OPEN-SOURCE SCRIPT

[SHORT ONLY] Consecutive Bars Above MA Strategy

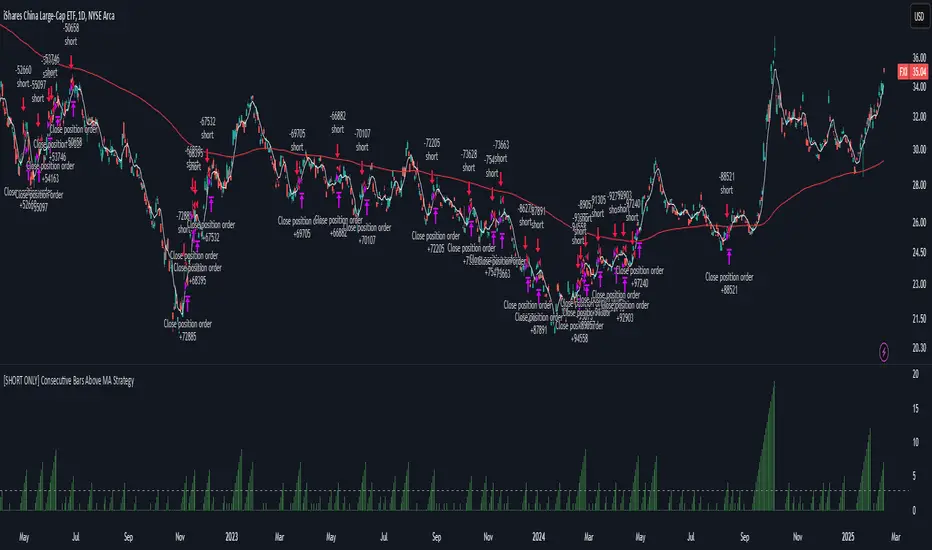

█ STRATEGY DESCRIPTION

The "Consecutive Bars Above MA Strategy" is a contrarian trading system aimed at exploiting overextended bullish moves in stocks and ETFs. It monitors the number of consecutive bars that close above a chosen short-term moving average (which can be either a Simple Moving Average or an Exponential Moving Average). Once the count reaches a preset threshold and the current bar’s close exceeds the previous bar’s high within a designated trading window, a short entry is initiated. An optional EMA filter further refines entries by requiring that the current close is below the 200-period EMA, helping to ensure that trades are taken in a bearish environment.

█ HOW ARE THE CONSECUTIVE BULLISH COUNTS CALCULATED?

The strategy utilizes a counter variable, `bullCount`, to track consecutive bullish bars based on their relation to the short-term moving average. Here’s how the count is determined:

█ SIGNAL GENERATION

1. SHORT ENTRY

A short signal is generated when:

2. EXIT CONDITION

█ ADDITIONAL SETTINGS

█ PERFORMANCE OVERVIEW

The "Consecutive Bars Above MA Strategy" is a contrarian trading system aimed at exploiting overextended bullish moves in stocks and ETFs. It monitors the number of consecutive bars that close above a chosen short-term moving average (which can be either a Simple Moving Average or an Exponential Moving Average). Once the count reaches a preset threshold and the current bar’s close exceeds the previous bar’s high within a designated trading window, a short entry is initiated. An optional EMA filter further refines entries by requiring that the current close is below the 200-period EMA, helping to ensure that trades are taken in a bearish environment.

█ HOW ARE THE CONSECUTIVE BULLISH COUNTS CALCULATED?

The strategy utilizes a counter variable, `bullCount`, to track consecutive bullish bars based on their relation to the short-term moving average. Here’s how the count is determined:

- Initialize the Counter

The counter is initialized at the start:Pine Script® var int bullCount = na - Bullish Bar Detection

For each bar, if the close is above the selected moving average (either SMA or EMA, based on user input), the counter is incremented:Pine Script® bullCount := close > signalMa ? (na(bullCount) ? 1 : bullCount + 1) : 0 - Reset on Non-Bullish Condition

If the close does not exceed the moving average, the counter resets to zero, indicating a break in the consecutive bullish streak.

█ SIGNAL GENERATION

1. SHORT ENTRY

A short signal is generated when:

- The number of consecutive bullish bars (i.e., bars closing above the short-term MA) meets or exceeds the defined threshold (default: 3).

- The current bar’s close is higher than the previous bar’s high.

- The signal occurs within the specified trading window (between Start Time and End Time).

- Additionally, if the EMA filter is enabled, the entry is only executed when the current close is below the 200-period EMA.

2. EXIT CONDITION

- An exit signal is triggered when the current close falls below the previous bar’s low, prompting the strategy to close the short position.

█ ADDITIONAL SETTINGS

- Threshold: The number of consecutive bullish bars required to trigger a short entry (default is 3).

- Trading Window: The Start Time and End Time inputs define when the strategy is active.

- Moving Average Settings: Choose between SMA and EMA, and set the MA length (default is 5), which is used to assess each bar’s bullish condition.

- EMA Filter (Optional): When enabled, this filter requires that the current close is below the 200-period EMA, supporting entries in a downtrend.

█ PERFORMANCE OVERVIEW

- This strategy is designed for stocks and ETFs and can be applied across various timeframes.

- It seeks to capture mean reversion by shorting after a series of bullish bars suggests an overextended move.

- The approach employs a contrarian short entry by waiting for a breakout (close > previous high) following consecutive bullish bars.

- The adjustable moving average settings and optional EMA filter allow for further optimization based on market conditions.

- Comprehensive backtesting is recommended to fine-tune the threshold, moving average parameters, and filter settings for optimal performance.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.