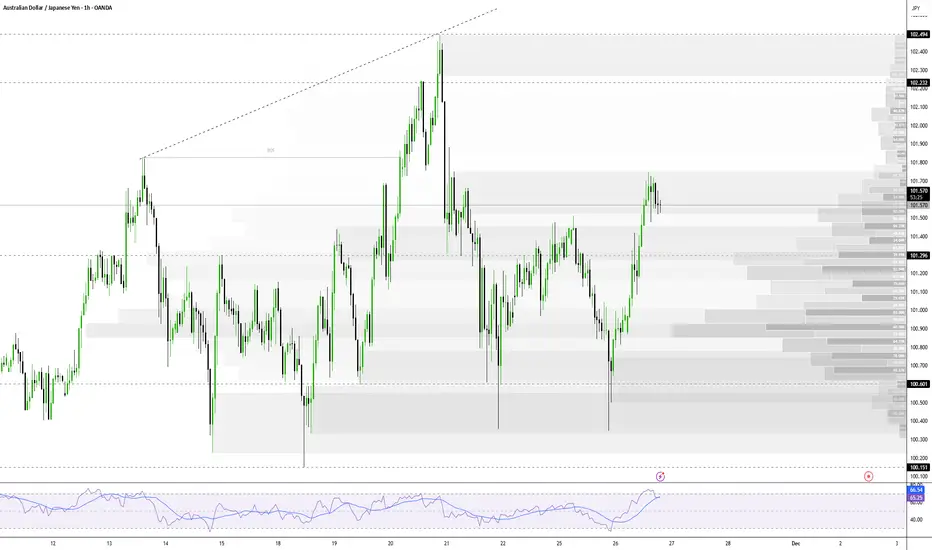

AUD/JPY | Bullish Momentum After Australian CPI Data Release

The AUD/JPY pair gained a strong bullish boost after higher-than-expected Australian consumer inflation data, which dampened speculation of an interest rate cut by the Reserve Bank of Australia (RBA). Currently, the price is at a new weekly high and awaits confirmation of a breakout.

1. Market Fundamental Factors (Drivers of the Upside)

Higher Australian Inflation: The hotter (higher) Australian consumer inflation figures dampened market bets for further interest rate cuts by the RBA.

Impact: This significantly boosted the Australian Dollar (AUD), lifting the AUD/JPY pair to the 101.70 area (a new weekly high).

2. Technical Analysis and Indicators

Long-Term Bias: The 100-day Simple Moving Average (SMA) is rising steadily, and the price is holding above it, reinforcing the bullish bias.

Trend Conditions: Trend conditions will remain favorable as long as the price is above the rising SMA, which is currently below 98.00.

3. Bullish Scenario ⬆️

Strong Upside Trigger: Bulls await a breakout through the nearly three-week-old trading range (currently around 101.70). A decisive MACD push into positive territory would strengthen this case.

Next Target: A move will head towards the 102.45-102.50 region, or the highest level since July 2024, touched last week.

4. Bearish Scenario ⬇️

Initial Key Support: Weakness below the 101.40 area is likely to find decent support near the 101.00 round number.

Trading Range Support: A break below 101.00 could retest the trading range support around the 100.40-100.35 region.

Bias Reversal: A convincing break below 100.35 could trigger technical selling and drag the price below the psychological 100.00 mark, towards the next relevant support near the 99.65 - 99.60 region.

1. Market Fundamental Factors (Drivers of the Upside)

Higher Australian Inflation: The hotter (higher) Australian consumer inflation figures dampened market bets for further interest rate cuts by the RBA.

Impact: This significantly boosted the Australian Dollar (AUD), lifting the AUD/JPY pair to the 101.70 area (a new weekly high).

2. Technical Analysis and Indicators

Long-Term Bias: The 100-day Simple Moving Average (SMA) is rising steadily, and the price is holding above it, reinforcing the bullish bias.

Trend Conditions: Trend conditions will remain favorable as long as the price is above the rising SMA, which is currently below 98.00.

3. Bullish Scenario ⬆️

Strong Upside Trigger: Bulls await a breakout through the nearly three-week-old trading range (currently around 101.70). A decisive MACD push into positive territory would strengthen this case.

Next Target: A move will head towards the 102.45-102.50 region, or the highest level since July 2024, touched last week.

4. Bearish Scenario ⬇️

Initial Key Support: Weakness below the 101.40 area is likely to find decent support near the 101.00 round number.

Trading Range Support: A break below 101.00 could retest the trading range support around the 100.40-100.35 region.

Bias Reversal: A convincing break below 100.35 could trigger technical selling and drag the price below the psychological 100.00 mark, towards the next relevant support near the 99.65 - 99.60 region.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.