OPEN-SOURCE SCRIPT

Aggiornato Technical checklist

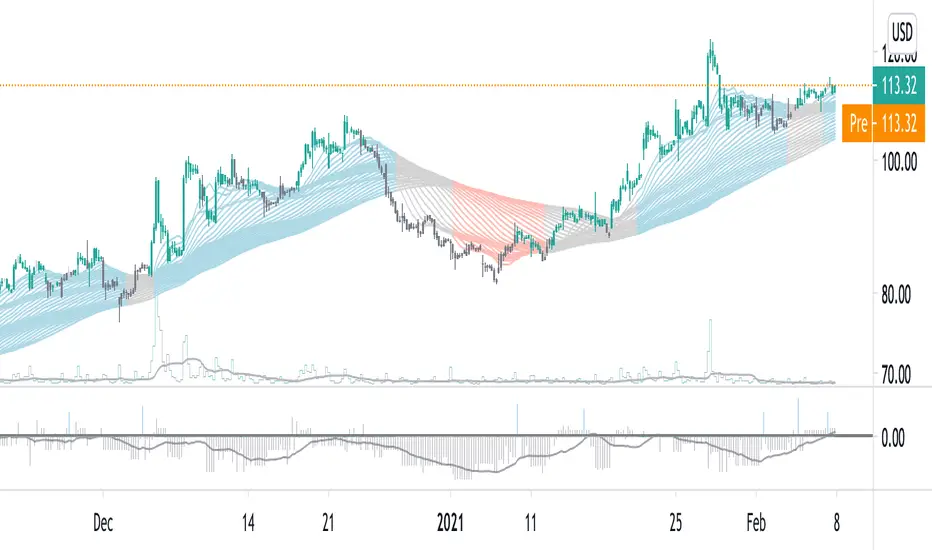

No one indicator is perfect. People always have their favorite indicators and maintain a bias on weighing them purely on psychological reasons other than mathematical. This technical checklist indicator collected 20 common indicators and custom ones to address the issue of a bias weighted decision.

Here, I apply machine learning using a simple sigmoid neuron network with one hidden layer and a single node to avoid artifacts. For the ease of data collection, the indicator matrix is first shown as a heatmap. Once an uptrend signal window is selected manually, an indicator matrix can be recorded in a binary format (i.e., 1 0 0 1 1 0, etc.).

For example, the following indicator matrix was retrieved from the MRNA chart (deciscion: first 5 rows, buying; last 5 rows, no buying):

<mrna_input.txt>

1 1 0 0 0 1 1 1 1 1 0 1 0 0 1 1 0 1 1 1

1 1 0 0 1 1 1 0 0 0 1 0 1 1 0 1 0 1 1 1

0 0 1 1 0 1 0 0 0 1 1 1 0 0 1 0 0 1 0 0

1 1 0 0 0 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0

0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 1 0 1 0 0

1 1 0 0 1 0 1 0 0 0 0 1 0 0 0 1 0 0 1 1

1 1 0 0 0 0 1 0 0 0 0 1 0 0 1 1 0 1 1 1

0 0 0 0 1 0 1 0 0 1 1 0 0 0 0 0 0 1 0 0

0 0 0 0 0 0 1 0 0 0 1 0 0 1 0 0 0 1 1 1

0 0 0 0 1 0 1 0 0 0 1 0 1 0 0 0 0 1 1 1

This matrix is then used as an input to train the machine learning network. With a correlated buying decision matrix as an output:

<output.txt>

1

1

1

1

1

0

0

0

0

0

After training, the corrected weight matrix can be applied back to the indicator. And the display mode can be changed from a heatmap into a histogram to reveal buying signals visually.

Usage:

python stock_ml.py mrna_input.txt output.txt

Weight matrix output:

1.37639407

1.67969656

1.0162141

1.3184323

-1.88888442

8.32928588

-5.35777295

3.08739916

3.06464844

0.82986227

-0.53092333

-1.95045383

4.14441698

2.99179435

-0.08379438

1.70379704

0.4173048

-1.51870972

-2.14284707

-2.08513252

Corresponding indicators to the weight matrix:

1. Breakout

2. Reversal

3. Crossover of ema20 and ema60

4. Crossover of ema20 and ema120

5. MACD golden cross

6. Long cycle (MACD crossover 0)

7. RSI not overbought

8. KD not overbought and crossover

9. OBV uptrend

10. Bullish gap

11. High volume

12. Breakout up fractal

13. Rebounce of down fractal

14. Convergence

15. Turbulence reversal

16. Low resistance

17. Bullish trend (blue zone)

18. Bearish trend (red zone)

19. VIX close above ema20

20. SPY close below ema20

PS. It is recommended not to use default settings but to train your weight matrix based on underlying and timeframe.

Here, I apply machine learning using a simple sigmoid neuron network with one hidden layer and a single node to avoid artifacts. For the ease of data collection, the indicator matrix is first shown as a heatmap. Once an uptrend signal window is selected manually, an indicator matrix can be recorded in a binary format (i.e., 1 0 0 1 1 0, etc.).

For example, the following indicator matrix was retrieved from the MRNA chart (deciscion: first 5 rows, buying; last 5 rows, no buying):

<mrna_input.txt>

1 1 0 0 0 1 1 1 1 1 0 1 0 0 1 1 0 1 1 1

1 1 0 0 1 1 1 0 0 0 1 0 1 1 0 1 0 1 1 1

0 0 1 1 0 1 0 0 0 1 1 1 0 0 1 0 0 1 0 0

1 1 0 0 0 1 1 1 1 1 1 0 1 0 0 1 0 1 0 0

0 0 1 1 0 1 1 1 0 1 1 1 0 1 1 1 0 1 0 0

1 1 0 0 1 0 1 0 0 0 0 1 0 0 0 1 0 0 1 1

1 1 0 0 0 0 1 0 0 0 0 1 0 0 1 1 0 1 1 1

0 0 0 0 1 0 1 0 0 1 1 0 0 0 0 0 0 1 0 0

0 0 0 0 0 0 1 0 0 0 1 0 0 1 0 0 0 1 1 1

0 0 0 0 1 0 1 0 0 0 1 0 1 0 0 0 0 1 1 1

This matrix is then used as an input to train the machine learning network. With a correlated buying decision matrix as an output:

<output.txt>

1

1

1

1

1

0

0

0

0

0

After training, the corrected weight matrix can be applied back to the indicator. And the display mode can be changed from a heatmap into a histogram to reveal buying signals visually.

Usage:

python stock_ml.py mrna_input.txt output.txt

Weight matrix output:

1.37639407

1.67969656

1.0162141

1.3184323

-1.88888442

8.32928588

-5.35777295

3.08739916

3.06464844

0.82986227

-0.53092333

-1.95045383

4.14441698

2.99179435

-0.08379438

1.70379704

0.4173048

-1.51870972

-2.14284707

-2.08513252

Corresponding indicators to the weight matrix:

1. Breakout

2. Reversal

3. Crossover of ema20 and ema60

4. Crossover of ema20 and ema120

5. MACD golden cross

6. Long cycle (MACD crossover 0)

7. RSI not overbought

8. KD not overbought and crossover

9. OBV uptrend

10. Bullish gap

11. High volume

12. Breakout up fractal

13. Rebounce of down fractal

14. Convergence

15. Turbulence reversal

16. Low resistance

17. Bullish trend (blue zone)

18. Bearish trend (red zone)

19. VIX close above ema20

20. SPY close below ema20

PS. It is recommended not to use default settings but to train your weight matrix based on underlying and timeframe.

Note di rilascio

Change the value of %K from 140 to 90.Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.