BANK NIFTY TRADING PLAN – 30-Oct-2025

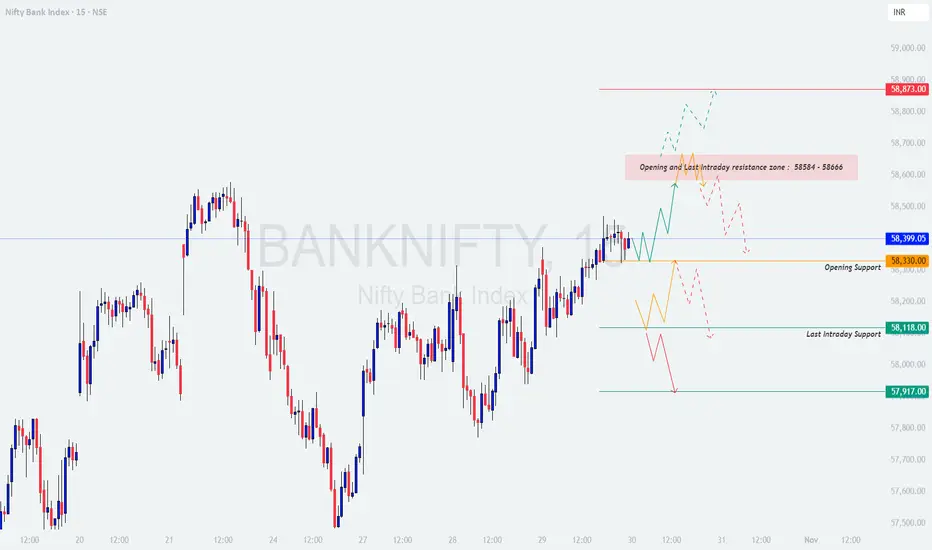

📊 Bank Nifty closed around 58,399, forming a near-term consolidation after a steady up-move. The index currently faces a key Opening & Last Intraday Resistance Zone at 58,584 – 58,666, while 58,330 acts as immediate opening support. The structure suggests a potential trending move once the index breaks out of this narrow consolidation.

🟩 SCENARIO 1: GAP-UP OPENING (200+ Points Above 58,666)

If Bank Nifty opens above 58,666, it will indicate strong bullish sentiment with a possible extension toward the upper resistance levels.

🧠 Educational Insight:

Gap-ups often attract impulsive buying, but smart traders wait for confirmation candles and sustained volume. A minor retracement after a gap-up can offer a low-risk entry with better R:R.

⚙️ Plan of Action:

→ Go long only if price sustains above 58,666 with confirmation.

→ Maintain stop-loss below 58,399 (hourly close basis).

→ Profit targets: 58,873, followed by 58,950.

🟨 SCENARIO 2: FLAT OPENING (Between 58,330 – 58,399)

A flat opening near the current close suggests an indecisive tone. Both bulls and bears will test each other near the resistance and support zones before a directional move develops.

🧠 Educational Insight:

A flat opening inside the previous day's range is often a setup for fake breakouts. Traders should remain neutral until a strong directional move appears beyond the identified levels.

⚙️ Plan of Action:

→ Avoid early entries; let the first 30 minutes define intraday bias.

→ Long bias only above 58,666; short bias below 58,330.

→ Respect intraday structure and avoid counter-trading against the prevailing move.

🟥 SCENARIO 3: GAP-DOWN OPENING (200+ Points Below 58,118)

If Bank Nifty opens below 58,118, the sentiment may turn mildly bearish with scope for deeper retracement toward 57,917 or lower levels.

🧠 Educational Insight:

Gap-downs near support zones often produce false panic. Patience and waiting for a proper reversal structure (like a double bottom or bullish engulfing) can give high-probability trades.

⚙️ Plan of Action:

→ Go short only if Bank Nifty fails to reclaim 58,118 post-gap-down.

→ Maintain stop-loss above 58,330.

→ Targets: 57,917 → 57,750 → 57,600.

→ For bullish reversal trades, wait for confirmation candle above 58,118 before entry.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📘 SUMMARY & CONCLUSION

🔹 Bank Nifty is currently at a critical decision zone, with clear reaction levels identified.

🔹 A breakout above 58,666 will confirm bullish continuation, while a breach below 58,118 can trigger short-term weakness.

🔹 Focus on price action, volume, and breakout confirmations for high-probability setups.

🔹 Remember — the best traders don’t predict, they react intelligently.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Please perform your own research or consult a certified financial advisor before taking any trading decisions.

📊 Bank Nifty closed around 58,399, forming a near-term consolidation after a steady up-move. The index currently faces a key Opening & Last Intraday Resistance Zone at 58,584 – 58,666, while 58,330 acts as immediate opening support. The structure suggests a potential trending move once the index breaks out of this narrow consolidation.

🟩 SCENARIO 1: GAP-UP OPENING (200+ Points Above 58,666)

If Bank Nifty opens above 58,666, it will indicate strong bullish sentiment with a possible extension toward the upper resistance levels.

- [] A gap-up opening above 58,666 may push the index toward 58,873, which is the next projected resistance.

[] Sustaining above 58,666 with volume confirmation will invite momentum buying.

[] However, if the price fails to hold above this zone and forms rejection wicks, expect intraday profit booking or a pullback toward 58,399 – 58,330.

[] Avoid chasing longs immediately at open; instead, let the price settle for the first 15–30 minutes and wait for consolidation or breakout retest.

🧠 Educational Insight:

Gap-ups often attract impulsive buying, but smart traders wait for confirmation candles and sustained volume. A minor retracement after a gap-up can offer a low-risk entry with better R:R.

⚙️ Plan of Action:

→ Go long only if price sustains above 58,666 with confirmation.

→ Maintain stop-loss below 58,399 (hourly close basis).

→ Profit targets: 58,873, followed by 58,950.

🟨 SCENARIO 2: FLAT OPENING (Between 58,330 – 58,399)

A flat opening near the current close suggests an indecisive tone. Both bulls and bears will test each other near the resistance and support zones before a directional move develops.

- [] If the price holds above 58,399, expect a gradual test of 58,584 – 58,666 resistance.

[] Sustained trade above 58,666 may invite intraday longs, targeting 58,873.

[] Conversely, if Bank Nifty slips below 58,330, it may trigger mild selling pressure toward 58,118.

[] Traders should focus on breakout confirmation candles rather than anticipating direction.

🧠 Educational Insight:

A flat opening inside the previous day's range is often a setup for fake breakouts. Traders should remain neutral until a strong directional move appears beyond the identified levels.

⚙️ Plan of Action:

→ Avoid early entries; let the first 30 minutes define intraday bias.

→ Long bias only above 58,666; short bias below 58,330.

→ Respect intraday structure and avoid counter-trading against the prevailing move.

🟥 SCENARIO 3: GAP-DOWN OPENING (200+ Points Below 58,118)

If Bank Nifty opens below 58,118, the sentiment may turn mildly bearish with scope for deeper retracement toward 57,917 or lower levels.

- [] Early buyers may attempt to defend 57,917 – 58,118, leading to a short-covering bounce.

[] A sharp rejection from 57,917 can trigger a technical rebound toward 58,330.

[] However, if the index fails to sustain above 58,118, fresh short positions may build up.

[] Avoid catching falling knives; instead, wait for a reversal pattern or a reclaim of 58,118 before going long.

🧠 Educational Insight:

Gap-downs near support zones often produce false panic. Patience and waiting for a proper reversal structure (like a double bottom or bullish engulfing) can give high-probability trades.

⚙️ Plan of Action:

→ Go short only if Bank Nifty fails to reclaim 58,118 post-gap-down.

→ Maintain stop-loss above 58,330.

→ Targets: 57,917 → 57,750 → 57,600.

→ For bullish reversal trades, wait for confirmation candle above 58,118 before entry.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

- [] Always wait for 15–30 minutes post-opening to avoid volatility traps.

[] Focus on ATM or slightly ITM options for intraday momentum trades.

[] Never risk more than 1–2% of trading capital per trade.

[] Use trailing stop-loss after your trade moves in profit.

[] Avoid over-leveraging—protecting capital ensures longevity in markets.

[] Always mark your key levels on chart before market opens; it builds discipline.

📘 SUMMARY & CONCLUSION

- [] Key Resistance Levels: 58,584 → 58,666 → 58,873

[] Key Support Levels: 58,330 → 58,118 → 57,917 - Trend Bias: Neutral-to-Positive, unless 58,118 breaks decisively

🔹 Bank Nifty is currently at a critical decision zone, with clear reaction levels identified.

🔹 A breakout above 58,666 will confirm bullish continuation, while a breach below 58,118 can trigger short-term weakness.

🔹 Focus on price action, volume, and breakout confirmations for high-probability setups.

🔹 Remember — the best traders don’t predict, they react intelligently.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This analysis is purely for educational and informational purposes. Please perform your own research or consult a certified financial advisor before taking any trading decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.