OPEN-SOURCE SCRIPT

Trend Following: Turtle Trading Strategy - Pyramiding Edition

📚 Strategy Origins

This indicator is based on the legendary Turtle Trading Rules

featured in "Trend Following" classics, combining Donchian

Channel breakouts with pyramiding system, designed specifically

for capturing mid-to-long term trends.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ Core Mechanics

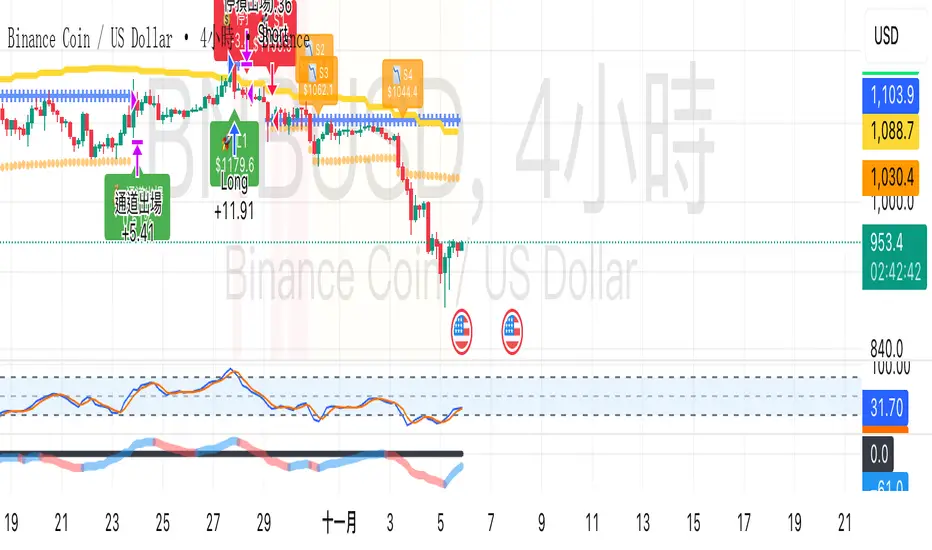

【Entry Logic】

- Break above 20-period Donchian high → Go Long

- Break below 20-period Donchian low → Go Short

【Exit Logic】

- Fall to 10-period Donchian low → Close Long

- Rise to 10-period Donchian high → Close Short

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ Risk Management System

【Triple Protection Mechanism】

1️⃣ Per-Trade Risk: Only 2% capital risk per trade

2️⃣ ATR Dynamic Stop: 2x ATR distance, adapts to volatility

3️⃣ Drawdown Circuit Breaker: Auto-close at 25% max drawdown

【Trailing Stop】

- Automatically updates stop after each pyramid add

- Protects profits while letting winners run

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏔️ Pyramiding Logic

【Add-On Conditions】

- Price moves 0.5 ATR in favorable direction → Trigger add

- Maximum 4 additions (5 total position layers)

- Each add = 100% of base position size

【Pyramiding Advantages】

✓ Scale into trends, maximize gains in strong moves

✓ ATR-based spacing prevents overtrading

✓ Visual markers (🚀 L1, 📈 L2...) for clear tracking

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Unique Optimization: Dual Timeframe Filter

【Daily 20 SMA Filter】

Yellow line on chart = Daily timeframe 20 SMA

📊 Filter Rules:

- 4H candle price > Daily 20 SMA → Long trades only

- 4H candle price < Daily 20 SMA → Short trades only

💡 Advantage: Avoids whipsaws in ranging markets,

ensures trading with the trend

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⏰ Optimal Usage Environment

【Recommended Settings】

📌 Timeframe: 4-Hour Chart (4H)

📌 Assets: High-volatility Altcoins

📌 Money Management: Strict 2% per-trade risk

【Why 4H + Altcoins?】

- 4H timeframe: Optimal balance between noise and trend

- Altcoins: High volatility & strong trends fit Turtle logic

- Backtest edge: Outperforms BTC in most scenarios

⚠️ Risk Warning: High volatility = High reward potential + High drawdown risk

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 Visualization Features

✅ Real-time Markers:

- 🚀 Initial entry labels (L1/S1)

- 📈📉 Pyramid addition markers (L2~L5)

- 💰 Exit signals with P&L percentage

✅ Helper Lines:

- Yellow line: Daily 20 SMA (trend direction)

- Blue crosses: Initial entry price

- Green/Orange dots: Next pyramid trigger price

✅ Background Alerts:

- Red background: Risk zone / Drawdown warning

- Yellow background: Multi-layer pyramid alert

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ Parameter Guide

【Basic Parameters】

- Entry Channel: 20-period (classic Turtle setting)

- Exit Channel: 10-period (quick profit-taking)

- ATR Period: 14 (dynamic volatility measure)

【Risk Management】

- Risk per Trade: 2% (adjustable 0.5~5%)

- ATR Stop Multiplier: 2x (adjustable for conservatism)

- Max Drawdown: 25% (circuit breaker protection)

【Pyramiding Settings】

- Max Additions: 4 times (5 total layers)

- Trigger Distance: 0.5 ATR

- Add Size: 100% (equal sizing)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Important Notes

1. This is a trend-following system; may underperform in ranging markets

2. Drawdowns are inevitable cost of trend trading; psychological tolerance required

3. Pyramiding amplifies both gains and losses; strict risk management essential

4. Recommended to test on paper trading first before going live

5. Altcoin liquidity varies; watch for slippage and trading costs

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📖 Ideal For

✓ Traders familiar with Turtle Trading Rules

✓ Medium-to-long term investors who can handle drawdowns

✓ Systematic trading enthusiasts

✓ Altcoin trend opportunity seekers

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 Usage Tips

1. Backtest First: Thoroughly test on target assets

2. Parameter Tuning: Adjust ATR multiplier based on asset characteristics

3. Diversification: Don't put all eggs in one strategy basket

4. Keep Records: Maintain trading journal for regular review

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

【Key Features vs Traditional Turtle】

- Added: Daily MA filter to reduce false breakouts

- Enhanced: Trailing stop mechanism to protect profits

- Visual: Clear chart labeling system

【Real-World Application】

On high-volatility altcoins like SOL, AVAX, MATIC,

this strategy effectively captures major trend moves

from 2022-2024, with single-trend returns of 50%+

(including pyramiding effect)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📌 Disclaimer:

This indicator is for educational and reference purposes only

and does not constitute investment advice. Cryptocurrency

trading carries high risk; please make decisions based on

your own circumstances.

Happy Trading! 🚀

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🐢 海龜交易法則 - 金字塔加碼版

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📚 策略靈感來源

本指標基於經典著作《趨勢跟蹤》中的海龜交易法則,

結合 Donchian 通道突破與金字塔加碼系統,

專為捕捉中長期趨勢而設計。

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ 核心機制

【進場邏輯】

- 突破 20 週期 Donchian 通道高點 → 做多

- 跌破 20 週期 Donchian 通道低點 → 做空

【出場邏輯】

- 回落至 10 週期 Donchian 通道低點 → 多單出場

- 反彈至 10 週期 Donchian 通道高點 → 空單出場

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ 風險控管系統

【三層保護機制】

1️⃣ 單筆風險控制:每筆交易僅冒 2% 資金風險

2️⃣ ATR 動態停損:2 倍 ATR 距離,適應市場波動

3️⃣ 回撤熔斷:達 25% 最大回撤自動平倉保護

【移動停損】

- 加碼後自動更新停損位

- 保護浮盈,讓利潤奔跑

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏔️ 金字塔加碼邏輯

【加碼條件】

- 價格朝有利方向移動 0.5 ATR → 觸發加碼

- 最多加碼 4 次(共 5 層倉位)

- 每次加碼為基礎倉位的 100%

【加碼優勢】

✓ 順勢增加曝險,在強趨勢中擴大收益

✓ ATR 動態調整,避免過度交易

✓ 視覺化標記(🚀 L1、📈 L2...),清晰追蹤

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 獨特優化:雙時間週期過濾

【日線 20 均線過濾】

圖表上的黃色線 = 日線級別的 20 SMA

📊 過濾規則:

- 4H K棒價格 > 日線 20 均線 → 僅開多單

- 4H K棒價格 < 日線 20 均線 → 僅開空單

💡 優勢:避免在震蕩市中頻繁交易,確保順勢而為

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⏰ 最佳使用環境

【推薦配置】

📌 時間週期:4 小時線圖(4H)

📌 交易標的:高波動山寨幣

📌 資金管理:嚴守 2% 單筆風險

【為什麼選 4H + 山寨幣?】

- 4H 週期:平衡噪音與趨勢的最佳時間框架

- 山寨幣:波動大、趨勢強,更符合海龜法則邏輯

- 回測優勢:相比 BTC,山寨幣的績效表現更出色

⚠️ 風險提示:高波動 = 高收益潛力 + 高回撤風險

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 視覺化功能

✅ 即時標記:

- 🚀 初始進場標記(L1/S1)

- 📈📉 加碼位置標記(L2~L5)

- 💰 出場信號與損益百分比

✅ 輔助線條:

- 黃色線:日線 20 均線(趨勢方向)

- 藍色叉號:初始進場價格

- 綠/橙圓點:下次加碼觸發價位

✅ 背景提示:

- 紅色背景:風險區 / 回撤警告

- 黃色背景:多層加碼提醒

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ 參數說明

【基礎參數】

- 進場通道:20 週期(經典海龜設定)

- 出場通道:10 週期(快速止盈)

- ATR 週期:14(動態波動率)

【風險管理】

- 每筆風險:2%(可調 0.5~5%)

- ATR 停損:2 倍(可調整保守程度)

- 最大回撤:25%(熔斷保護)

【加碼設定】

- 加碼次數:4 次(共 5 層倉位)

- 觸發距離:0.5 ATR

- 加碼比例:100%(等量加碼)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ 重要提醒

1. 本策略為趨勢跟蹤系統,在震蕩市可能表現不佳

2. 回撤是趨勢策略的必然代價,需要心理承受力

3. 金字塔加碼會放大盈虧,務必嚴守風險管理

4. 建議先在模擬盤測試,熟悉策略邏輯後再實盤

5. 山寨幣流動性差異大,需注意滑點與交易成本

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📖 適合對象

✓ 熟悉海龜交易法則的交易者

✓ 能承受回撤的中長期投資者

✓ 偏好系統化交易的量化愛好者

✓ 尋找山寨幣趨勢機會的投機者

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 使用建議

1. 回測驗證:在目標幣種上進行充分回測

2. 參數調整:根據標的特性微調 ATR 倍數

3. 分散投資:不要將全部資金用於單一策略

4. 記錄追蹤:保持交易日誌,定期檢討優化

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📌 免責聲明:

本指標僅供教育和參考用途,不構成投資建議。

加密貨幣交易存在高風險,請根據自身情況謹慎決策。

祝交易順利!🚀

This indicator is based on the legendary Turtle Trading Rules

featured in "Trend Following" classics, combining Donchian

Channel breakouts with pyramiding system, designed specifically

for capturing mid-to-long term trends.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ Core Mechanics

【Entry Logic】

- Break above 20-period Donchian high → Go Long

- Break below 20-period Donchian low → Go Short

【Exit Logic】

- Fall to 10-period Donchian low → Close Long

- Rise to 10-period Donchian high → Close Short

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ Risk Management System

【Triple Protection Mechanism】

1️⃣ Per-Trade Risk: Only 2% capital risk per trade

2️⃣ ATR Dynamic Stop: 2x ATR distance, adapts to volatility

3️⃣ Drawdown Circuit Breaker: Auto-close at 25% max drawdown

【Trailing Stop】

- Automatically updates stop after each pyramid add

- Protects profits while letting winners run

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏔️ Pyramiding Logic

【Add-On Conditions】

- Price moves 0.5 ATR in favorable direction → Trigger add

- Maximum 4 additions (5 total position layers)

- Each add = 100% of base position size

【Pyramiding Advantages】

✓ Scale into trends, maximize gains in strong moves

✓ ATR-based spacing prevents overtrading

✓ Visual markers (🚀 L1, 📈 L2...) for clear tracking

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 Unique Optimization: Dual Timeframe Filter

【Daily 20 SMA Filter】

Yellow line on chart = Daily timeframe 20 SMA

📊 Filter Rules:

- 4H candle price > Daily 20 SMA → Long trades only

- 4H candle price < Daily 20 SMA → Short trades only

💡 Advantage: Avoids whipsaws in ranging markets,

ensures trading with the trend

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⏰ Optimal Usage Environment

【Recommended Settings】

📌 Timeframe: 4-Hour Chart (4H)

📌 Assets: High-volatility Altcoins

📌 Money Management: Strict 2% per-trade risk

【Why 4H + Altcoins?】

- 4H timeframe: Optimal balance between noise and trend

- Altcoins: High volatility & strong trends fit Turtle logic

- Backtest edge: Outperforms BTC in most scenarios

⚠️ Risk Warning: High volatility = High reward potential + High drawdown risk

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 Visualization Features

✅ Real-time Markers:

- 🚀 Initial entry labels (L1/S1)

- 📈📉 Pyramid addition markers (L2~L5)

- 💰 Exit signals with P&L percentage

✅ Helper Lines:

- Yellow line: Daily 20 SMA (trend direction)

- Blue crosses: Initial entry price

- Green/Orange dots: Next pyramid trigger price

✅ Background Alerts:

- Red background: Risk zone / Drawdown warning

- Yellow background: Multi-layer pyramid alert

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ Parameter Guide

【Basic Parameters】

- Entry Channel: 20-period (classic Turtle setting)

- Exit Channel: 10-period (quick profit-taking)

- ATR Period: 14 (dynamic volatility measure)

【Risk Management】

- Risk per Trade: 2% (adjustable 0.5~5%)

- ATR Stop Multiplier: 2x (adjustable for conservatism)

- Max Drawdown: 25% (circuit breaker protection)

【Pyramiding Settings】

- Max Additions: 4 times (5 total layers)

- Trigger Distance: 0.5 ATR

- Add Size: 100% (equal sizing)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ Important Notes

1. This is a trend-following system; may underperform in ranging markets

2. Drawdowns are inevitable cost of trend trading; psychological tolerance required

3. Pyramiding amplifies both gains and losses; strict risk management essential

4. Recommended to test on paper trading first before going live

5. Altcoin liquidity varies; watch for slippage and trading costs

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📖 Ideal For

✓ Traders familiar with Turtle Trading Rules

✓ Medium-to-long term investors who can handle drawdowns

✓ Systematic trading enthusiasts

✓ Altcoin trend opportunity seekers

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 Usage Tips

1. Backtest First: Thoroughly test on target assets

2. Parameter Tuning: Adjust ATR multiplier based on asset characteristics

3. Diversification: Don't put all eggs in one strategy basket

4. Keep Records: Maintain trading journal for regular review

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

【Key Features vs Traditional Turtle】

- Added: Daily MA filter to reduce false breakouts

- Enhanced: Trailing stop mechanism to protect profits

- Visual: Clear chart labeling system

【Real-World Application】

On high-volatility altcoins like SOL, AVAX, MATIC,

this strategy effectively captures major trend moves

from 2022-2024, with single-trend returns of 50%+

(including pyramiding effect)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📌 Disclaimer:

This indicator is for educational and reference purposes only

and does not constitute investment advice. Cryptocurrency

trading carries high risk; please make decisions based on

your own circumstances.

Happy Trading! 🚀

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🐢 海龜交易法則 - 金字塔加碼版

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📚 策略靈感來源

本指標基於經典著作《趨勢跟蹤》中的海龜交易法則,

結合 Donchian 通道突破與金字塔加碼系統,

專為捕捉中長期趨勢而設計。

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ 核心機制

【進場邏輯】

- 突破 20 週期 Donchian 通道高點 → 做多

- 跌破 20 週期 Donchian 通道低點 → 做空

【出場邏輯】

- 回落至 10 週期 Donchian 通道低點 → 多單出場

- 反彈至 10 週期 Donchian 通道高點 → 空單出場

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🛡️ 風險控管系統

【三層保護機制】

1️⃣ 單筆風險控制:每筆交易僅冒 2% 資金風險

2️⃣ ATR 動態停損:2 倍 ATR 距離,適應市場波動

3️⃣ 回撤熔斷:達 25% 最大回撤自動平倉保護

【移動停損】

- 加碼後自動更新停損位

- 保護浮盈,讓利潤奔跑

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🏔️ 金字塔加碼邏輯

【加碼條件】

- 價格朝有利方向移動 0.5 ATR → 觸發加碼

- 最多加碼 4 次(共 5 層倉位)

- 每次加碼為基礎倉位的 100%

【加碼優勢】

✓ 順勢增加曝險,在強趨勢中擴大收益

✓ ATR 動態調整,避免過度交易

✓ 視覺化標記(🚀 L1、📈 L2...),清晰追蹤

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

🎯 獨特優化:雙時間週期過濾

【日線 20 均線過濾】

圖表上的黃色線 = 日線級別的 20 SMA

📊 過濾規則:

- 4H K棒價格 > 日線 20 均線 → 僅開多單

- 4H K棒價格 < 日線 20 均線 → 僅開空單

💡 優勢:避免在震蕩市中頻繁交易,確保順勢而為

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⏰ 最佳使用環境

【推薦配置】

📌 時間週期:4 小時線圖(4H)

📌 交易標的:高波動山寨幣

📌 資金管理:嚴守 2% 單筆風險

【為什麼選 4H + 山寨幣?】

- 4H 週期:平衡噪音與趨勢的最佳時間框架

- 山寨幣:波動大、趨勢強,更符合海龜法則邏輯

- 回測優勢:相比 BTC,山寨幣的績效表現更出色

⚠️ 風險提示:高波動 = 高收益潛力 + 高回撤風險

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📊 視覺化功能

✅ 即時標記:

- 🚀 初始進場標記(L1/S1)

- 📈📉 加碼位置標記(L2~L5)

- 💰 出場信號與損益百分比

✅ 輔助線條:

- 黃色線:日線 20 均線(趨勢方向)

- 藍色叉號:初始進場價格

- 綠/橙圓點:下次加碼觸發價位

✅ 背景提示:

- 紅色背景:風險區 / 回撤警告

- 黃色背景:多層加碼提醒

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚙️ 參數說明

【基礎參數】

- 進場通道:20 週期(經典海龜設定)

- 出場通道:10 週期(快速止盈)

- ATR 週期:14(動態波動率)

【風險管理】

- 每筆風險:2%(可調 0.5~5%)

- ATR 停損:2 倍(可調整保守程度)

- 最大回撤:25%(熔斷保護)

【加碼設定】

- 加碼次數:4 次(共 5 層倉位)

- 觸發距離:0.5 ATR

- 加碼比例:100%(等量加碼)

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

⚠️ 重要提醒

1. 本策略為趨勢跟蹤系統,在震蕩市可能表現不佳

2. 回撤是趨勢策略的必然代價,需要心理承受力

3. 金字塔加碼會放大盈虧,務必嚴守風險管理

4. 建議先在模擬盤測試,熟悉策略邏輯後再實盤

5. 山寨幣流動性差異大,需注意滑點與交易成本

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📖 適合對象

✓ 熟悉海龜交易法則的交易者

✓ 能承受回撤的中長期投資者

✓ 偏好系統化交易的量化愛好者

✓ 尋找山寨幣趨勢機會的投機者

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

💡 使用建議

1. 回測驗證:在目標幣種上進行充分回測

2. 參數調整:根據標的特性微調 ATR 倍數

3. 分散投資:不要將全部資金用於單一策略

4. 記錄追蹤:保持交易日誌,定期檢討優化

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

📌 免責聲明:

本指標僅供教育和參考用途,不構成投資建議。

加密貨幣交易存在高風險,請根據自身情況謹慎決策。

祝交易順利!🚀

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Script open-source

In pieno spirito TradingView, il creatore di questo script lo ha reso open-source, in modo che i trader possano esaminarlo e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricorda che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.