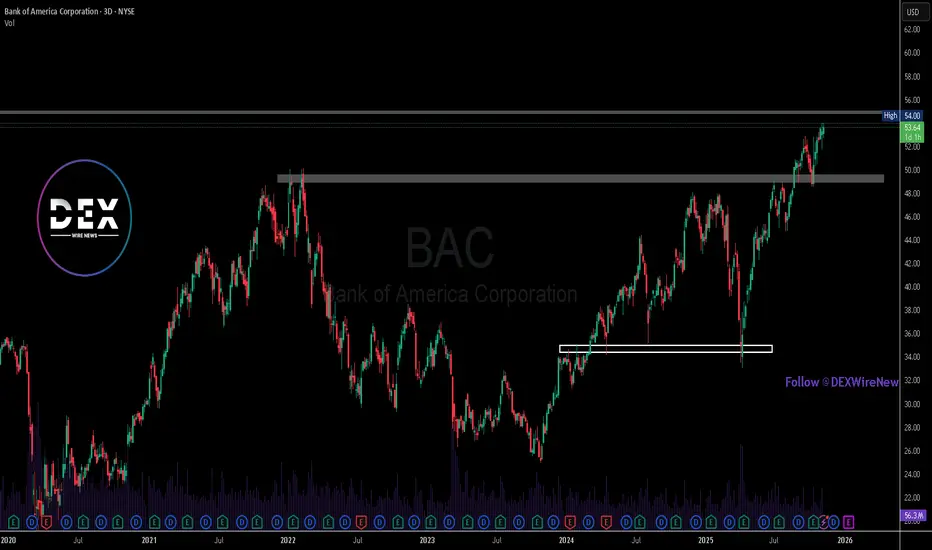

Bank of America’s stock has officially revisited a key multi-year high zone, a level the market last interacted with meaningfully back in 2021. The current structure, as shown in the chart, reflects a very clean technical narrative: a major base, a breakout, and a return to the upper supply zone that has historically triggered profit-taking.

From mid-2023 through early 2024, BAC went through a long accumulation/structural repair cycle. Buyers defended demand aggressively between the $32–$35 region, which acted like a clear multi-touch floor. That zone eventually formed the bottom that launched the entire current rally leg. Once that base held, structural higher-lows began to form and the stock convincingly reclaimed the $48–$50 area, which used to be a stubborn supply wall in previous cycles. That former resistance has now flipped into support.

What stands out today is that BAC is now testing the $54 region, the area representing a major swing high and the top of the structure. This is where price historically reacted sharply, so it is a true macro decision zone. If bulls can hold above this region and convert it into a support shelf, the next phase could trigger a fresh price discovery sequence, with the potential to unlock a new upper range beyond the 2021 highs.

Volume behaviour remains steady, not euphoric, suggesting this move is being driven more by real accumulation rather than speculative blow-off flows.

Heading into the next quarter, macro yields, bank earnings expectations, and broad market risk appetite will dictate whether BAC sustains this breakout. But purely technically, the stock is exactly where major trend continuations historically begin, or trend reversals historically show themselves.

From mid-2023 through early 2024, BAC went through a long accumulation/structural repair cycle. Buyers defended demand aggressively between the $32–$35 region, which acted like a clear multi-touch floor. That zone eventually formed the bottom that launched the entire current rally leg. Once that base held, structural higher-lows began to form and the stock convincingly reclaimed the $48–$50 area, which used to be a stubborn supply wall in previous cycles. That former resistance has now flipped into support.

What stands out today is that BAC is now testing the $54 region, the area representing a major swing high and the top of the structure. This is where price historically reacted sharply, so it is a true macro decision zone. If bulls can hold above this region and convert it into a support shelf, the next phase could trigger a fresh price discovery sequence, with the potential to unlock a new upper range beyond the 2021 highs.

Volume behaviour remains steady, not euphoric, suggesting this move is being driven more by real accumulation rather than speculative blow-off flows.

Heading into the next quarter, macro yields, bank earnings expectations, and broad market risk appetite will dictate whether BAC sustains this breakout. But purely technically, the stock is exactly where major trend continuations historically begin, or trend reversals historically show themselves.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

⭐⭐⭐ Sign Up for Free ⭐⭐⭐

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

1) Download our Mobile App >> link-to.app/dexwirenews

2) Join our Chat Room >> discord.gg/x3EQven3ZY

3) Sign Up for Text Alerts >>

dexwirenews.com/TEXT

4) Follow @DEXWireNews on Social Media

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.