🧠 The Problem With Crypto – Part 1: Centralized Exchanges

It actually took me a while to decide what title to give this post.

Because every single one of these would fit:

-The Exchange Illusion

-The Liquidation Machine

-The Centralized Harvest

-Inside the Casino

-How Exchanges Always Win

-Where Did Your Money Go? 💰

-They Say They’ll Compensate You… So Who’s Holding Your Cash?

-The Perfect Crime Nobody Talks About 🎭

-Your Loss = Their Profit

-The Casino Always Wins 🎰

And honestly… they’re all partially — or maybe wholly — true.

💥 About Friday’s Crash

Friday’s collapse wasn’t random.

It wasn’t “volatility.”

It was a harvest event — engineered by liquidation engines that feed the exchanges.

Coins didn’t drop 50–60 % because of news — they dropped because leverage met latency, and the house collected the pot.

👩🏫 A Question From My Student

One of my community members, Sarah, asked me:

“Professor, how did this even happen? How can small-leverage positions just disappear?”

So here’s the truth — no sugar-coating. ☕💀

🎭 The Illusion of Liquidity

When you see a coin drop 50–60 % in minutes, that’s not price discovery — it’s engineered implosion.

Exchanges create the illusion of deep liquidity, but when panic hits, that liquidity vanishes faster than your stop-loss button.

They brag about billions in open interest, but that’s just leveraged ghost money.

On a 100× market, $10 million in deposits looks like $1 billion of “open interest.”

A 1 % move = total collapse of the stack.

🧨 How the Domino Falls

1️⃣ Market dips 1–2 %.

Liquidation bots start killing over-levered longs.

2️⃣ Those positions don’t close quietly — the system market-sells them, pushing price lower and triggering the next wave.

3️⃣ Within seconds you have a cascade — a healthy market turns into a slaughterhouse.

That’s how you get –60 % in five minutes on a coin with no news, no hack, no reason.

🏦 The Exchanges’ Dirty Secret

They love these crashes.

Because every liquidation = trading fee + funding reset + spread capture.

They collect the liquidation fee (usually 0.5–1 %).

They resell your collateral into thin order books.

Their own market makers scoop up panic liquidity at discounts.

Then the price “recovers” 30–40 % like nothing happened.

It’s not volatility — it’s profit harvesting disguised as market action.

🧮 “But It’s the Trader’s Fault, Right?”

That’s the official line.

They’ll say, “You were liquidated because you took too much risk.”

But here’s what nobody explains:

Your liquidation price often triggers before your stop-loss — sometimes way before.

Let’s say you open a position with $100 using 50× leverage.

Your exposure is $5 000.

You’d expect to only lose that $100 if the market moves 2 %.

Instead, the exchange liquidates you when your position drops about 75 % of your margin,

so you’re wiped out on a 1.5–2 % move — while the chart barely twitches.

Now compound this:

If you scale or DCA into a trade, the liquidation engine recalculates your threshold even closer —

often within 10–15 % of normal price action.

Meaning your trade could still have equity left, but the exchange force-closes it,

sells it into the book, and keeps the rest.

And here’s the question no one dares to ask:

👉 If these exchanges have AI, algorithms, and “smart risk engines,”

why don’t they auto-close your position when you’re down 10–15 % and just take the loss?

Why do they wait until liquidation — when the trader loses 100 % and the exchange keeps the remainder?

Where does that extra money go?

It doesn’t vanish.

It’s absorbed by the exchange’s insurance and profit pools — the same ones that market makers draw from.

In other words, they could have saved you at minus 15 %,

but they chose to liquidate you at minus 100 % because it pays them better.

That’s not a trading platform.

That’s a profit engine disguised as protection.

(in Part 3 we will examine a lot more closely into this and other factors like how order books work and WHO sets them UP!!!!)

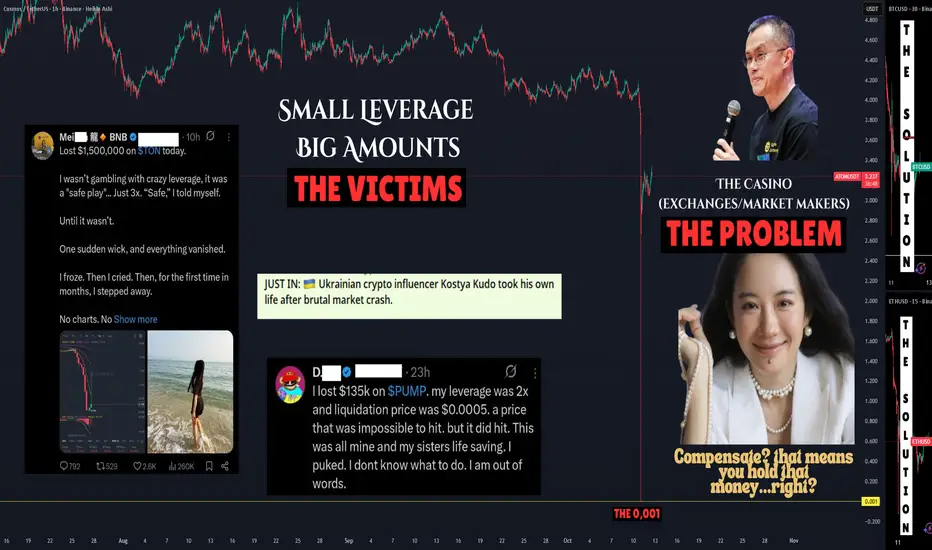

🩸 Small Leverage, Big Losses

People think “2× or 3× is safe.”

It wasn’t.

Friday proved that even low leverage isn’t safe when the exchange controls the price feed.

We saw ATOM,

ATOM,  PUMP, and others hit zero ticks on Binance.

PUMP, and others hit zero ticks on Binance.

That’s not a market event — that’s a systemic failure or an engineered flush.

One trader lost $135 K at 2×.

Another lost $1.5 M at 3×.

These aren’t degens — they’re victims of a broken system.

💬 Community Voices Demanding Answers

Even the Turkish crypto community (and I'm 100% Greek by the way) publicly asked CZ:

“How can altcoins crash 90 % in seconds when no one sold?

How can prices nuke without real volume?

And why did tokens not listed on exchanges stay safe?”

These are valid questions.

And Binance, Bybit, MEXC and the rest — owe us PROPER answers.

🧾 The Yi He Statement

Yi He, co-founder and Chief Customer Service Officer of Binance — the public face of the company after CZ — finally spoke.

She said:

“We’ll address losses case-by-case.

We won’t compensate for price fluctuations or unrealized losses.”

Now, read that carefully.

Translation: We hold the money and decide who gets it back.

If Binance can “compensate,” that means the liquidated funds didn’t vanish — they were captured and are still inside the system.

And that raises the obvious question:

👉 Where does all that liquidation money actually go?

Yi He’s post feels like the moment when you lose at a casino, the dealer miscounts the chips, and management says, “Don’t worry, we’ll review your case individually.”

You know the money never left the casino.

So is it the same here?

Do the exchanges hold these funds?

How are they redistributed?

We need clear answers — from Yi He herself, from CZ, and from every exchange that claims to be transparent.

It’s time they step forward and explain how these liquidation systems truly work — because people lost life savings, and silence isn’t customer service.

⚙️ The Mechanics Behind the Scenes

1️⃣ When you’re liquidated, your collateral is sold instantly into the order book.

2️⃣ That money moves into the exchange’s insurance fund.

3️⃣ The insurance fund feeds market makers to “stabilize” prices.

4️⃣ The exchange earns fees on each loop.

It’s a closed system where every loss feeds their balance sheet.

🧯 The Verdict

-Friday’s crash wasn’t a bug.

-It was a business model.

-A perfect harvest executed in 24 hours.

While millions lost life savings, exchanges collected fees, spreads, and collateral — and then tweeted “systems functioned normally.”

Until there’s transparency on liquidation flows, public insurance fund audits, and a ban on exchange-owned market makers, this will happen again.

💙 Final Word

To every retail trader who lost money on Friday — you weren’t reckless.

You were caught in a system designed to protect itself first and you last.

This is only Part 1 of The Problem With Crypto.

There will be at least two more parts, because this story runs far deeper than one flash crash.

I originally planned to release this series at the end of October,

but what happened on Friday forced me to start early.

The truth couldn’t wait.

Part 2 will dive into the unregulated, decentralized perpetual DEXs —

names like Aster, Hyperliquid, and others — platforms offering anonymity to insider traders and quietly damaging the market from multiple angles.

Part 3 will expose the market-maker cartels and their connections to the exchanges,

showing how price control and “liquidity partnerships” have become the hidden layer of manipulation behind every listing.

But it won’t end in darkness.

Because every cycle — like in the ancient Greek tragedies — follows the same path:

Ύβρις → Άτη → Νέμεσις → Κάθαρσις

(Hubris → Delusion → Retribution → Catharsis)

We’re living through Νέμεσις now — the correction phase.

The arrogance, the greed, the manipulation — they’re being exposed.

And what comes next is Κάθαρσις — purification and renewal.

That’s where the good side of crypto will rise again:

cleaner, fairer, more transparent.

Crypto doesn’t need to burn — it just needs to evolve.

And it will.

👉There are some truths I can’t fully share here — TradingView has its limits

and I’ve been banned before for saying too much or crossing lines. (can't advertise and sharing links might appear like that, so i won't risk it, sorry!)

So I’ll explain everything I can’t post here in a separate, long-form video soon (I am allowed to post my links here so follow those).

Stay tuned — because this story is just another day of progress 👩🏫 :

For those who remember my post from November 2022 — “Just another delay: Bitcoin will prevail” —

I’ll say it again, two years later, with even more conviction:

It was never the end.

It was only Nemesis on the way to Catharsis.💙💙💙

Bitcoin — and the real spirit of crypto — will prevail. 💙💙

As for the exchanges: It's your time to get your Token2049 parties aside and start thinking and acting right, like there IS a tomorrow! Start with giving your side of the story, explanations.

One Love,

The FXPROFESSOR💙

PS. This ATOM to 0.001 chart should first hunt you (👉 你 (nǐ)) — and then it should never happen again in crypto.

The tech is there to make crypto what it’s supposed to be — use it and stop abusing it.

Every problem has a solution. 🔧

It actually took me a while to decide what title to give this post.

Because every single one of these would fit:

-The Exchange Illusion

-The Liquidation Machine

-The Centralized Harvest

-Inside the Casino

-How Exchanges Always Win

-Where Did Your Money Go? 💰

-They Say They’ll Compensate You… So Who’s Holding Your Cash?

-The Perfect Crime Nobody Talks About 🎭

-Your Loss = Their Profit

-The Casino Always Wins 🎰

And honestly… they’re all partially — or maybe wholly — true.

💥 About Friday’s Crash

Friday’s collapse wasn’t random.

It wasn’t “volatility.”

It was a harvest event — engineered by liquidation engines that feed the exchanges.

Coins didn’t drop 50–60 % because of news — they dropped because leverage met latency, and the house collected the pot.

👩🏫 A Question From My Student

One of my community members, Sarah, asked me:

“Professor, how did this even happen? How can small-leverage positions just disappear?”

So here’s the truth — no sugar-coating. ☕💀

🎭 The Illusion of Liquidity

When you see a coin drop 50–60 % in minutes, that’s not price discovery — it’s engineered implosion.

Exchanges create the illusion of deep liquidity, but when panic hits, that liquidity vanishes faster than your stop-loss button.

They brag about billions in open interest, but that’s just leveraged ghost money.

On a 100× market, $10 million in deposits looks like $1 billion of “open interest.”

A 1 % move = total collapse of the stack.

🧨 How the Domino Falls

1️⃣ Market dips 1–2 %.

Liquidation bots start killing over-levered longs.

2️⃣ Those positions don’t close quietly — the system market-sells them, pushing price lower and triggering the next wave.

3️⃣ Within seconds you have a cascade — a healthy market turns into a slaughterhouse.

That’s how you get –60 % in five minutes on a coin with no news, no hack, no reason.

🏦 The Exchanges’ Dirty Secret

They love these crashes.

Because every liquidation = trading fee + funding reset + spread capture.

They collect the liquidation fee (usually 0.5–1 %).

They resell your collateral into thin order books.

Their own market makers scoop up panic liquidity at discounts.

Then the price “recovers” 30–40 % like nothing happened.

It’s not volatility — it’s profit harvesting disguised as market action.

🧮 “But It’s the Trader’s Fault, Right?”

That’s the official line.

They’ll say, “You were liquidated because you took too much risk.”

But here’s what nobody explains:

Your liquidation price often triggers before your stop-loss — sometimes way before.

Let’s say you open a position with $100 using 50× leverage.

Your exposure is $5 000.

You’d expect to only lose that $100 if the market moves 2 %.

Instead, the exchange liquidates you when your position drops about 75 % of your margin,

so you’re wiped out on a 1.5–2 % move — while the chart barely twitches.

Now compound this:

If you scale or DCA into a trade, the liquidation engine recalculates your threshold even closer —

often within 10–15 % of normal price action.

Meaning your trade could still have equity left, but the exchange force-closes it,

sells it into the book, and keeps the rest.

And here’s the question no one dares to ask:

👉 If these exchanges have AI, algorithms, and “smart risk engines,”

why don’t they auto-close your position when you’re down 10–15 % and just take the loss?

Why do they wait until liquidation — when the trader loses 100 % and the exchange keeps the remainder?

Where does that extra money go?

It doesn’t vanish.

It’s absorbed by the exchange’s insurance and profit pools — the same ones that market makers draw from.

In other words, they could have saved you at minus 15 %,

but they chose to liquidate you at minus 100 % because it pays them better.

That’s not a trading platform.

That’s a profit engine disguised as protection.

(in Part 3 we will examine a lot more closely into this and other factors like how order books work and WHO sets them UP!!!!)

🩸 Small Leverage, Big Losses

People think “2× or 3× is safe.”

It wasn’t.

Friday proved that even low leverage isn’t safe when the exchange controls the price feed.

We saw

That’s not a market event — that’s a systemic failure or an engineered flush.

One trader lost $135 K at 2×.

Another lost $1.5 M at 3×.

These aren’t degens — they’re victims of a broken system.

💬 Community Voices Demanding Answers

Even the Turkish crypto community (and I'm 100% Greek by the way) publicly asked CZ:

“How can altcoins crash 90 % in seconds when no one sold?

How can prices nuke without real volume?

And why did tokens not listed on exchanges stay safe?”

These are valid questions.

And Binance, Bybit, MEXC and the rest — owe us PROPER answers.

🧾 The Yi He Statement

Yi He, co-founder and Chief Customer Service Officer of Binance — the public face of the company after CZ — finally spoke.

She said:

“We’ll address losses case-by-case.

We won’t compensate for price fluctuations or unrealized losses.”

Now, read that carefully.

Translation: We hold the money and decide who gets it back.

If Binance can “compensate,” that means the liquidated funds didn’t vanish — they were captured and are still inside the system.

And that raises the obvious question:

👉 Where does all that liquidation money actually go?

Yi He’s post feels like the moment when you lose at a casino, the dealer miscounts the chips, and management says, “Don’t worry, we’ll review your case individually.”

You know the money never left the casino.

So is it the same here?

Do the exchanges hold these funds?

How are they redistributed?

We need clear answers — from Yi He herself, from CZ, and from every exchange that claims to be transparent.

It’s time they step forward and explain how these liquidation systems truly work — because people lost life savings, and silence isn’t customer service.

⚙️ The Mechanics Behind the Scenes

1️⃣ When you’re liquidated, your collateral is sold instantly into the order book.

2️⃣ That money moves into the exchange’s insurance fund.

3️⃣ The insurance fund feeds market makers to “stabilize” prices.

4️⃣ The exchange earns fees on each loop.

It’s a closed system where every loss feeds their balance sheet.

🧯 The Verdict

-Friday’s crash wasn’t a bug.

-It was a business model.

-A perfect harvest executed in 24 hours.

While millions lost life savings, exchanges collected fees, spreads, and collateral — and then tweeted “systems functioned normally.”

Until there’s transparency on liquidation flows, public insurance fund audits, and a ban on exchange-owned market makers, this will happen again.

💙 Final Word

To every retail trader who lost money on Friday — you weren’t reckless.

You were caught in a system designed to protect itself first and you last.

This is only Part 1 of The Problem With Crypto.

There will be at least two more parts, because this story runs far deeper than one flash crash.

I originally planned to release this series at the end of October,

but what happened on Friday forced me to start early.

The truth couldn’t wait.

Part 2 will dive into the unregulated, decentralized perpetual DEXs —

names like Aster, Hyperliquid, and others — platforms offering anonymity to insider traders and quietly damaging the market from multiple angles.

Part 3 will expose the market-maker cartels and their connections to the exchanges,

showing how price control and “liquidity partnerships” have become the hidden layer of manipulation behind every listing.

But it won’t end in darkness.

Because every cycle — like in the ancient Greek tragedies — follows the same path:

Ύβρις → Άτη → Νέμεσις → Κάθαρσις

(Hubris → Delusion → Retribution → Catharsis)

We’re living through Νέμεσις now — the correction phase.

The arrogance, the greed, the manipulation — they’re being exposed.

And what comes next is Κάθαρσις — purification and renewal.

That’s where the good side of crypto will rise again:

cleaner, fairer, more transparent.

Crypto doesn’t need to burn — it just needs to evolve.

And it will.

👉There are some truths I can’t fully share here — TradingView has its limits

and I’ve been banned before for saying too much or crossing lines. (can't advertise and sharing links might appear like that, so i won't risk it, sorry!)

So I’ll explain everything I can’t post here in a separate, long-form video soon (I am allowed to post my links here so follow those).

Stay tuned — because this story is just another day of progress 👩🏫 :

For those who remember my post from November 2022 — “Just another delay: Bitcoin will prevail” —

I’ll say it again, two years later, with even more conviction:

It was never the end.

It was only Nemesis on the way to Catharsis.💙💙💙

Bitcoin — and the real spirit of crypto — will prevail. 💙💙

As for the exchanges: It's your time to get your Token2049 parties aside and start thinking and acting right, like there IS a tomorrow! Start with giving your side of the story, explanations.

One Love,

The FXPROFESSOR💙

PS. This ATOM to 0.001 chart should first hunt you (👉 你 (nǐ)) — and then it should never happen again in crypto.

The tech is there to make crypto what it’s supposed to be — use it and stop abusing it.

Every problem has a solution. 🔧

🚀💰fxprofessor.com 🌍 Subscribe

🗽 Telegram Bot: t.me/FXPROFESSOR_bot

💙 100% decentralized + AI utility at its core 🐋#CRGPT Cryptogpt.io

🗽 Telegram Bot: t.me/FXPROFESSOR_bot

💙 100% decentralized + AI utility at its core 🐋#CRGPT Cryptogpt.io

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

🚀💰fxprofessor.com 🌍 Subscribe

🗽 Telegram Bot: t.me/FXPROFESSOR_bot

💙 100% decentralized + AI utility at its core 🐋#CRGPT Cryptogpt.io

🗽 Telegram Bot: t.me/FXPROFESSOR_bot

💙 100% decentralized + AI utility at its core 🐋#CRGPT Cryptogpt.io

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.