BTC WaveTrend R:R=1:1.5In this strategy, I used Wavetrend indicator (Lazy Bear).

It is very simple and easy to understanding: Long when Wavetrend1 crossover Wavetrend2 and they are less than a limit value (not buy when price overbought). Stoploss at lowest 3 bar previous. R:R = 1:1,5.

About other shortterm strategies for crypto market, you can view my published strategies.

WAVE-B

RSI Wave SignalsQuick Description: Smoothed RSI with optimized trailing moving average. Look for cross above or cross under signals for buy and sell orders respectively.

VIDYA moving average of RSI incorporated with "optimized trend tracker" system. Thanks to kivancozbilgic and anilozeksi for implementing this great idea on Tradingview. The indicator adds "1,000" to the RSI MA values for more natural and accurate percentage trailing.

Settings:

- Period MA is the moving average length of the blue line

- Trailing Percentage of MA adjusts the percentage (sort of) trailing level of the moving average.

- RSI Length adjusts the rsi length in calculation.

Trading Tips:

- System might be enhanced by taking signals only on "oversold" or "overbought" territories (i.e <~1020 or >~1080)

- Adjust position size of by 4 times of atr(length=14)

- Take 50% of position as profit when position reaches the 4*atr TP Level (breakeven)

- Let the rest ride.

- Best performing on short frequencies such as 1, 3, 5 mins.

SpyGuyTrendTrackerWorking on official documentation at the moment!

As soon as I have that ready I will update this description to incorporate that information.

Basic knowledge:

The clouds are differentiated by EMA lengths and distortion values

Yellow: Short Term

Red: Mid Term

Blue Long Term

I will get finalized documentation ASAP, until then, have fun backtesting and creating your own strategies / ideas while using this indicator!

Wave Chart v1##Wave Chart v1##

For analyzing Neo-wave theory

Plot the market's highs and lows in real-time order.

Then connect the highs and lows

with a diagonal line. Next, the last plot of one day (or bar) is connected with a straight line to the

first plot of the next day (or bar).

##How To Use##

if you want a weekly chart you drop the time frame to the daily chart.

Then you set the range to 7(if the market opens 7 days per week).

Then you click "highlight the bar that runs to plot" and you must shift the highlight to the last day that the weekly chart bar close(Sunday / Friday)

##Example 1

Weekly chart BTCUSDT on BINANCE

first open daily chart, set range = 7 and Bars_shift = 3 (shift highlight to Sunday)

##Example 2

Weekly chart XAUUSD on FXOPEN

first open daily chart, set range = 5 (market open 5 days per week) and Bars_shift = 1 (shift highlight to Friday)

##Note##

If the market has a special holiday Wave Chart may be inaccurate.

Ultimate HODL WaveThe basis for this indicator is the HODL Wave (> 1 Year) developed by Unchained Capital. This represents the percentage of coins that have not been moved for at least a year.

The Hull MA perfectly tracks the HODL Wave and provides an easy bull/bear trend in the mid-term.

The long-term and more macro bull/bear trend is decided by if the Hull MA is above or below the base MA.

I have purposefully chosen the 365 day length for the Hull MA and the 730 day for the base MA on the daily timeframe since they represent 1 year and 2 years respectively.

Neowave Chart PlotterThis Indicator is applicable to plot wave charts as per the NeoWave method (Neely Extension of Wave Theory). NeoWave is a scientific, objective and revolutionary style of Elliott Wave Theory that was invented by Glenn Neely in 1990 in the “Mastering Elliott Wave” book.

To start analyzing with this method, we need a particular chart called the Wave Chart or Cash Data chart. This is the first step for a good wave analysis. To draw this chart, Highs and Lows should be plotted in the order that they occurred. This could be a very challenging and time-consuming task to do for any symbol on any Timeframe.

This Indicator can accurately Find High and low in each Period and draw them in the order that they occurred. for any Symbol on any Timeframe automatically and in real-time.

For example on Monthly timeframe, indicator separates each year and find high and low on the period. Then it recognizes which occurred early and plot them in order that occurred. this called "Yearly Wave Chart" and you can start to analysis it, base on Neowave method.

Important : This Indicator Works on All Type of Accounts

Some features of this Expert Adviser are:

- Draw Wave Chart on yearly, monthly, weekly, daily, hourly and minutely timeframes

- Draw Wave Chart on any integer multiples of above timeframes

- Switch between Wave Chart and Candlestick Chart simultaneously

- Online auto updating Wave Charts

- Possibility of putting watermarks

- Show Monowaves count

- Show Suspicions Monowave (where high and low occur on same Bar)

- Show Triple Monowave (where high or low occur twice on a period)

- Show Monowaves count

- plotting wave chart base on Calendar and bar count

- Show Monowaves count

- plotting wave chart on Equal distances

[Herif's] Wolfe WavesWolfe Waves™

This indicator draws wolfe wave patterns.

Some patterns need to be validated by the user.

When detecting Wolfe waves, two triangles are formed.

A target line is drawn from the origin of one of these triangles to the apex or trough of the other.

Bullish patterns are indicated by green triangles and bearish patterns by red triangles. The target line is black.

Care bullish wolfe wave rules

Understanding Wolfe Waves

Wolfe Wave patterns were first identified by Bill Wolfe and his son, Brian. According to Wolfe, they occur naturally in all markets. To recognize them, traders must identify a series of price oscillations that correspond to specific criteria:

-The waves must cycle at a consistent time interval.

-The third and fourth waves must stay within the channel created by the first and second waves.

-The third and fourth waves must show symmetry with the first and second waves.

-In a Wolfe Wave pattern, the fifth wave breaks out of the channel. According to the theory behind the pattern, a line drawn from the point at the beginning of the first wave and passing through the beginning of the fourth wave predicts a target price for the end of the fifth wave. If a trader properly identifies a Wolfe Wave as it forms, the beginning of the fifth wave represents an opportunity to take a long or short position. The target price predicts the end of the wave, and therefore the point at which the trader aims to profit off the position.

Wave Trend OscillatorThis is a very standard version of the Wave Trend Oscillator.

The Channel and Average values are displayed as lines, most people display them as areas.

The Channel and Average difference is displayed as a histogram, most people display it as a tiny noisy area.

I was unable to find a standard version of the Wave Trend Oscillator.

The colorful hyped up versions of this indicator made me feel like a clown while using them.

I have essentially copied the style of the MACD with this indicator, to keep things professional.

With this WTO, you can change the timeframe and source.

You can also change the histogram average length and multiplier, making it usable.

The typical way that people display the histogram is completely unusable and just for appearance.

Now it does a decent job showing when the momentum of the WTO's downward movement is slowing down, just like how the MACD histogram works.

This indicator is essentially a normalized MACD, though they are calculated differently.

The Wave Trend Oscillator is useful for spotting/monitoring changed in mid-trend momentum.

In my experience, divergence in this indicator is a strong signal.

If the MACD is too slow for you, then this is a great alternative; without all the extra fluff people usually add to it.

test - wave collapseexperimental:

translates a gaussian wave to collapse from high/low peaks, slice of a pun intended to the cat in the box :)

Chirped Sine Wave GeneratorINTRODUCTION:

The title pretty much sums up what this tool is, but not what it's for. It's NOT an indicator, just a chirped sine wave generator intended as a developer tool. Basically it sweeps from a very high frequency near the "Nyquist frequency" by chosen starting, step, and repetition rates to an ever decreasing lower frequency. This is typically viewed best on ALL, 5Y, or 1Y charts starting at bar_index==0 onward. Also, with the chart interval being intraday, you may use (ALT + SHIFT + ◀) keyboard shortcuts to jump back to barstate.isfirst. I will say, to witness a much broader scope of the sweep, having 4K is better for viewing it with the highest detailed resolution when making comparisons.

VISUAL AIDS:

When a frequency steps to another frequency a label displays the cycle period of the new frequency. This may be disabled to remove it's obstruction of view when overlaying indicators on top of it. I also included RMS levels that may be enabled.

USAGE:

As you can see above, I sourced TV built-in indicators to the "cSine Wave" plot, having varying results across the varying frequencies generated. Oscillating indicators and filters (ema, sma, etc...) of all sorts can be applied to it to inspect lag, amplitudes, or anomalies that render across the flux on the sweeping sine wave. Keep in mind market data has near infinite frequencies existing at any given time that can pop up or disappear instantly, so performance in theory on this swept synthetic waveform does not equate to performance on ANY ticker. It's gives you "ONE" totally different perspective to evaluate novel indicators.

OBSERVATIONS:

Witnessing the antiquated RSI on higher short frequencies, you will see it has a few issues, hmm. The amplitude is clamped near 50 at the Nyquist frequency growing with increasing amplitude in a funnel like shape. That doesn't imply it's a bad indicator, only there could be room for improvements... potentially. Wilder was calculating the RSI on paper basically, and the calculations were made as simple as possible in late 1970's. With advances in modern computing, many exotic permutations of RSI now exist attempting to improve upon it's original characteristics. EMA sourced to this tool appears in similar fashion to the RSI with it's own peculiarities. I suspect this occurs because EMA and RSI both use an IIR filter. CCI has a better representation across the spectral flux in this case, but that doesn't imply it's a perfect indicator on market data either. CCI could be improved as well...

REVELATIONS:

The chirped sine wave is only revealing a partial story about RSI's, EMA's, and CCI's attributes. In conclusion, how various frequencies affect our indicators, can be a bit more visually obvious using this tool, but it doesn't reveal all. For example, a 3D-RSI tells a different story when viewed in that perspective. Using a chirped sine wave, observations of ringing, weird frequency excitations, or no plot (na) may elude to more serious issues with an algorithm. In many cases, I often move the testing indicator pane to overlay the chirped sine wave pane for a more direct and precise inspection on 4K. I hope that gives you a better idea of this developer tool's intention and it's potentially limited but profound usage. I will be employing this upon nearly indicator fit for evaluation that I can utilize, upgrade, or invent in the future...

Cash Data Chart (Wave Chart)This Indicator is applicable to plot Cash Data Chart in tradingview and it will be very useful for traders who analyze with NEoWave method.

NEoWave analysis method was invented by Glenn Neely and it is a revolutionary style of Elliott Wave Theory.

For analyzing with NEoWave method, we need a particular chart called Wave Chart or Cash Data chart. Wave charts provide a very accurate representation of the Wave movement of the market and allow for much better Wave analysis as a result. To draw this chart, Highs and Lows should be plotted in the order that they occurred. This could be a very challenging and time-consuming task to do for any symbol on any Timeframe. This indicator can calculate and plot Cash Data Charts fast and accurately.

Cash Data Chart is not only useful for people who want to analyze with the NEoWave method, but can also can have a wide range of research areas and can be used in other research and analytical methods.

Some features of this indicator:

- Draw the chart in the desired time frame fast and accurately

- Detect intervals with two duplicate highs or two duplicate lows

- View wave chart and Candlestick chart simultaneously or separately

- Draw charts automatically or draw a chart with the desired interval length and desired start time

- Auto updating Cash Data Charts

- Draw charts on logarithmic and linear price scales

special thanks to www.tradingview.com

Original Wave AnalyzerThis can be applied to Forex, Stocks, and Crypto.

Understanding it

When the buy or sell signal align with the wave, it means the price is heading in the direction of alignment.

This indicator is intended to be used as a confirmation indicator for other algorithms for the best result.

Indicators with specifically tested and chosen settings have been shown to work on a number of timeframes.

How to use on a buy

When you receive a buy signal if it's within the wave or above the wave, it's an indication the market is about to continue that direction. You could aim for 20-50 pips depending on the pair.

When to sell

When you receive a sell signal if it's within the wave or below the wave, it's an indication the market is about to continue that direction. You could aim for 20-50 pips depending on the pair.

When to exit

You can set our indicator to alert you when it's a good time to exit the trade.

How to Access

Gain access to FX Social Entry Finder for your TradingView account by being a active member of FX Social.

Volume Pump WaveThis indicator displays volume as a pump wave. Can be useful for chart analysis and easy detection of anomalies/trends.

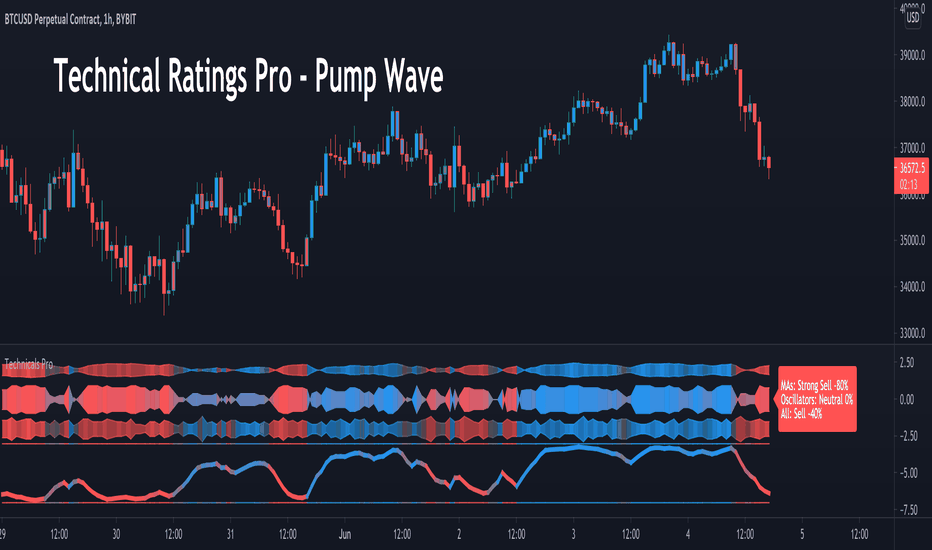

Technical Ratings Pro - Pump WaveThis script uses the built in Technical Ratings indicator but interprets the data visually. It plots the results for "total", "MA" and "other" as pump waves. It uses MA to plot a trend line (can be turned off in settings) . Candles are colored to the rating strength and a percentage number was added to the results. For more informations on the Technical Ratings indicator please refer to official documentation.

Wave Trend Momentum OscillatorThis momentum oscillator is instantaneous and also extremely accurate. For use on all timeframes. Shows wave trend momentum as well as reliable diversions. A secondary crossover (Wave Trend Crossover) can be turned on to give even earlier entries and exits. This indicator has the ability to show changes in trend before it happens. Diversions can be turned off in settings.

There are 3 different smoothing options to tune the indicator to your chart/timeframe. Default setting is HULL.

Wave trend has 4 coloring options: sold, dual color 1, dual color 2 or none (dont show wave trend).

A J line can be turned on in settings as well as the wave trend crossover.

John Ehlers - The Price RadioPrice curves consist of much noise and little signal. For separating the latter from the former, John Ehlers proposed in the Stocks&Commodities May 2021 issue an unusual approach: Treat the price curve like a radio wave. Apply AM and FM demodulating technology for separating trade signals from the underlying noise.

reference: financial-hacker.com

Wave Trend w/ VWMA overlayThis is a trend-following strategy and indicator which combines the Wave Trend Strategy (Lazy Bear) by thomas.gigure with the cRSI + Waves Strategy with VWMA overlay by Dr_Roboto .

You may update the parameters of the Wave Trend oscillator or the VWMA indicator to match your own preferences. You may also adjust the Base Quantity used for determining trade size (as described below) to suit your account size and risk tolerance.

The strategy identifies potential signals based on the on the Wave Trend oscillator, originally ported to TradingView by LazyBear. When a signal is produced by the Wave Trend oscillator, trade size is determined by the VWMA.

When the VWMA is trending against the direction of the Wave Trend signal, Base Quantity x 1 is used

When the VWMA is trending neutral, Base Quantity x 2 is used

When the VWMA is trending with the direction of the Wave Trend signal, Base Quantity x 4 is used

The strategy includes the ability to limit trade signals to certain defined periods of time ("Sessions") during the trading day and, optionally, to close any open position at the end of either or both "Sessions." This may be enabled/disabled via the Limit Signals to Trading Sessions? option on the "Inputs" tab of the strategy's "Settings" window.

If you are trading on a daily chart (or longer) you must disable the Limit Signals to Trading Sessions? in order for the strategy to produce signals.

Orion AlgoOrion Algo is a next-gen trading algorithm designed to help traders find the highs and lows of the market before, during, and after they happen. We wanted to give an indicator to people that was simple to use. In fact we created the algorithm in such a way that it currently only needs a single input from the user. Since no indicator can predict the market perfectly, Orion should be used as just another tool (although quite a sharp one) for you to trade with. Fundamental knowledge of price action and TA should be used with Orion Algo.

Being an oscillator, Orion currently has a bias towards market volatility. So you will want to be trading markets over 30% volatility. We have plans to develop future versions that take this into account and adjust automatically for dead conditions. Also, while there are some similarities across all oscillators, what sets ours apart is the prediction curve. The prediction curve looks at the current signal values and gives it a relative score to approximate tops and bottoms 1-2 bars ahead of the signal curve. We also designed a velocity curve that attempts to predict the signal curve 2+ bars ahead. You can find the relative change in velocity in the Info panel. The bottom momentum wave is based on the signal curve and helps find overall market direction of higher time-frames while in a lower one.

Future Roadmap:

Create secondary on-bar indicator to pair with Orion Algo

Automatically adjust internal variables based on market volatility

Indicator style selection

Simple Strategy:

1. Start at a high time-frame to get an overview of the market you are wanting to enter. Daily is usually a good starting time.

2. If you can, add Orion to a second chart with a lower time-frame such as 4H.

3. Check the lower time frame to find potential medium term entry points based on where the trend was heading from the higher time-frame.

4. Step even lower to the 1H to find your optimal entry based on the higher times and technical analysis of the charts (support/resistance, patterns, etc)

5. The momentum wave can be used to find overall trend of the market. When it starts curving up, the market is bullish. When it curves down, the market could be bearish.

Intermediate Strategy:

1. Use simple strategy first.

2. Use the Prediction and ∆v curves to see future reversals in the works.

3. You can use these curves as potential entries as well as exit points.

4. Take into account potential divergence of the signal lines and price action.

Settings and How to Use them:

User Agreement – Orion Algo is a tool for you to use while trading. We aren’t responsible for losses OR the gains you make with it. By clicking the checkbox on the left you are agreeing to the terms.

Super Smooth – Smooths the main signal line based on the value inside the box. Lower values shift the pivot points to the left but also make things more noisy. Higher values move things to the right making it lag a bit more while creating a smoother signal. 8 is a good value to start with.

Theme – Changes the color scheme of Orion.

Info – Turns on a dashboard with useful stats, such as Delta v, Volatility, Rsi, etc. Changing the value box will move the dashboard left and right.

Pivots – Toggles main bull/bear dots.

Prediction – A secondary prediction model that attempts to predict a reversal before it happens (0-2bars). This can be noisy some times so make your best judgement. Curve will toggle a curve view of the prediction. Pivots will toggle bull/bear dots.

∆v – Delta v (change in velocity). This shows momentum of the signal. Crossing 0 signals a reversal. If you see the delta v changing direction, it may signify a reversal in the several bars depending on the overall momentum of the market.

Divergence – Toggles divergence lines. Hidden will show hidden divergences. Cross will show divergences that cross the 0 line.

Momentum Wave – Uses the signal as a macro trend indicator. Changes in direction of the wave can signify macro changes in the market. Average will toggle an averaging algorithm of the momentum waves and makes it easy to understand.

OBOS – Overbought/Oversold lines. Dyn will convert them to dynamic OBOS lines. The value box will adjust the smoothing.

MarketVision BWith Special Thanks to Everyone who has gone before me, and who have both allowed me given me permission to bring my version of Market Cipher to the World

Especially LazyBear for his amazing Wave Trend Oscillator and for Aevir, falconCoin, vumanchu, Crypto_Spike and others who have freely brought MarketCipher to the Tradingview Community

Also special mention to RicardoSantos for his Divergence script

MarketVision B - My take on MarketCipher B / Market Cipher B, Ive just put outlines on the Wave Trend to add to the Visual Appeal and Added a Trend Meter and a few more options for the Oscillators

Nice To Look At

Oscillator 1 Choose Between - RSI, MFI and Ultimate Oscillator

For Stochastics Choose Between Standard and RSI Stochastics and for the source you can choose On Balance Volume

Wave Trend

Money Flow

Trend Meter & Signals Bar

Divergences are marked, However they are easy to spot and it is better to train your eyes to spot them before the indicator marks them out

Lots of Alerts and Loads of ways to trade using MarketVision

PS: You can make this look like the original by adjusting the parameters in the menu

Weis Wave With Effort/Reward MatrixThis is based on Weis Wave principle with different customization. Namely

Shows Volume (in thousands) for each wave

Calculates the effort/reward matrix of each wave (proprietary calculation)

Can show either bar count or Effort/Reward (E/R) Matrix with volume for each wave

Default is E/R Matrix only

You can choose what you want to see from the indicator setting. It could be just wave volume, just ER Matrix (default), both ER Matrix and volume, ER Matrix and bar count or all three.

How It Works

BUY - Look for a wave (down) that ends at and around a same level with double or more ER Matrix

SELL- Look for a wave (up) that ends at and around a same level with double or more ER Matrix

There is also a principle called fading E/R Matrix that suggest the dying interest of either buyers or sellers. That also could be a good pointer to initiate fresh trades in the direction against the fading participants.

Points To Note

That said, it is best that you try to align it with your own trading style and existing principles. For example, I use only this indicator and don't even use candle sticks. It's more to do with the way I want to wade away negative and psychological brain fades. I generally use it with E/R Matrix only. As I have mentioned earlier, I always look for a level failure, i.e when I see the price fail to make a new high/low at around the same level with double or more E/R Matrix value. When this happens the price tends to reverse direction. I generally keep the SL 10 pips below/above the last wave end depending on the kind of trade I am into. What I have seen, it has a decent accuracy rate. Of course you ought to have basic price action idea to use this indicator effectively. It is for the people who have prior price action knowledge, so don't expect the script to generate buy/sell signal, because it won't. This indicator itself is an ecosystem of trading and you have to use it based on your trading style.

You can apply it on to your existing charts (bar, candle, line) or can use the wave alone as I do. Just make sure that you keep your opacity of your candles/bars to a level that makes the wave itself more prominent.

The colour combination looks best on a dark background

Carpe Diem [Strategy]Carpe Diem Strategy, a wave cycle strategy that only enters when markets are up trending.

The script uses 3 different trend detection indicators including volume which helps with confirmation.

This script has 10 variations built within it which are fitted for the coins differnt coinditions

The coins included are

BTC/USDT 4H

ETH/USDT 4H

LTC/USDT 4H

ADA/USDT 4H

BNB/USDT 2H

BAND/USDT 4H

BAT/USDT 3H

OGN/USDT 4H

ZIL/USDT 4H

BZRX/USDT 2H

How to use the Indicator

You can change what plots are shown in the settings Cog

When the wave lines are green, the market is up trending and will be looking for a trade whereas when they are red, the market is in a sideways or downtrend.

The buy signal is given by the fast wave either crossing over the slow wave line, or crossing over the value of 25.

The exit signal is when the wave crosses back under the 75 value

This strategy includes Fees and there is NO Repaint. The script is written in version 4

There is an option in the settings cog to choose from 10 Coins and timeframes which the Strategies have been optimised for.

There is also another option in the settings cog to change the backtesting range.

There is also another option to adjust the stop loss. I have left it on the Default value which I believe works best

This strategy performs best on the Binance listings

Dual Weis Wave VolumeIt took but left, a Weis wave volume that shows the main wave and the fractal wave, thinking of everyone who wants to save space with indicators, you can adjust 2 indicators within 1, it is the dual indicator.

This indicator calculates the volume waves, being created initially by David Weis, largely behind the wyckoff method that unfortunately died, being very useful in reading flow, replacing even Times in Trades in Tape Reading, since he makes the information more accurate visually.

The novelty is the addition of a fractal flow, that is, if the main one misses an information, the fractal will show, in addition to saving space to add another indicator and not the same with other values.

Swing Index System - Heiken Ashi Pivot Breakout StrategyFor Educational Purposes. Results can differ on different markets and can fail at any time. Profit is not guaranteed.

This only works in a few markets and in certain situations. Changing the settings can give better or worse results for other markets. This is a breakout strategy that uses the heiken ashi bars to find the support and resistance levels or the swing pivots to try to objectively find a breakout. When the price breaks out of a swing pivot, breakout can be confirmed and a strategy can be made. The trade exits as soon as in profit when the heiken ashi bar changes color, when the price swings start to slow down, or when the price breaks below a swing pivot. There might be many strategies and possible ideas that can be made just from knowing where the swing pivots are alone. For this one, I decided to try to emulate Wilder's Adam Theory approach by entering only a specific criteria when it makes new highs or lows that I experimented with. The Swing Index System seems to be similar to what he describes in his book (or perhaps it is the same thing).

Some say that price is the ultimate indicator, but not many really know what that really means. This is yet another approach to try to interpret what that means. This strategy only contains a piece of the complete breakout and trend strategy approach of the Adam Theory and won't be profitable in every market under every situation. This does not include price patterns that the Swing Index System is said to be able to find such as chart patterns, wedges, tops/bottoms, etc. This only includes the small breakout portion requirement in the book. I included specific entry and exit criteria to make the strategy work well that involves nothing but the price action of the swing points only due to the lack of the other missing pieces. It does not contain the missing pieces. Despite this, it can still help find where breakouts might be in an objective matter using the Swing Index System as a standalone trading system and it doesn't involve lookbacks or anything but price alone.