Detailed Market Structure Breakdown

4-Hour Chart (Macro Trend)

Structure: The Bank Nifty is back in a Strong Bullish Momentum phase, recovering from the sharp sell-off last week (Oct 31, where it closed near the lows). The price has successfully climbed back into the steep ascending channel, confirming a strong retest and bounce from the 57,400 area (implied lower channel boundary).

Key Levels:

Major Supply (Resistance): 58,300 - 58,600. This area encompasses the recent swing high and the All-Time High of 58,577.50. A decisive breakout above 58,600 is critical for further upside.

Major Demand (Support): 57,800 - 58,000. This area, which includes the lower trendline of the current ascending channel and a prior FVG, is the must-hold zone for the short-term uptrend.

Outlook: The short-term bias is Strongly Bullish. The market is poised to challenge the ATH again.

1-Hour Chart (Intermediate View)

Structure: The 1H chart shows a clear Break of Structure (MSS) back to the upside, following the successful re-entry into the ascending channel. The price is trading strongly above the 9-period EMA.

Key Levels:

Immediate Resistance: 58,300 (Upper trendline of the immediate channel).

Immediate Support: 57,900 - 58,000 (Psychological mark and lower channel boundary).

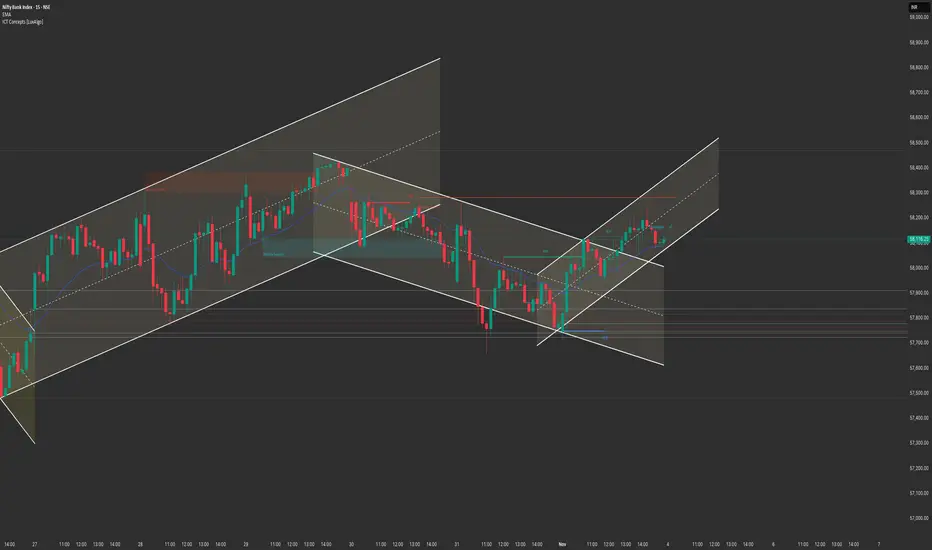

15-Minute Chart (Intraday View)

Structure: The 15M chart confirms the strong reversal. The price is trading at the upper end of the daily range, forming a small bullish continuation pattern right below the 58,300 resistance.

Key Levels:

Intraday Supply: 58,300.

Intraday Demand: 58,000.

Outlook: Aggressively Bullish.

📈 Structure Analysis & Trade Plan: 4th November

Market Outlook: Bank Nifty has shown massive strength, completely negating the sharp selling pressure from last week's end. The focus is on a breakout above the 58,300 resistance for an ATH retest.

Bullish Scenario (Primary Plan: Continuation)

Justification: The successful re-entry into the channel and the V-shaped recovery strongly favor continuation towards the ATH.

Entry: Long entry on a decisive break and 15-minute candle close above 58,300 (breaking the upper channel boundary). Alternatively, look for a dip entry near 58,000 - 58,100 (the immediate support zone).

Stop Loss (SL): Place a stop loss below 57,800 (below the lower channel trendline).

Targets:

T1: 58,577 (All-Time High retest).

T2: 59,000 (Psychological extension target).

Bearish Scenario (Counter-Trend/Reversal)

Justification: High-risk. Only valid if the market fails aggressively at the 58,300 mark.

Trigger: A sustained break and 1-hour close back below 57,800.

Entry: Short entry below 57,800.

Stop Loss (SL): Above 58,100.

Targets:

T1: 57,500 (Previous swing low/consolidation support).

T2: 57,200 (Major FVG support).

Key Levels for Observation:

Immediate Decision Point: 58,000 - 58,300 zone.

Bullish Confirmation: Sustained trade above 58,300.

Bearish Warning: A move below 57,800.

Line in the Sand: 57,800. Below this level, the short-term bullish bias is nullified.

4-Hour Chart (Macro Trend)

Structure: The Bank Nifty is back in a Strong Bullish Momentum phase, recovering from the sharp sell-off last week (Oct 31, where it closed near the lows). The price has successfully climbed back into the steep ascending channel, confirming a strong retest and bounce from the 57,400 area (implied lower channel boundary).

Key Levels:

Major Supply (Resistance): 58,300 - 58,600. This area encompasses the recent swing high and the All-Time High of 58,577.50. A decisive breakout above 58,600 is critical for further upside.

Major Demand (Support): 57,800 - 58,000. This area, which includes the lower trendline of the current ascending channel and a prior FVG, is the must-hold zone for the short-term uptrend.

Outlook: The short-term bias is Strongly Bullish. The market is poised to challenge the ATH again.

1-Hour Chart (Intermediate View)

Structure: The 1H chart shows a clear Break of Structure (MSS) back to the upside, following the successful re-entry into the ascending channel. The price is trading strongly above the 9-period EMA.

Key Levels:

Immediate Resistance: 58,300 (Upper trendline of the immediate channel).

Immediate Support: 57,900 - 58,000 (Psychological mark and lower channel boundary).

15-Minute Chart (Intraday View)

Structure: The 15M chart confirms the strong reversal. The price is trading at the upper end of the daily range, forming a small bullish continuation pattern right below the 58,300 resistance.

Key Levels:

Intraday Supply: 58,300.

Intraday Demand: 58,000.

Outlook: Aggressively Bullish.

📈 Structure Analysis & Trade Plan: 4th November

Market Outlook: Bank Nifty has shown massive strength, completely negating the sharp selling pressure from last week's end. The focus is on a breakout above the 58,300 resistance for an ATH retest.

Bullish Scenario (Primary Plan: Continuation)

Justification: The successful re-entry into the channel and the V-shaped recovery strongly favor continuation towards the ATH.

Entry: Long entry on a decisive break and 15-minute candle close above 58,300 (breaking the upper channel boundary). Alternatively, look for a dip entry near 58,000 - 58,100 (the immediate support zone).

Stop Loss (SL): Place a stop loss below 57,800 (below the lower channel trendline).

Targets:

T1: 58,577 (All-Time High retest).

T2: 59,000 (Psychological extension target).

Bearish Scenario (Counter-Trend/Reversal)

Justification: High-risk. Only valid if the market fails aggressively at the 58,300 mark.

Trigger: A sustained break and 1-hour close back below 57,800.

Entry: Short entry below 57,800.

Stop Loss (SL): Above 58,100.

Targets:

T1: 57,500 (Previous swing low/consolidation support).

T2: 57,200 (Major FVG support).

Key Levels for Observation:

Immediate Decision Point: 58,000 - 58,300 zone.

Bullish Confirmation: Sustained trade above 58,300.

Bearish Warning: A move below 57,800.

Line in the Sand: 57,800. Below this level, the short-term bullish bias is nullified.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.