📊 BANK NIFTY INTRADAY TRADING PLAN – 16-Jul-2025

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

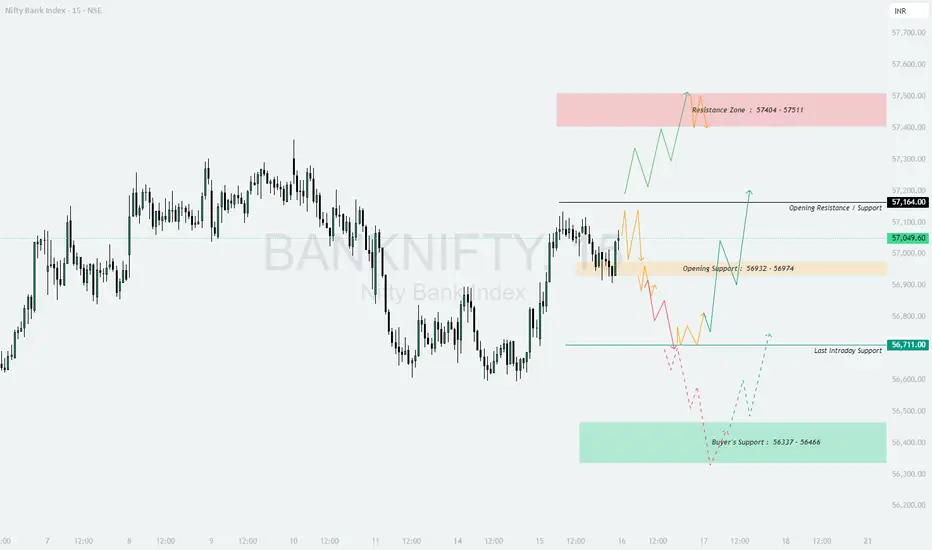

📍 IMPORTANT LEVELS TO WATCH

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

📌 SUMMARY & CONCLUSION

Based on 15-Min Chart Observation | 200+ Point Gap Considered Significant

📍 IMPORTANT LEVELS TO WATCH

- []🟥 Resistance Zone: 57,404 – 57,511

[]⚫️ Opening Resistance / Support: 57,164

[]🟧 Opening Support Zone: 56,932 – 56,974

[]🟩 Last Intraday Support: 56,711 - 🟩 Buyer’s Support Zone: 56,337 – 56,466

🚀 SCENARIO 1: GAP-UP OPENING (Above 57,164) 📈

- []If BANK NIFTY opens above 57,164 with a gap of 200+ points, expect a continuation toward the Resistance Zone 57,404 – 57,511.

[]Aggressive buying should only be considered after a 15-min candle close above 57,164 to confirm strength.

[]If prices enter the Resistance Zone, avoid fresh longs and look for profit booking opportunities.

[]Options Tip: Focus on ATM or ITM Call Options. Avoid far OTM options on gap-up days to minimize theta loss.

📊 SCENARIO 2: FLAT OPENING (Between 56,932 – 57,164) 🔄

- []This range is marked as a mixed zone: Opening Resistance / Support Zone. Price behavior here will set the day’s tone.

[]If BANK NIFTY sustains above 57,164, move towards the bullish setup targeting the upper Resistance Zone.

[]If BANK NIFTY breaks below 56,932, expect a decline toward Last Intraday Support 56,711.

[]Options Tip: Consider Straddle or Strangle setups for premium decay if prices stay sideways between 56,932 – 57,164. Exit quickly if volatility spikes.

📉 SCENARIO 3: GAP-DOWN OPENING (Below 56,711) ⚠️

- []A gap-down below 56,711 signals bearish momentum. Initial downside target would be the Buyer’s Support Zone: 56,337 – 56,466.

[]Wait for the first 15-minute candle close below 56,711 before shorting to confirm strength.

[]If prices bounce from Buyer’s Support Zone, observe for reversal signals and manage trailing stop-loss.

[]Options Tip: Favor ATM or ITM Put Options. On gap-downs, avoid naked far OTM positions—use Bear Put Spreads for balanced risk-reward.

💡 RISK MANAGEMENT TIPS FOR OPTIONS TRADERS

- []📏 Risk only 1–2% of your trading capital per trade.

[]⏳ Avoid impulsive entries in the first 15–30 minutes of market opening.

[]⚖️ Always mark your Stop-Loss based on candle close, not just price spikes.

[]📈 Choose ATM or ITM options—they offer better Delta and lesser time decay. - 💼 Reduce position size when markets open with large gaps to avoid slippage risks.

📌 SUMMARY & CONCLUSION

- []Bullish Scenario: Above 57,164 → Target 57,404 – 57,511

[]Range-Bound Scenario: Between 56,932 – 57,164 → Watch closely for breakouts

[]Bearish Scenario: Below 56,711 → Target 56,337 – 56,466

[]Stay disciplined and patient. Let the market come to your planned levels instead of chasing moves.

⚠️ DISCLAIMER: I am not a SEBI-registered analyst. This analysis is for educational purposes only. Please do your own research or consult a certified financial advisor before making trading decisions.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.