Financial Performance (March Quarter 2025)

* Revenue: Alibaba reported a 7% year-over-year increase in revenue, reaching RMB236.5 billion (approximately USD 33.4 billion).

* Adjusted EBITDA: The company's adjusted EBITDA rose by 36% year-over-year to RMB32.6 billion (USD 4.5 billion).

* Net Income: Non-GAAP net income increased by 22% to RMB29.8 billion (USD 4.1 billion), while GAAP net income stood at RMB12 billion (USD 1.7 billion).

E-Commerce Initiatives

* Taobao Instant Commerce: Launched recently, this new portal has surpassed 40 million daily orders within a month, offering 60-minute delivery by integrating merchants from Ele.me into the Taobao platform.

* Domestic E-Commerce: The Taobao and Tmall Group experienced nearly 9% revenue growth, driven by increased consumer engagement and a rise in orders.

* International Expansion: Alibaba's International Digital Commerce Group reported a 24% increase in retail revenue, primarily due to growth in platforms like AliExpress and Trendyol.

Cloud Computing and AI Investments

* Revenue Growth: Alibaba Cloud's revenue grew by 18% year-over-year to RMB30.1 billion (USD 4.2 billion), with AI-related product revenue maintaining triple-digit growth for the seventh consecutive quarter.

* Strategic Investment: The company announced plans to invest over $52 billion in AI and cloud infrastructure over the next three years, aiming to enhance its position as a leading global cloud provider.

* SAP Partnership: Alibaba has entered into a strategic partnership with SAP to accelerate cloud transformation, focusing on AI-powered digital solutions.

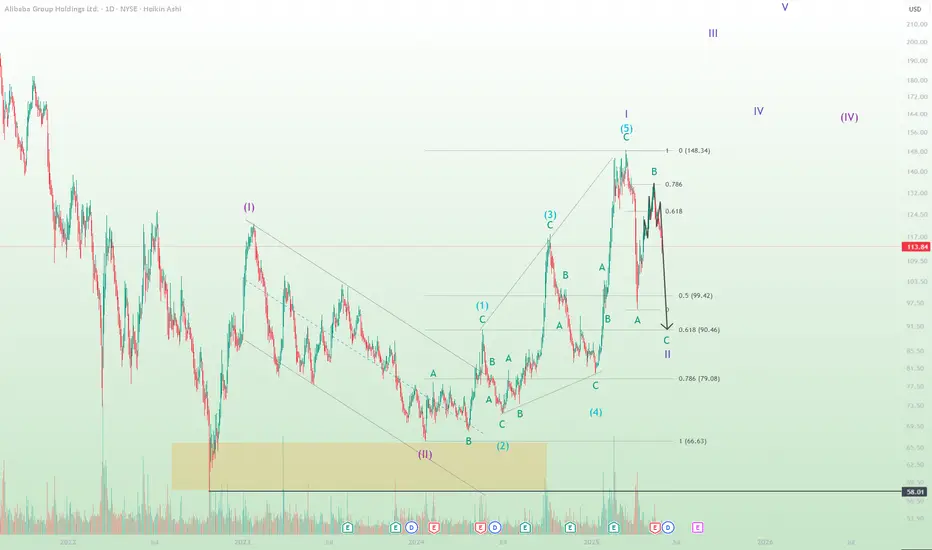

Stock Performance

As of May 31, 2025, Alibaba's stock price stands at $113.84, reflecting a recent decline of 2.7%

* Revenue: Alibaba reported a 7% year-over-year increase in revenue, reaching RMB236.5 billion (approximately USD 33.4 billion).

* Adjusted EBITDA: The company's adjusted EBITDA rose by 36% year-over-year to RMB32.6 billion (USD 4.5 billion).

* Net Income: Non-GAAP net income increased by 22% to RMB29.8 billion (USD 4.1 billion), while GAAP net income stood at RMB12 billion (USD 1.7 billion).

E-Commerce Initiatives

* Taobao Instant Commerce: Launched recently, this new portal has surpassed 40 million daily orders within a month, offering 60-minute delivery by integrating merchants from Ele.me into the Taobao platform.

* Domestic E-Commerce: The Taobao and Tmall Group experienced nearly 9% revenue growth, driven by increased consumer engagement and a rise in orders.

* International Expansion: Alibaba's International Digital Commerce Group reported a 24% increase in retail revenue, primarily due to growth in platforms like AliExpress and Trendyol.

Cloud Computing and AI Investments

* Revenue Growth: Alibaba Cloud's revenue grew by 18% year-over-year to RMB30.1 billion (USD 4.2 billion), with AI-related product revenue maintaining triple-digit growth for the seventh consecutive quarter.

* Strategic Investment: The company announced plans to invest over $52 billion in AI and cloud infrastructure over the next three years, aiming to enhance its position as a leading global cloud provider.

* SAP Partnership: Alibaba has entered into a strategic partnership with SAP to accelerate cloud transformation, focusing on AI-powered digital solutions.

Stock Performance

As of May 31, 2025, Alibaba's stock price stands at $113.84, reflecting a recent decline of 2.7%

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.