OPEN-SOURCE SCRIPT

Aggiornato Opening Range and Market Boundaries

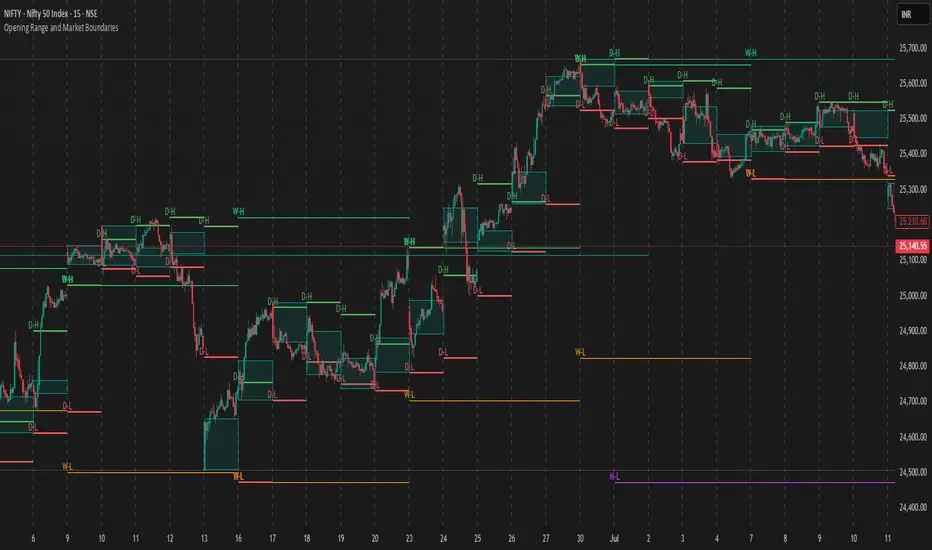

Opening Range and Market Boundaries

This versatile and insightful indicator combines two powerful concepts frequently used by professional traders: Opening Range Analysis and Market Boundaries derived from previous high/low levels. It is specifically designed to support intraday trading strategies and helps you identify key price zones for entries, exits, and breakout confirmations.

🔍 Features & Utility

1. Opening Range Box

What it does:

Highlights the high and low of the first candle after market open (9:15 AM IST) with a shaded box. This box spans the full trading session, from 9:15 AM to 3:30 PM, representing the key price range where the initial balance is formed.

Timeframe Compatibility:

The Opening Range box is optimized for 1-minute to 1-hour charts. It is most effective on lower timeframes (1m, 5m, 15m, 30m) where intraday price movements and breakout patterns can be clearly observed.

Usage Tips:

Breakouts above or below the Opening Range box can signal potential directional bias for the rest of the trading day.

Price consolidating within the range may indicate a choppy or range-bound session.

Works well with volume and momentum indicators for confirmation.

2. Market Boundaries

What it does:

Plots horizontal lines at:

Previous Day High/Low

Previous Week High/Low

Previous Month High/Low

Why it matters:

These levels act as natural support and resistance zones, and are commonly watched by institutional traders, making them crucial for:

Spotting reversals or breakouts

Planning stop-loss and target zones

Avoiding trades around high-rejection areas

Customization Options:

Toggle ON/OFF for Daily, Weekly, and Monthly levels.

Independent colors and line thickness for each level, enabling you to distinguish between different timeframes easily.

🛠️ How to Use Effectively

Use during market open:

Switch to a 5-minute or 15-minute chart during the first few candles of the session. Observe the Opening Range box formation and plan trades based on breakout direction.

Confluence Trading:

Look for price action near previous session highs/lows in confluence with the Opening Range box edges. These intersections often become high-probability zones for breakouts or reversals.

Session Preparation:

Before the market opens, analyze where the price is relative to past high/low boundaries. If it's near a weekly/monthly level, be cautious — those areas can cause whipsaws or false breakouts.

Avoid low-volume breakouts:

Use this indicator in conjunction with volume tools or price action confirmation to validate the strength of a move outside the Opening Range or Market Boundaries.

📌 Summary

This indicator is designed for intraday traders, scalpers, and swing traders who want a reliable structure to guide their decisions. It visually marks the opening balance of the market and essential higher timeframe boundaries, helping you trade with discipline and precision.

This versatile and insightful indicator combines two powerful concepts frequently used by professional traders: Opening Range Analysis and Market Boundaries derived from previous high/low levels. It is specifically designed to support intraday trading strategies and helps you identify key price zones for entries, exits, and breakout confirmations.

🔍 Features & Utility

1. Opening Range Box

What it does:

Highlights the high and low of the first candle after market open (9:15 AM IST) with a shaded box. This box spans the full trading session, from 9:15 AM to 3:30 PM, representing the key price range where the initial balance is formed.

Timeframe Compatibility:

The Opening Range box is optimized for 1-minute to 1-hour charts. It is most effective on lower timeframes (1m, 5m, 15m, 30m) where intraday price movements and breakout patterns can be clearly observed.

Usage Tips:

Breakouts above or below the Opening Range box can signal potential directional bias for the rest of the trading day.

Price consolidating within the range may indicate a choppy or range-bound session.

Works well with volume and momentum indicators for confirmation.

2. Market Boundaries

What it does:

Plots horizontal lines at:

Previous Day High/Low

Previous Week High/Low

Previous Month High/Low

Why it matters:

These levels act as natural support and resistance zones, and are commonly watched by institutional traders, making them crucial for:

Spotting reversals or breakouts

Planning stop-loss and target zones

Avoiding trades around high-rejection areas

Customization Options:

Toggle ON/OFF for Daily, Weekly, and Monthly levels.

Independent colors and line thickness for each level, enabling you to distinguish between different timeframes easily.

🛠️ How to Use Effectively

Use during market open:

Switch to a 5-minute or 15-minute chart during the first few candles of the session. Observe the Opening Range box formation and plan trades based on breakout direction.

Confluence Trading:

Look for price action near previous session highs/lows in confluence with the Opening Range box edges. These intersections often become high-probability zones for breakouts or reversals.

Session Preparation:

Before the market opens, analyze where the price is relative to past high/low boundaries. If it's near a weekly/monthly level, be cautious — those areas can cause whipsaws or false breakouts.

Avoid low-volume breakouts:

Use this indicator in conjunction with volume tools or price action confirmation to validate the strength of a move outside the Opening Range or Market Boundaries.

📌 Summary

This indicator is designed for intraday traders, scalpers, and swing traders who want a reliable structure to guide their decisions. It visually marks the opening balance of the market and essential higher timeframe boundaries, helping you trade with discipline and precision.

Note di rilascio

Opening Range Box and Price Ranges (Enhanced Version)Overview: The Opening Range Box and Price Ranges indicator is a powerful tool for both intraday traders and swing traders. It automatically plots the Opening Range Box (ORB), which identifies the high and low of the market's opening range, as well as Price Ranges from previous trading sessions (daily, weekly, and monthly high/low levels). This tool provides valuable support and resistance zones, offering traders clear reference points for making informed trading decisions.

The Opening Range Box is widely used for intraday breakout strategies, while the Price Ranges are effective for identifying key support/resistance areas that can guide swing trading decisions. This tool works globally across any asset class, including stocks, forex, commodities, and cryptocurrency, making it versatile for traders in any market.

Key Features:

Opening Range Box (ORB): Automatically plots the first candle's high and low of the trading day, providing a reference for potential breakouts and intraday trends.

Past Trading Ranges: Displays the high and low for the previous day, week, and month, which are critical for understanding market structure and identifying potential support and resistance zones.

Global Market Compatibility: The indicator works universally across all asset classes—whether you're trading stocks, forex, crypto, or commodities.

Customizable Inputs: Fully customizable inputs for adjusting box fill colors, border colors, and line thickness to suit your trading style and preferences.

Toggle Options: Easily toggle the visibility of Opening Range Box and Past Trading Ranges with checkboxes, allowing traders to choose the data they want to display.

How to Use:

Intraday Traders: The Opening Range Box (ORB) is key for breakout strategies. Price movements beyond the ORB range may signal a strong intraday trend.

Swing Traders: The Price Ranges (daily, weekly, and monthly highs/lows) help identify critical support and resistance levels for multi-day or multi-week price moves.

Customization: Adjust colors and line thicknesses based on your preferred chart setup. The indicator also provides toggles to control the display of ORB and Past Trading Ranges independently.

Global Application: Use this indicator in any market to identify levels where price could reverse or break out.

What's New in This Version:

Enhanced UI: The new version includes checkboxes to toggle the Opening Range Box and Past Trading Ranges, giving you more control over your chart’s display.

Broader Compatibility: This version is compatible with all global markets, making it useful for stocks, forex, cryptocurrencies, and commodities traders alike.

Versatile Trading Tool: Whether you trade intraday breakouts or longer-term swing trades, this tool adapts to your style, offering dynamic support and resistance zones.

Note di rilascio

Opening Range Box and Price RangesThis indicator combines the Opening Range Box (ORB) strategy with key price level plotting from previous trading sessions to help traders make informed intraday decisions.

🔍 Features

✅ Opening Range Box (ORB)

Automatically draws a box using the high and low of the first candle of the day

Supports any timeframe from 1-minute to 1-hour

Highlights the day’s range early for breakout or range-bound strategies

✅ Previous High/Low Levels

Plots Daily, Weekly, and Monthly high/low levels

Color-coded and customizable line thickness for easy distinction

Helps identify key support/resistance levels from past sessions

✅ Flexible Controls

Enable/disable ORB box and past levels individually

Choose colors and thickness for each line

⚠️ IMPORTANT USAGE NOTE

This indicator is based on Regular Trading Hours (RTH).

If you have Extended Trading Hours (ETH) enabled in your chart layout, the Opening Range Box may not appear correctly (may show as a line or be misplaced).

🔧 To Fix This:

Please disable ETH in your chart’s "Symbol" settings → "Session" tab → uncheck "Extended Trading Hours".

This ensures the box is created using the true first candle of the regular session.

🔄 New Enhancements in This Version

Added visual alert comment in script regarding ETH vs. RTH behavior

Clarified usage and reliability expectations in various layouts

Cleaner and more intuitive control options for user customization

Note di rilascio

Opening Range and Market BoundariesThis indicator combines the Opening Range Box (ORB) strategy with key price level plotting from previous sessions. It displays the opening range for the first Regular Trading Hours (RTH) candle and offers the option to show high/low levels for the previous day, week, and month. Users can customize the appearance, including line thickness, color, and more. The indicator also provides clear visibility for market boundaries from prior trading sessions, making it an ideal tool for day traders and swing traders looking to track significant price levels.

Note di rilascio

This indicator combines the powerful Opening Range Box (ORB) strategy with essential market structure levels from previous Day, Week, and Month. Designed for clarity and efficiency, this simplified version avoids clutter while keeping the most critical price boundaries visible for intraday and swing traders.📌 Key Features

✅ Opening Range Box (ORB): Automatically draws a box from the high and low of the first RTH candle each day.

✅ Previous Day/Week/Month High & Low Lines with custom color and thickness settings.

✅ Optional Text Labels (e.g., D-H, W-L) near the highs/lows for quick visual reference.

✅ Lightweight, fast, and ideal for clean charting without distractions.

⚙️ Customization Options

Toggle ON/OFF for:

Opening Range Box (ORB)

Daily / Weekly / Monthly levels

Text Labels (for H/L lines)

Set custom:

Line colors and widths for each timeframe

ORB box fill and border color

⚠️ Important Notes

ORB logic uses the first candle of the RTH session. Make sure Extended Trading Hours (ETH) are disabled in your chart settings for accurate plots:

Chart Settings → Symbol → Session → Uncheck "Extended Trading Hours"

🧠 How to Use

Scalpers & Day Traders: Use ORB breakouts with confluence from previous day's levels.

Swing Traders: Watch how price respects weekly/monthly highs/lows to gauge momentum shifts.

Label visibility ensures clear reference without excessive clutter.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.