🍎 AAPL Swing/Day Trade: The Great Apple Heist Plan 🚨

Asset: AAPL (Apple Inc. Stock)

Market: US Stock

MarketVibe: Bullish, sneaky, and ready to loot some profits! 💰

📜 The Master Plan: Bullish EMA Pullback Heist

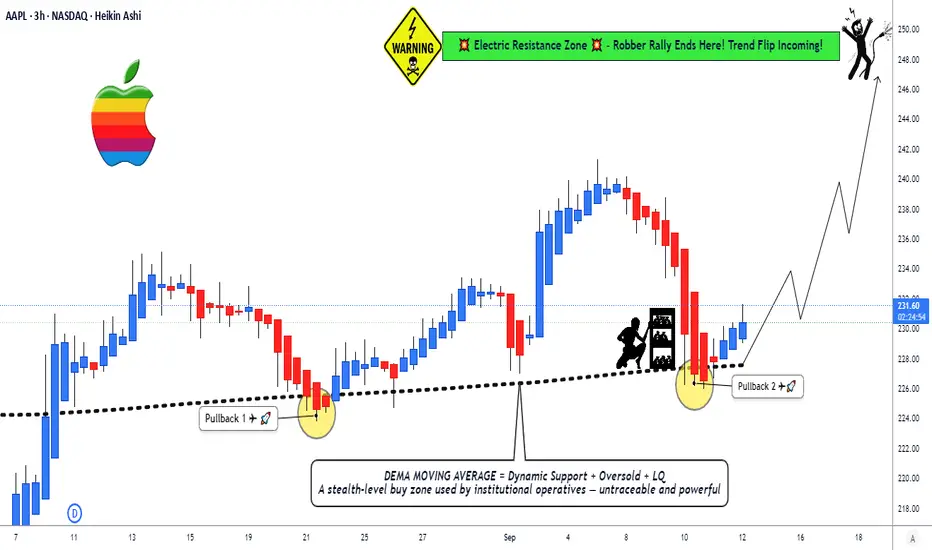

🎯 Strategy: We're pulling off a slick Double Exponential Moving Average (DEMA) pullback plan, targeting a breakout at dynamic support levels. Think of it as a high-stakes caper where we sneak in, grab the profits, and escape before the market knows what hit it! 😎

🔑 Key Setup Details:

Chart Setup: AAPL is showing a bullish setup with a DEMA pullback, signaling a potential swing or day trade opportunity.

Dynamic Line: We’re eyeing the DEMA as our guiding star 🌟 for entries and exits.

🚪 Entry: The Sneaky Thief Layering Strategy

🔍 How to Enter: Deploy the Thief Layering Strategy with multiple buy limit orders to maximize your entry precision:

🤑 Buy Limit Layers: Place orders at $227, $228, $229, $230 (or add more layers based on your risk appetite — you’re the mastermind here!).

💡 Pro Tip: Feel free to adjust entry levels to suit your style. The market’s your playground, so pick your spot!

🛑 Stop Loss: Protect Your Loot!

⚠️ Thief SL: Set your stop loss at $224 post-breakout to guard your stash.

Note: Dear Ladies & Gentlemen (Thief OGs 🕵️♂️), this SL is a suggestion. Adjust it based on your strategy and risk tolerance. You’re in charge of your heist, so protect your loot your way!

🎯 Target: Hit the Jackpot & Escape!

💥 Profit Target: Aim for $248, where a high-voltage resistance wall ⚡️ awaits, potentially paired with overbought conditions and a sneaky trap. Grab your profits and vanish before the market catches on!

Note: Dear Thief OGs, this target is a suggestion. Set your TP based on your goals and risk management. Take the money and run at your own discretion! 😏

👀 Related Pairs to Watch (Correlations & Opportunities)

To boost your heist, keep an eye on these correlated assets:

MSFT (Microsoft): Tech giant with similar market moves to AAPL. If AAPL’s bullish, MSFT might follow suit. Watch for parallel DEMA pullbacks.

MSFT (Microsoft): Tech giant with similar market moves to AAPL. If AAPL’s bullish, MSFT might follow suit. Watch for parallel DEMA pullbacks.

QQQ (Invesco QQQ ETF): Tracks the Nasdaq-100, where AAPL is a heavy hitter. QQQ’s trend can confirm AAPL’s bullish momentum.

QQQ (Invesco QQQ ETF): Tracks the Nasdaq-100, where AAPL is a heavy hitter. QQQ’s trend can confirm AAPL’s bullish momentum.

SPY (SPDR S&P 500 ETF): Broad market index. If SPY’s trending up, it supports AAPL’s bullish case.

SPY (SPDR S&P 500 ETF): Broad market index. If SPY’s trending up, it supports AAPL’s bullish case.

Key Correlation Insight: AAPL often moves in tandem with tech-heavy indices like QQQ. A bullish QQQ or MSFT can reinforce confidence in this trade setup.

⚡ Why This Setup Rock

Bullish Momentum: DEMA pullback signals a strong continuation pattern.

Layered Entries: Multiple limit orders reduce risk and increase flexibility.

Clear Risk Management: Defined SL and TP keep your heist disciplined.

Market Context: Tech sector strength (check QQQ/MSFT) supports AAPL’s upward move.

⚠️ Risk Disclaimer

Dear Thief OGs, this is not financial advice. The market’s a wild place, and you’re the master of your trades. Set your SL and TP based on your own risk tolerance and strategy. Steal profits wisely! 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Hashtags: #AAPL #SwingTrading #DayTrading #StockMarket #ThiefStrategy #TechnicalAnalysis #Bullish #TradingView

Asset: AAPL (Apple Inc. Stock)

Market: US Stock

MarketVibe: Bullish, sneaky, and ready to loot some profits! 💰

📜 The Master Plan: Bullish EMA Pullback Heist

🎯 Strategy: We're pulling off a slick Double Exponential Moving Average (DEMA) pullback plan, targeting a breakout at dynamic support levels. Think of it as a high-stakes caper where we sneak in, grab the profits, and escape before the market knows what hit it! 😎

🔑 Key Setup Details:

Chart Setup: AAPL is showing a bullish setup with a DEMA pullback, signaling a potential swing or day trade opportunity.

Dynamic Line: We’re eyeing the DEMA as our guiding star 🌟 for entries and exits.

🚪 Entry: The Sneaky Thief Layering Strategy

🔍 How to Enter: Deploy the Thief Layering Strategy with multiple buy limit orders to maximize your entry precision:

🤑 Buy Limit Layers: Place orders at $227, $228, $229, $230 (or add more layers based on your risk appetite — you’re the mastermind here!).

💡 Pro Tip: Feel free to adjust entry levels to suit your style. The market’s your playground, so pick your spot!

🛑 Stop Loss: Protect Your Loot!

⚠️ Thief SL: Set your stop loss at $224 post-breakout to guard your stash.

Note: Dear Ladies & Gentlemen (Thief OGs 🕵️♂️), this SL is a suggestion. Adjust it based on your strategy and risk tolerance. You’re in charge of your heist, so protect your loot your way!

🎯 Target: Hit the Jackpot & Escape!

💥 Profit Target: Aim for $248, where a high-voltage resistance wall ⚡️ awaits, potentially paired with overbought conditions and a sneaky trap. Grab your profits and vanish before the market catches on!

Note: Dear Thief OGs, this target is a suggestion. Set your TP based on your goals and risk management. Take the money and run at your own discretion! 😏

👀 Related Pairs to Watch (Correlations & Opportunities)

To boost your heist, keep an eye on these correlated assets:

Key Correlation Insight: AAPL often moves in tandem with tech-heavy indices like QQQ. A bullish QQQ or MSFT can reinforce confidence in this trade setup.

⚡ Why This Setup Rock

Bullish Momentum: DEMA pullback signals a strong continuation pattern.

Layered Entries: Multiple limit orders reduce risk and increase flexibility.

Clear Risk Management: Defined SL and TP keep your heist disciplined.

Market Context: Tech sector strength (check QQQ/MSFT) supports AAPL’s upward move.

⚠️ Risk Disclaimer

Dear Thief OGs, this is not financial advice. The market’s a wild place, and you’re the master of your trades. Set your SL and TP based on your own risk tolerance and strategy. Steal profits wisely! 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#Hashtags: #AAPL #SwingTrading #DayTrading #StockMarket #ThiefStrategy #TechnicalAnalysis #Bullish #TradingView

Trade attivo

Trade chiuso: obiettivo raggiunto

AAPL Real-Time Stock Feed (Sept 24, 2025)Current Price: $251.84 USD

Change Today: Down $2.59 (-1.02%) from previous close of $254.43

Open: $255.22

Day's Range: $251.04 - $255.73

Volume: 18.9M shares (below avg of 57.1M)

52-Week Range: $169.21 - $260.10

Market Cap: $3.737T

(Data from NYSE, latest at ~2:30 PM UTC+1; market open 2:30 PM - 9:00 PM UTC+1.)

Fundamental Analysis (Company Health & Value)

Apple is financially strong with high revenue and profits, but trading at a premium price.

Revenue (last 12 months): $408.62B

Net Income (last 12 months): $99.28B

Cash on Hand: $55.37B

Debt Level: 154% of equity (moderate risk)

Earnings Per Share: $6.59

Price-to-Earnings Ratio: 38.22 (high, means stock costs a lot per profit dollar)

Next Earnings Date: Oct 30, 2025

Dividend: $1.04 per share (0.41% yield)

Analyst Target Price (1 year): $242.32 (below current, suggests possible downside)

Health: Solid cash and profits show stability. Value: Overpriced vs targets, but ecosystem strength supports it.

Catalyst & News-Driven Analysis (Price Movers)

Strong iPhone 17 demand: Wait times high, turning stock positive YTD after launch. UBS notes entry-level mixing may limit price gains this quarter.

Carbon neutral push: 14,000-acre California forest buy advances green goals.

Analyst views: Wedbush raised target to $310 (bullish on China rebound); Rosenblatt to $241 (neutral). Some funds cut stakes.

Broader: Underperformed "Magnificent Seven" peers in 2025. No major events today; watch Powell's rate comments for tech impact.

These could lift price on demand news, but limit upside short-term.

Market Sentiment & Macro Environment

Overall Market: Wall Street flat/choppy; S&P/Nasdaq subdued after Fed's Powell tempered rate-cut hopes (no aggressive cuts soon). Tech rebounding but AAPL lags peers.

Beta (volatility vs market): 1.11 (slightly more volatile than average).

Macro: Stable but cautious on rates; tech sentiment improving on AI/iPhone buzz.

Retail & Institutional Traders Sentiment

Retail: Mostly positive. Social chatters posts show excitement on iPhone 17 demand, bullish targets ($260+), and "unstoppable" momentum. Some caution on pullbacks/overextension. High anecdotes of global demand.

Institutional: Owns 67.73% of shares (high confidence). 4,083 buyers last year; inflows steady. Some raises (e.g., Aaron Wealth up 6K shares), but mixed (one fund cut stake). Underexposed vs peers, per analysts.

Investor Mood: Fear & Greed Measure

CNN Fear & Greed Index: In "Greed" zone (investors optimistic, buying dips).

Overall mood: Greed with caution; sentiment improved on stock records.

Overall Score

Bullish (long trend): Strong fundamentals, iPhone demand, and greed mood outweigh today's dip and high valuation. Watch earnings for confirmation.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.