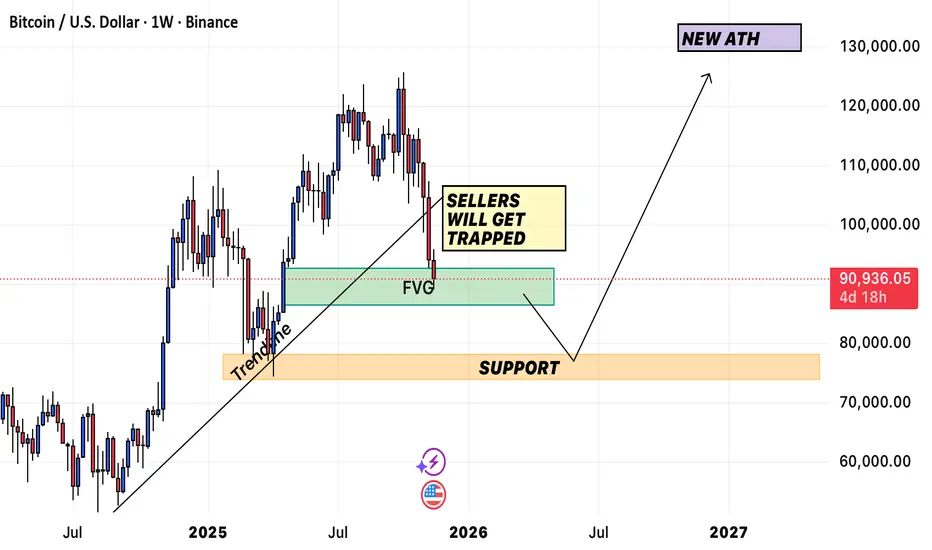

Bitcoin is currently correcting into a higher-timeframe weekly imbalance (FVG) after breaking down from a short-term distribution range. Price has tapped into the upper portion of the green FVG zone, where liquidity is likely being engineered to trap late sellers. The wick reaction suggests that the market may be accumulating long positions while incentivizing shorts to enter below the recent swing.

Below the FVG sits a major HTF demand / support zone, aligned with a prior consolidation and a retested trendline area. This orange zone represents the highest-probability area for a strong bullish response, as it holds unmitigated demand and external liquidity from previous lows.

If price sweeps liquidity beneath the FVG and taps deeper into the HTF support, it would complete a classic SMC sequence:

1. Liquidity grab below FVG

2. Mitigation of untested HTF demand

3. Reaccumulation phase

4. Bullish displacement

A bullish market structure shift from this zone would confirm the continuation of the macro uptrend.

Once demand is confirmed, price would likely target:

• Inefficiencies left above

• Old highs serving as liquidity pools

• A potential rally toward a new all-time high (ATH) as drawn on your projection.

The overall structure remains bullish as long as the HTF support zone holds. This current corrective move appears to be a retracement designed to rebalance price and accumulate liquidity before the next expansion leg upward.

Below the FVG sits a major HTF demand / support zone, aligned with a prior consolidation and a retested trendline area. This orange zone represents the highest-probability area for a strong bullish response, as it holds unmitigated demand and external liquidity from previous lows.

If price sweeps liquidity beneath the FVG and taps deeper into the HTF support, it would complete a classic SMC sequence:

1. Liquidity grab below FVG

2. Mitigation of untested HTF demand

3. Reaccumulation phase

4. Bullish displacement

A bullish market structure shift from this zone would confirm the continuation of the macro uptrend.

Once demand is confirmed, price would likely target:

• Inefficiencies left above

• Old highs serving as liquidity pools

• A potential rally toward a new all-time high (ATH) as drawn on your projection.

The overall structure remains bullish as long as the HTF support zone holds. This current corrective move appears to be a retracement designed to rebalance price and accumulate liquidity before the next expansion leg upward.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.