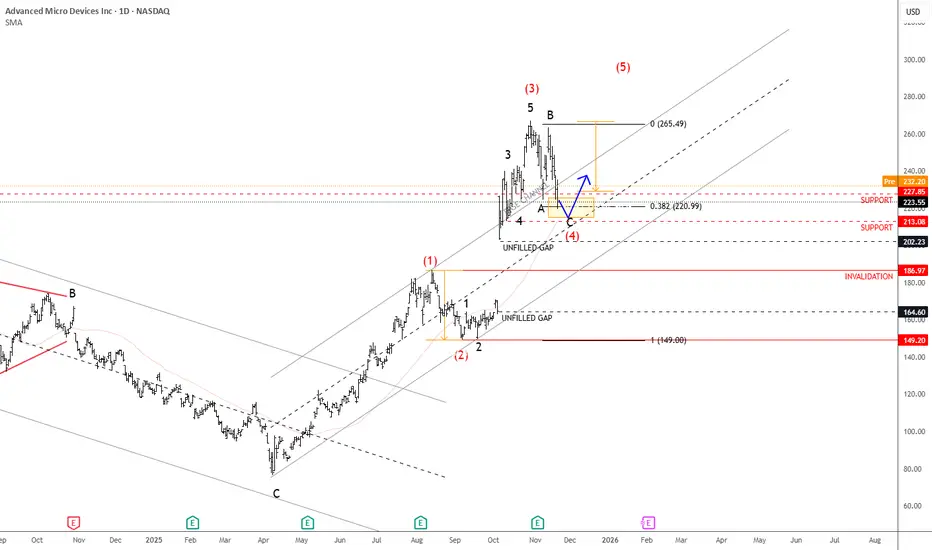

AMD is in a very strong uptrend, supported by the impressive rally since early October when it gapped higher on positive AI news. Since then, the stock has gained more than 50%, and this bullish momentum could continue after a retracement, especially considering latest company’s better-than-expected earnings report.

But based in latest price action, we assume that the market is now in a corrective pullback before resuming higher, ideally forming wave four within a broader five-wave sequence. The previous high around 220 could act as the first key support, followed by the 200 area, which also aligns with upper range of unfilled gap. So if we are correct, then later this month or early in December, the market can once again stabilize and turn up for a new high, while the price is above 187 invalidation level.

Highlights:

Trend: Strong uptrend, wave four correction in view

Support: 220 / 200 zone

Invalidation: Below 186

Note: Wait for a pullback to complete before considering new long opportunities

But based in latest price action, we assume that the market is now in a corrective pullback before resuming higher, ideally forming wave four within a broader five-wave sequence. The previous high around 220 could act as the first key support, followed by the 200 area, which also aligns with upper range of unfilled gap. So if we are correct, then later this month or early in December, the market can once again stabilize and turn up for a new high, while the price is above 187 invalidation level.

Highlights:

Trend: Strong uptrend, wave four correction in view

Support: 220 / 200 zone

Invalidation: Below 186

Note: Wait for a pullback to complete before considering new long opportunities

Black Friday Discount: Save up to 50% and get Educational videos for free

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter

👉 bit.ly/3FVPVzO

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter

👉 bit.ly/3FVPVzO

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Black Friday Discount: Save up to 50% and get Educational videos for free

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter

👉 bit.ly/3FVPVzO

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter

👉 bit.ly/3FVPVzO

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.