OPEN-SOURCE SCRIPT

Volume Imbalance Analyzer - 70% & 80% Version1.01

Here’s a clean “definition” you can drop into your docs. It explains **what** the indicator is, **what it helps with**, and **how** to use it—plain and practical.

# Definition

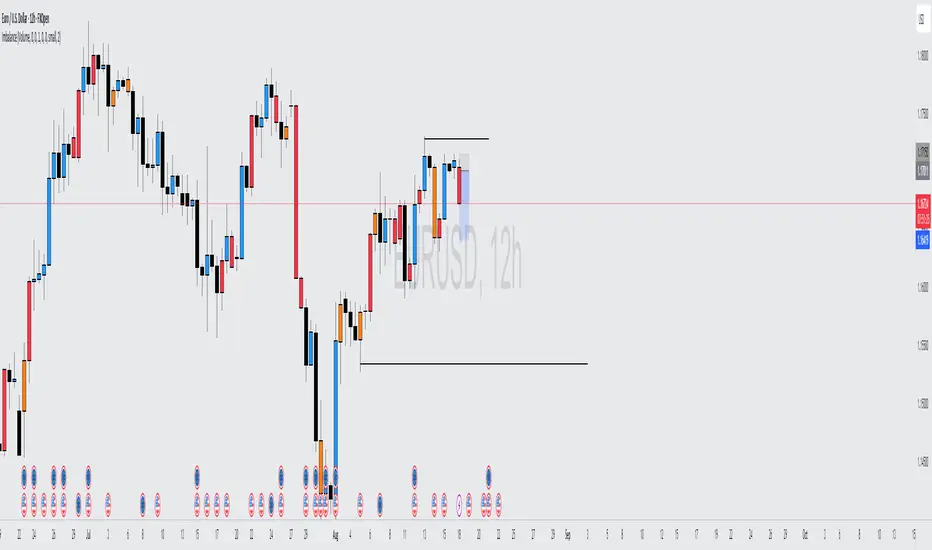

**Volume Imbalance Analyzer (70% & 80%)** flags bars where estimated buy vs. sell volume is heavily one-sided. It colors those bars, adds labels (B70/B80 or S70/S80), and can alert you in real time. The goal is to quickly spot spots of **aggressive participation** (buyers or sellers) that often act as magnets for a **retest** or as **exhaustion/continuation** areas.

# What it helps you do

* **Find high-energy bars** where one side dominates (potential turning or continuation points).

* **Plan retests:** Track when price comes back into the imbalance candle’s range (common entry/take-profit logic).

* **Filter trades:** Only act when the market shows unusual pressure (≥70% or ≥80%).

* **Add context to setups:** Combine with S/R, FVGs, or trend tools to time entries with less guesswork.

* **Alert-driven workflow:** Get notified the moment extreme pressure prints.

# How it helps (workflow)

1. **Scan for signals:**

* **B80/B70** = strong buying; **S80/S70** = strong selling.

* 80% is “extreme” and overrides 70%.

2. **Mark the zone:** The imbalance candle’s **high–low** defines a zone. Many traders wait for a **retest** into that range.

3. **Decide intent:**

* After **B80/B70**, look for pullbacks to buy (or fades if you see exhaustion).

* After **S80/S70**, look for rallies to sell (or fades if exhaustion).

4. **Confirm with context:** Check trend, key levels, liquidity, session timing, ATR/volatility.

5. **Manage risk:** Place stops beyond the zone; size trades so a failed retest doesn’t ruin the day.

# How it works (under the hood, briefly)

The script **estimates buy/sell volume** from each candle’s body, wicks, and total volume, then computes an **imbalance %**. If the % crosses **70%** or **80%** (scaled by a Sensitivity setting), it paints the bar, drops a label, and optionally fires an alert. It also stores the imbalance candle’s range so you can watch for a **retest**.

# Reading the signals (quick guide)

* **B80**: Extreme buyer pressure → watch for pullback buys or exhaustion shorts, depending on context.

* **B70**: Strong buyer pressure → mild continuation bias.

* **S80**: Extreme seller pressure → watch for rally sells or exhaustion longs.

* **S70**: Strong seller pressure → higher reversal probability noted in the table (informational).

# Configuration tips

* **Sensitivity**: Higher = more bars qualify (more signals).

* **Label distance**: Scales with ATR so labels don’t overlap candles.

* **Colors/opacity**: Separate for 70% vs 80% and buyer vs seller.

* **Alerts**: Enable to catch signals live without staring at the screen.

# Notes & limits

* Uses **estimation** (not true bid/ask) on most symbols; treat as a **context tool**, not a stand-alone system.

* The optional stats table’s “expected outcomes” are **informational**, not live probabilities.

* Works on any timeframe; results improve when combined with structure and risk controls.

# Definition

**Volume Imbalance Analyzer (70% & 80%)** flags bars where estimated buy vs. sell volume is heavily one-sided. It colors those bars, adds labels (B70/B80 or S70/S80), and can alert you in real time. The goal is to quickly spot spots of **aggressive participation** (buyers or sellers) that often act as magnets for a **retest** or as **exhaustion/continuation** areas.

# What it helps you do

* **Find high-energy bars** where one side dominates (potential turning or continuation points).

* **Plan retests:** Track when price comes back into the imbalance candle’s range (common entry/take-profit logic).

* **Filter trades:** Only act when the market shows unusual pressure (≥70% or ≥80%).

* **Add context to setups:** Combine with S/R, FVGs, or trend tools to time entries with less guesswork.

* **Alert-driven workflow:** Get notified the moment extreme pressure prints.

# How it helps (workflow)

1. **Scan for signals:**

* **B80/B70** = strong buying; **S80/S70** = strong selling.

* 80% is “extreme” and overrides 70%.

2. **Mark the zone:** The imbalance candle’s **high–low** defines a zone. Many traders wait for a **retest** into that range.

3. **Decide intent:**

* After **B80/B70**, look for pullbacks to buy (or fades if you see exhaustion).

* After **S80/S70**, look for rallies to sell (or fades if exhaustion).

4. **Confirm with context:** Check trend, key levels, liquidity, session timing, ATR/volatility.

5. **Manage risk:** Place stops beyond the zone; size trades so a failed retest doesn’t ruin the day.

# How it works (under the hood, briefly)

The script **estimates buy/sell volume** from each candle’s body, wicks, and total volume, then computes an **imbalance %**. If the % crosses **70%** or **80%** (scaled by a Sensitivity setting), it paints the bar, drops a label, and optionally fires an alert. It also stores the imbalance candle’s range so you can watch for a **retest**.

# Reading the signals (quick guide)

* **B80**: Extreme buyer pressure → watch for pullback buys or exhaustion shorts, depending on context.

* **B70**: Strong buyer pressure → mild continuation bias.

* **S80**: Extreme seller pressure → watch for rally sells or exhaustion longs.

* **S70**: Strong seller pressure → higher reversal probability noted in the table (informational).

# Configuration tips

* **Sensitivity**: Higher = more bars qualify (more signals).

* **Label distance**: Scales with ATR so labels don’t overlap candles.

* **Colors/opacity**: Separate for 70% vs 80% and buyer vs seller.

* **Alerts**: Enable to catch signals live without staring at the screen.

# Notes & limits

* Uses **estimation** (not true bid/ask) on most symbols; treat as a **context tool**, not a stand-alone system.

* The optional stats table’s “expected outcomes” are **informational**, not live probabilities.

* Works on any timeframe; results improve when combined with structure and risk controls.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.