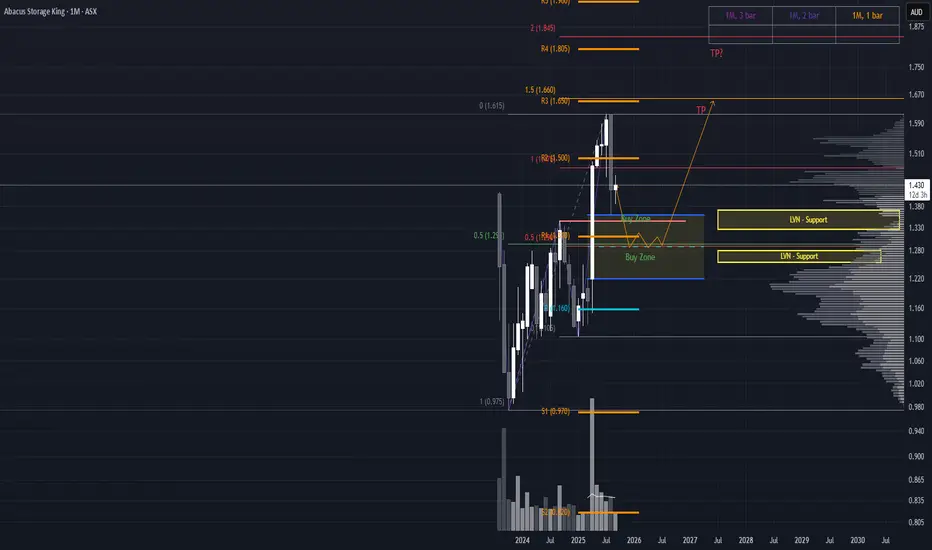

ASK is showing promising signs of continuation after a strong 30% rally in April. The chart appears to be consolidating, potentially setting up for the next leg higher.

Ideal Pullback Scenario

The most favorable setup would involve a pullback to the major 50% retracement level, which aligns with:

- The Equilibrium (EQ) of the Fair Value Gap (FVG)

- A Low Volume Node (LVN) zone

This confluence of technical factors makes it a high-probability area for a bounce, offering strong risk-to-reward potential.

Alternative Support Zone

It’s also important to watch the $1.345 level, which presents another solid support zone:

- Contains a notable LVN

- Coincides with the previous All-Time High (ATH)

Price may wick into this zone without showing acceptance, then rebound sharply, making it a viable entry point for aggressive traders.

Trade Management

Take Profit (TP): Initial target sits around $1.70, offering a solid upside from current levels.

Stop Loss (SL): Trade invalidation occurs on a break and close below the $1.105 swing low.

If a higher low forms during the pullback, the SL can be adjusted accordingly to tighten risk.

Ideal Pullback Scenario

The most favorable setup would involve a pullback to the major 50% retracement level, which aligns with:

- The Equilibrium (EQ) of the Fair Value Gap (FVG)

- A Low Volume Node (LVN) zone

This confluence of technical factors makes it a high-probability area for a bounce, offering strong risk-to-reward potential.

Alternative Support Zone

It’s also important to watch the $1.345 level, which presents another solid support zone:

- Contains a notable LVN

- Coincides with the previous All-Time High (ATH)

Price may wick into this zone without showing acceptance, then rebound sharply, making it a viable entry point for aggressive traders.

Trade Management

Take Profit (TP): Initial target sits around $1.70, offering a solid upside from current levels.

Stop Loss (SL): Trade invalidation occurs on a break and close below the $1.105 swing low.

If a higher low forms during the pullback, the SL can be adjusted accordingly to tighten risk.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.