OPEN-SOURCE SCRIPT

DCA Strategy with Hedging

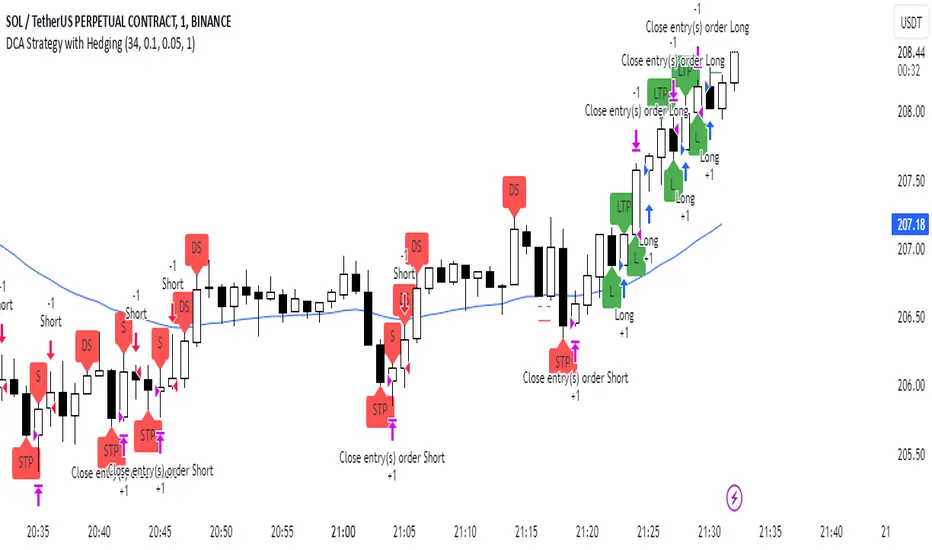

This strategy implements a dynamic hedging system with Dollar-Cost Averaging (DCA) based on the 34 EMA. It can hold simultaneous long and short positions, making it suitable for ranging and trending markets.

Key Features:

How it Works

Long Entries:

Short Entries:

Settings

Indicators

Alerts

Compatible with all standard TradingView alerts:

Position Opens (Long/Short)

DCA Entries

Take Profit Hits

Note: This strategy works best on lower timeframes with high liquidity pairs. Adjust parameters based on asset volatility.

Key Features:

- Uses 34 EMA as baseline indicator

- Implements hedging with simultaneous long/short positions

- Dynamic DCA for position management

- Automatic take-profit adjustments

- Entry confirmation using 3-candle rule

How it Works

Long Entries:

- Opens when price closes above 34 EMA for 3 candles

- Adds positions every 0.1% price drop

- Takes profit at 0.05% above average entry

Short Entries:

- Opens when price closes below 34 EMA for 3 candles

- Adds positions every 0.1% price rise

- Takes profit at 0.05% below average entry

Settings

- EMA Length: Controls the EMA period (default: 34)

- DCA Interval: Price movement needed for additional entries (default: 0.1%)

- Take Profit: Profit target from average entry (default: 0.05%)

- Initial Position: Starting position size (default: 1.0)

Indicators

- L: Long Entry

- DL: Long DCA

- S: Short Entry

- DS: Short DCA

- LTP: Long Take Profit

- STP: Short Take Profit

Alerts

Compatible with all standard TradingView alerts:

Position Opens (Long/Short)

DCA Entries

Take Profit Hits

Note: This strategy works best on lower timeframes with high liquidity pairs. Adjust parameters based on asset volatility.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.