💼 BANK NIFTY TRADING PLAN – 28-Aug-2025

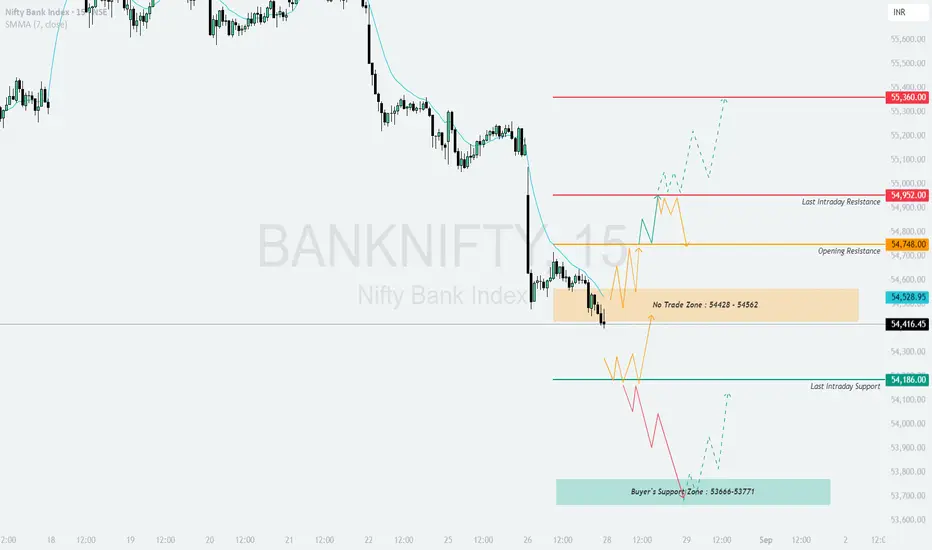

📌 Key Levels to Watch:

Opening Resistance: 54,748

Last Intraday Resistance: 54,952

Major Resistance Above: 55,360

No-Trade Zone: 54,428 – 54,562

Last Intraday Support: 54,186

Buyer’s Support Zone: 53,666 – 53,771

These levels act as decision-making zones for intraday setups.

🔼 1. Gap-Up Opening (200+ points above 54,748)

If Bank Nifty opens above 54,748, early strength will be visible.

📌 Plan of Action:

👉 Educational Note: On strong gap-ups, always avoid chasing; instead, wait for price retests near support to manage risk better.

➖ 2. Flat Opening (Around 54,428 – 54,562 No-Trade Zone)

A flat start near the No-Trade Zone means price is indecisive.

📌 Plan of Action:

👉 Educational Note: Flat openings require patience. Allow 30 minutes for trend clarity before entering trades.

🔽 3. Gap-Down Opening (200+ points below 54,186)

If Bank Nifty opens below 54,186, bearish momentum will dominate.

📌 Plan of Action:

👉 Educational Note: On gap-down days, trend-following trades work better than reversal attempts. Wait for retests before shorting.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

🟢 Above 54,952 → Possible upside to 55,360.

🟧 Flat near 54,428–54,562 → Avoid trades until breakout.

🔴 Below 54,186 → Downside towards 53,666–53,771.

🎯 Key Decision Zone: 54,428 – 54,562 (No-Trade Zone) will guide the trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading or investment decisions.

📌 Key Levels to Watch:

Opening Resistance: 54,748

Last Intraday Resistance: 54,952

Major Resistance Above: 55,360

No-Trade Zone: 54,428 – 54,562

Last Intraday Support: 54,186

Buyer’s Support Zone: 53,666 – 53,771

These levels act as decision-making zones for intraday setups.

🔼 1. Gap-Up Opening (200+ points above 54,748)

If Bank Nifty opens above 54,748, early strength will be visible.

📌 Plan of Action:

- [] Sustaining above 54,952 (Last Intraday Resistance) can push the index towards 55,360, which will act as a major resistance and profit booking zone.

[] Failure to hold above 54,952 may drag prices back to retest 54,748 support, giving rangebound moves. - A breakout above 55,360 should be traded cautiously with partial booking at higher levels.

👉 Educational Note: On strong gap-ups, always avoid chasing; instead, wait for price retests near support to manage risk better.

➖ 2. Flat Opening (Around 54,428 – 54,562 No-Trade Zone)

A flat start near the No-Trade Zone means price is indecisive.

📌 Plan of Action:

- [] If Bank Nifty sustains above 54,748, buyers may take it towards 54,952 → 55,360.

[] If it slips below 54,428, selling pressure may drag it down to 54,186 support. - Avoid aggressive trading inside the no-trade band (54,428 – 54,562), as it can trigger false breakouts.

👉 Educational Note: Flat openings require patience. Allow 30 minutes for trend clarity before entering trades.

🔽 3. Gap-Down Opening (200+ points below 54,186)

If Bank Nifty opens below 54,186, bearish momentum will dominate.

📌 Plan of Action:

- [] Below 54,186, price can slide quickly towards 53,666 – 53,771 Buyer’s Zone.

[] Watch carefully for reversals in the buyer’s zone; if sustained, a recovery bounce can emerge. - If the buyer’s zone breaks with volume, deeper weakness may continue.

👉 Educational Note: On gap-down days, trend-following trades work better than reversal attempts. Wait for retests before shorting.

🛡️ Risk Management Tips for Options Traders

- [] Risk only 1–2% of capital per trade.

[] Use hourly close stop-loss for directional moves.

[] Prefer spreads (Bull Call / Bear Put) on gap days to minimize premium decay.

[] Do not trade aggressively in the No-Trade Zone (54,428 – 54,562). - Monitor Bank Nifty PCR & India VIX to gauge sentiment and volatility.

📌 Summary & Conclusion

🟢 Above 54,952 → Possible upside to 55,360.

🟧 Flat near 54,428–54,562 → Avoid trades until breakout.

🔴 Below 54,186 → Downside towards 53,666–53,771.

🎯 Key Decision Zone: 54,428 – 54,562 (No-Trade Zone) will guide the trend.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is purely for educational purposes and should not be considered financial advice. Please consult a financial advisor before making trading or investment decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.