BANK NIFTY TRADING PLAN – 07-Oct-2025

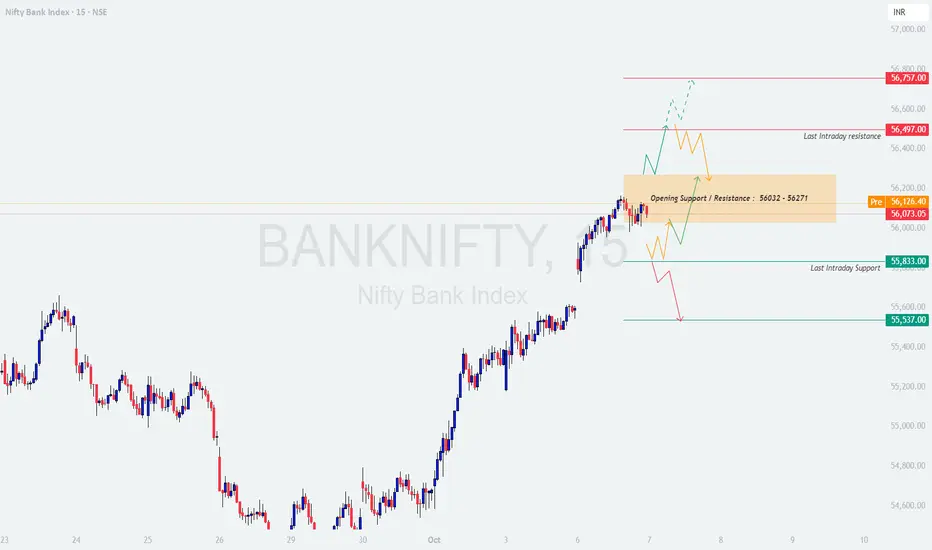

Bank Nifty closed at 56,073, showing slight consolidation after a strong rally in recent sessions. The index is currently hovering around a short-term decision zone, suggesting that the next directional move could emerge from the Opening Support/Resistance band (56,032 – 56,271). Tomorrow’s behavior around this area will be critical to define intraday bias.

📊 Key Technical Levels:

Opening Support / Resistance: 56,032 – 56,271

Last Intraday Resistance: 56,497

Major Resistance: 56,757

Last Intraday Support: 55,833

Major Support: 55,537

🚀 Scenario 1: Gap Up Opening (200+ points)

📘 Educational Note: Gap-ups near resistance often trigger early euphoria but also risk reversal traps. Always confirm a breakout with strong volume and closing strength.

⚖️ Scenario 2: Flat Opening (within ±200 points)

📘 Educational Note: Flat openings reflect indecision. Allow the market to establish direction through initial range expansion before positioning aggressively.

📉 Scenario 3: Gap Down Opening (200+ points)

📘 Educational Note: Gap-downs often create emotional selling. Instead of panic trades, look for reversal confirmations at major supports for high R:R setups.

🛡️ Risk Management Tips for Options Traders

📌 Summary & Conclusion

📈 The index remains in a short-term uptrend but faces immediate resistance at 56,497. A breakout could extend momentum, while a failure near resistance may trigger mild correction. Patience and disciplined entries near levels will be key to capturing tomorrow’s move effectively.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please perform your own research or consult a financial advisor before taking any trading decisions.

Bank Nifty closed at 56,073, showing slight consolidation after a strong rally in recent sessions. The index is currently hovering around a short-term decision zone, suggesting that the next directional move could emerge from the Opening Support/Resistance band (56,032 – 56,271). Tomorrow’s behavior around this area will be critical to define intraday bias.

📊 Key Technical Levels:

Opening Support / Resistance: 56,032 – 56,271

Last Intraday Resistance: 56,497

Major Resistance: 56,757

Last Intraday Support: 55,833

Major Support: 55,537

🚀 Scenario 1: Gap Up Opening (200+ points)

- [] If Bank Nifty opens above 56,271, it will likely attempt to test the Last Intraday Resistance at 56,497.

[] Sustained trading above 56,497 may extend the bullish trend toward 56,757, marking a potential breakout zone for momentum traders.

[] However, if the index fails to hold above 56,271 and shows rejection candles near resistance, early profit booking can push prices back toward the 56,032 zone.

[] Traders should wait for a 15-min confirmation candle above 56,497 before entering long positions. Avoid chasing a gap-up blindly.

📘 Educational Note: Gap-ups near resistance often trigger early euphoria but also risk reversal traps. Always confirm a breakout with strong volume and closing strength.

⚖️ Scenario 2: Flat Opening (within ±200 points)

- [] A flat opening near 56,000 will keep the price action within the Opening Support/Resistance zone (56,032 – 56,271).

[] If the price sustains above 56,271, bulls could regain control and target 56,497.

[] On the contrary, a breakdown below 56,032 may invite selling pressure, dragging the index towards 55,833 initially.

[] The best strategy here is to let the first 30 minutes define direction — trade only on clear breakouts from this box range.

📘 Educational Note: Flat openings reflect indecision. Allow the market to establish direction through initial range expansion before positioning aggressively.

📉 Scenario 3: Gap Down Opening (200+ points)

- [] If Bank Nifty opens near 55,800 or below, it will test the Last Intraday Support at 55,833.

[] A decisive breakdown below 55,833 can extend weakness toward 55,537, which is a key bounce zone.

[] Conversely, if 55,833 holds firmly and bullish reversal candles form, expect a short-covering move toward 56,000+.

[] Avoid aggressive shorts near 55,537; this level can attract strong dip-buying interest.

📘 Educational Note: Gap-downs often create emotional selling. Instead of panic trades, look for reversal confirmations at major supports for high R:R setups.

🛡️ Risk Management Tips for Options Traders

- [] 🕒 Avoid trading in the first 15–30 minutes — allow volatility to settle.

[] 🛑 Always use hourly candle closes for SL validation instead of reacting to noise.

[] 💡 Prefer Bull Call / Bear Put Spreads near key levels to manage premium decay.

[] 💰 Follow a strict 1:2 Risk-Reward Ratio — never enter trades without clear R:R visibility.

[] 📉 Trail profits after every 100–150 points to protect gains in trending markets.

[] 🚫 Never risk more than 2%–3% of total capital on a single trade.

📌 Summary & Conclusion

- [] Bullish Bias: Above 56,497, upside targets 56,757 → 56,900.

[] Neutral Zone: Between 56,032 – 56,271, expect sideways volatility until breakout. - Bearish Bias: Below 55,833, weakness may extend towards 55,537.

📈 The index remains in a short-term uptrend but faces immediate resistance at 56,497. A breakout could extend momentum, while a failure near resistance may trigger mild correction. Patience and disciplined entries near levels will be key to capturing tomorrow’s move effectively.

⚠️ Disclaimer: This analysis is for educational purposes only. I am not a SEBI-registered analyst. Please perform your own research or consult a financial advisor before taking any trading decisions.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.