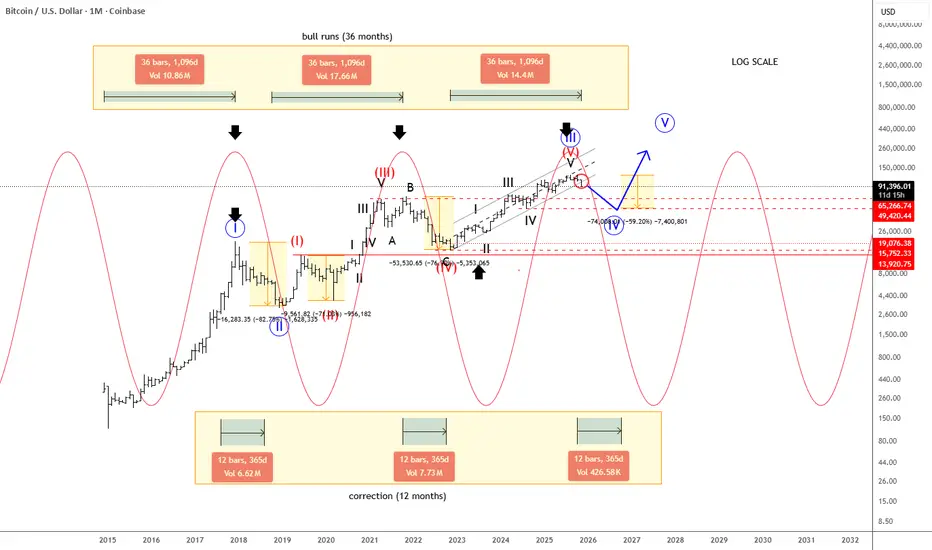

Bitcoin is breaking back below the $100k level and the channel support drawn from the 2022 lows. This price action suggests that we may be completing the bull cycle that began from those lows—one that lasted roughly three years, similar to previous bullish phases from January 2015 to December 2017 and December 2018 to November 2021.

Given this context, there is now a meaningful risk of a deeper correction. Historically, each new cycle tends to produce shallower percentage pullbacks, but the correction phase is still an important part of the broader market structure. For those looking to position themselves for the next major bull run, it would be safer to wait for the market to undergo a sustained corrective period, potentially lasting around a year, before re-entering with the broader trend.

From an Elliott Wave perspective, Bitcoin may have completed a five-wave impulse within a higher-degree wave (V) of III, aligning with the idea that a higher-degree wave IV correction could now be unfolding. Additionally, from a cyclical standpoint, the market appears to have topped in October 2025, which further supports the probability of entering a bear-market phase.

In summary, Bitcoin may now be transitioning from a multi-year advance into a structurally significant corrective period—one that could provide a healthier foundation for the next major expansionary cycle.

Given this context, there is now a meaningful risk of a deeper correction. Historically, each new cycle tends to produce shallower percentage pullbacks, but the correction phase is still an important part of the broader market structure. For those looking to position themselves for the next major bull run, it would be safer to wait for the market to undergo a sustained corrective period, potentially lasting around a year, before re-entering with the broader trend.

From an Elliott Wave perspective, Bitcoin may have completed a five-wave impulse within a higher-degree wave (V) of III, aligning with the idea that a higher-degree wave IV correction could now be unfolding. Additionally, from a cyclical standpoint, the market appears to have topped in October 2025, which further supports the probability of entering a bear-market phase.

In summary, Bitcoin may now be transitioning from a multi-year advance into a structurally significant corrective period—one that could provide a healthier foundation for the next major expansionary cycle.

US Single STOCKS (FREE Access), FX, Crypto

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

US Single STOCKS (FREE Access), FX, Crypto

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

7 DAY TRIAL: testwt7

👉Explore Our Services with @ wavetraders.com/elliott-wave-plans/

Learn Elliott Waves

👉 wavetraders.com/academy/

Newsletter Sign up

👉 bit.ly/3FVPVzO

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.