Price Calculation:

Converts the close price of KASPA into a logarithmic scale to account for exponential growth or decay.

Rolling Slope:

Computes the rate of change in logarithmic prices over the defined slope window.

Normalization:

The slope is normalized between 0 and 100, allowing easier identification of extreme values.

Smoothing and Visualization:

Smoothing the Slope:

A Simple Moving Average (SMA) is applied to the normalized slope for the specified smoothing period.

Plotting the Oscillator:

The smoothed slope is plotted on the oscillator chart. Horizontal lines indicate overbought (80), oversold (20), and the mid-level (50).

Background Color Indications:

Background colors (red or green) indicate when the slope crosses above the overbought or below the oversold levels, respectively, signaling potential buy or sell conditions.

Detection of Local Maxima and Minima:

The code identifies local peaks (maxima) above the overbought level and troughs (minima) below the oversold level.

Vertical background lines are highlighted in red or green at these points, signaling potential reversals.

Short Summary:

The oscillator line fluctuates between 0 and 100, representing the normalized momentum of the price.

Red background areas indicate periods when the oscillator is above the overbought level (80), suggesting a potential overbought condition or a sell signal.

Green background areas indicate periods when the oscillator is below the oversold level (20), suggesting a potential oversold condition or a buy signal.

The vertical lines on the background mark local maxima and minima where price reversals may occur.

(I also want to thank ForgoWork for optimizing visuality and cleaning up the source code)

The indicator is plotted in a separate pane below the price chart and uses a mathematical approach to calculate and visualize the momentum or "slope" of KASPA's price movements.

Input Parameters:

Slope Window (days):

Defines the period (66 days by default) over which the slope is calculated.

Normalization Window (days):

The window size (85 days) for normalizing the slope values between 0 and 100.

Smoothing Period:

The number of days (15 days) over which the slope values are smoothed to reduce noise.

Overbought and Oversold Levels:

Threshold levels set at 80 (overbought) and 20 (oversold), respectively.

Calculation of the Slope:

Logarithmic Price Calculation:

Converts the close price of KASPA into a logarithmic scale to account for exponential growth or decay.

Rolling Slope:

Computes the rate of change in logarithmic prices over the defined slope window.

Normalization:

The slope is normalized between 0 and 100, allowing easier identification of extreme values.

Smoothing and Visualization:

Smoothing the Slope:

A Simple Moving Average (SMA) is applied to the normalized slope for the specified smoothing period.

Plotting the Oscillator:

The smoothed slope is plotted on the oscillator chart. Horizontal lines indicate overbought (80), oversold (20), and the mid-level (50).

Background Color Indications:

Background colors (red or green) indicate when the slope crosses above the overbought or below the oversold levels, respectively, signaling potential buy or sell conditions.

Detection of Local Maxima and Minima:

The code identifies local peaks (maxima) above the overbought level and troughs (minima) below the oversold level.

Vertical background lines are highlighted in red or green at these points, signaling potential reversals.

Short Summary:

The oscillator line fluctuates between 0 and 100, representing the normalized momentum of the price.

Red background areas indicate periods when the oscillator is above the overbought level (80), suggesting a potential overbought condition or a sell signal.

Green background areas indicate periods when the oscillator is below the oversold level (20), suggesting a potential oversold condition or a buy signal.

The vertical lines on the background mark local maxima and minima where price reversals may occur.

(I also want to thank ForgoWork for optimizing visuality and cleaning up the source code)

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.