OPEN-SOURCE SCRIPT

Aggiornato EMA 5 Alert Candle Short

The 5 EMA (Exponential Moving Average) Strategy is a simple yet effective trading strategy that helps traders identify short-term trends and potential entry and exit points. This strategy is widely used in intraday and swing trading, particularly in forex, stocks, and crypto markets.

Components of the 5 EMA Strategy

5 EMA: A fast-moving average that reacts quickly to price movements.

15-minute or 1-hour timeframe (commonly used, but adaptable to other timeframes).

Candlestick Patterns: To confirm entry signals.

How the 5 EMA Strategy Works

Buy (Long) Setup:

Price Above the 5 EMA: The price should be trading above the 5 EMA.

Pullback to the 5 EMA: A minor retracement or consolidation near the 5 EMA.

Bullish Candlestick Confirmation: A bullish candle (e.g., engulfing or pin bar) forms near the 5 EMA.

Entry: Enter a long trade at the close of the bullish candle.

Stop Loss: Place below the recent swing low or 5-10 pips below the 5 EMA.

Take Profit: Aim for a risk-reward ratio of at least 1:2 or trail the stop using a higher EMA (e.g., 10 or 20 EMA).

Sell (Short) Setup:

Price Below the 5 EMA: The price should be trading below the 5 EMA.

Pullback to the 5 EMA: A small retracement towards the 5 EMA.

Bearish Candlestick Confirmation: A bearish candle (e.g., engulfing or pin bar) near the 5 EMA.

Entry: Enter a short trade at the close of the bearish candle.

Stop Loss: Place above the recent swing high or 5-10 pips above the 5 EMA.

Take Profit: Aim for a 1:2 risk-reward ratio or use a trailing stop.

Additional Filters for Better Accuracy

Higher Timeframe Confirmation: Check the trend on a higher timeframe (e.g., 1-hour or 4-hour).

Volume Confirmation: Enter trades when volume is increasing.

Avoid Sideways Market: Use the strategy only when the market is trending.

Advantages of the 5 EMA Strategy

✔️ Simple and easy to use.

✔️ Works well in trending markets.

✔️ Helps traders capture short-term momentum.

Disadvantages

❌ Less effective in choppy or sideways markets.

❌ Requires discipline in following stop-loss rules.

Components of the 5 EMA Strategy

5 EMA: A fast-moving average that reacts quickly to price movements.

15-minute or 1-hour timeframe (commonly used, but adaptable to other timeframes).

Candlestick Patterns: To confirm entry signals.

How the 5 EMA Strategy Works

Buy (Long) Setup:

Price Above the 5 EMA: The price should be trading above the 5 EMA.

Pullback to the 5 EMA: A minor retracement or consolidation near the 5 EMA.

Bullish Candlestick Confirmation: A bullish candle (e.g., engulfing or pin bar) forms near the 5 EMA.

Entry: Enter a long trade at the close of the bullish candle.

Stop Loss: Place below the recent swing low or 5-10 pips below the 5 EMA.

Take Profit: Aim for a risk-reward ratio of at least 1:2 or trail the stop using a higher EMA (e.g., 10 or 20 EMA).

Sell (Short) Setup:

Price Below the 5 EMA: The price should be trading below the 5 EMA.

Pullback to the 5 EMA: A small retracement towards the 5 EMA.

Bearish Candlestick Confirmation: A bearish candle (e.g., engulfing or pin bar) near the 5 EMA.

Entry: Enter a short trade at the close of the bearish candle.

Stop Loss: Place above the recent swing high or 5-10 pips above the 5 EMA.

Take Profit: Aim for a 1:2 risk-reward ratio or use a trailing stop.

Additional Filters for Better Accuracy

Higher Timeframe Confirmation: Check the trend on a higher timeframe (e.g., 1-hour or 4-hour).

Volume Confirmation: Enter trades when volume is increasing.

Avoid Sideways Market: Use the strategy only when the market is trending.

Advantages of the 5 EMA Strategy

✔️ Simple and easy to use.

✔️ Works well in trending markets.

✔️ Helps traders capture short-term momentum.

Disadvantages

❌ Less effective in choppy or sideways markets.

❌ Requires discipline in following stop-loss rules.

Note di rilascio

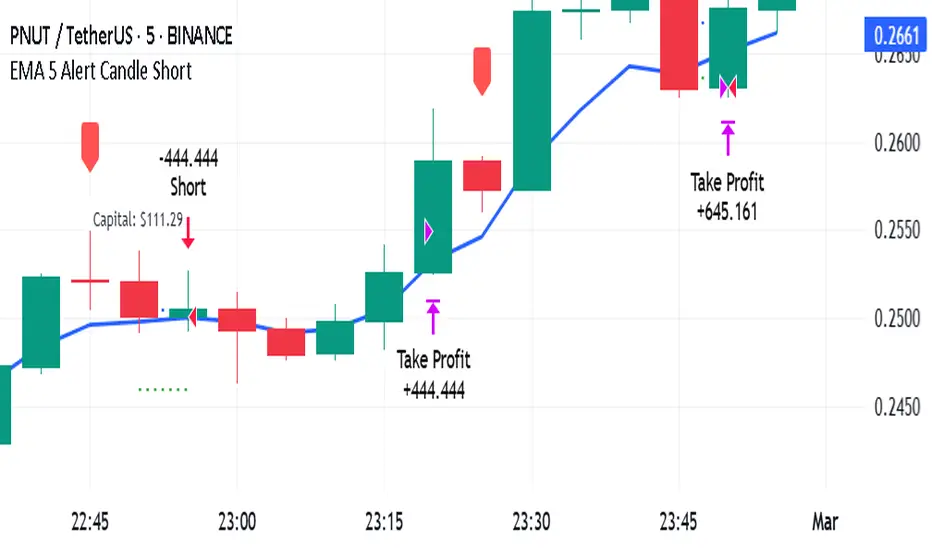

Strategy Description: EMA 5 Alert Candle ShortOverview:

This strategy is designed for short trades based on price interactions with the 5-period Exponential Moving Average (EMA). The system identifies a special "Alert Candle" that meets specific conditions and waits for a breakout of its low to enter a short position. Position sizing is calculated dynamically based on the length of the alert candle, ensuring a fixed risk of $2 per trade.

Entry Criteria:

EMA 5 Interaction Check:

The last three candles must have touched or been close to the 5 EMA.

The current candle must be significantly above the 5 EMA, meaning it does not touch it.

Alert Candle Formation:

If the above conditions are met, the current candle is marked as an Alert Candle.

The high and low of this candle are recorded as reference points.

Short Entry Condition:

The next candle must break below the low of the Alert Candle.

Once this happens, a short position is entered.

Risk Management & Position Sizing:

✅ Fixed Risk Per Trade: $2

✅ Position Size Calculation:

The length of the Alert Candle is calculated as:

Alert Candle Range = High - Low

Position size is determined using the formula:

Position Size = $2 / Alert Candle Range

Capital used is calculated as:

Capital Used = Position Size × Short Entry Price

✅ Trade Execution:

Stop Loss: The high of the Alert Candle.

Take Profit: Equal to the stop-loss distance (1:1 Risk-Reward Ratio).

✅ Capital Used is displayed on the chart for easy tracking.

Trade Execution Logic:

🔴 Step 1: Identify the Alert Candle (Based on EMA & candle positioning).

🟡 Step 2: Wait for Breakout Below the Alert Candle’s Low.

🟢 Step 3: Enter Short Position.

🔵 Step 4: Exit at Stop Loss (Alert Candle High) or Take Profit (1:1 RR).

Visual Aids in the Strategy:

📌 EMA 5 Line: Blue line for trend tracking.

📌 Alert Candle Marker: Red label above the Alert Candle.

📌 Trade Setup Lines:

Entry Line: Blue (short entry).

Stop Loss Line: Red (above entry).

Take Profit Line: Green (below entry).

📌 Capital Used Label: White text above the Alert Candle.

Advantages of This Strategy:

✅ Simple & Effective for Trend Reversals.

✅ Dynamic Position Sizing Adjusts to Market Conditions.

✅ Fixed Risk Per Trade Ensures Consistent Risk Management.

✅ Visually Clear Entries & Exits for Easy Execution.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Script open-source

Nello spirito di TradingView, l'autore di questo script lo ha reso open source, in modo che i trader possano esaminarne e verificarne la funzionalità. Complimenti all'autore! Sebbene sia possibile utilizzarlo gratuitamente, ricordiamo che la ripubblicazione del codice è soggetta al nostro Regolamento.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.