Today, we have one of the most important macro events — the FOMC Meeting Minutes

Let’s quickly understand what it is and why it could shake the crypto market

What are FOMC Minutes?

They’re the detailed notes from the last Federal Reserve meeting, showing what members discussed about interest rates, inflation, and the economy.

Markets carefully read every line to find hints about future rate cuts or continued tightening.

Why does it matter for Bitcoin?

When the Fed turns dovish (hinting at lower rates), risk assets like Bitcoin usually rally But when the tone is hawkish (worried about inflation), investors move to cash or bonds, causing crypto to dip.

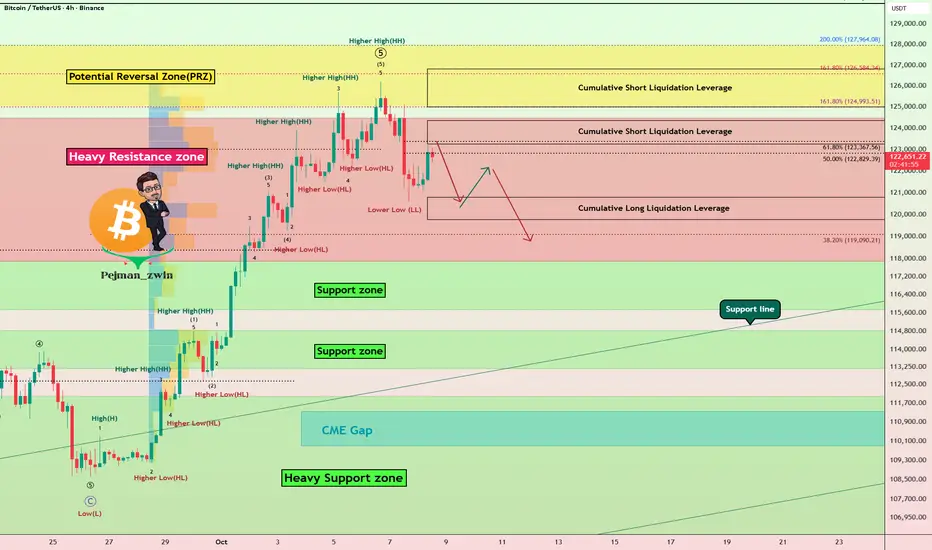

Let’s take a look at Bitcoin(

BTCUSDT) on the 4-hour timeframe.

BTCUSDT) on the 4-hour timeframe.

Before analyzing the chart, let’s quickly review what defines a strong uptrend:

1-Higher Lows(HL):

Each new low should form above the previous one, showing that buyers are stepping in earlier each time.

2-Higher Highs(HH):

Each new high should be higher than the last, confirming that bullish momentum is still in control.

3-Structure Respect:

The new low should not break below the previous high — if it does, it doesn’t necessarily mean the trend is over, but it indicates a weakening of the bullish structure.

Based on the points above, Bitcoin failed to form a new Higher Low(HL) during the past 24 hours, and the previous high was retested.

These signals indicate a loss of bullish momentum, suggesting that we might see at least a short-term correction from a technical perspective.

Bitcoin has already started to bounce back nicely from the Potential Reversal Zone (PRZ)[$128,000-$125,000] and is currently trading in a Heavy Resistance zone($124,474-$117,900).

In terms of Elliott Wave theory, it seems that with the formation of a Lower Low(LL), Bitcoin has completed at least a series of impulsive waves, and we can now expect corrective waves.

I expect Bitcoin to drop to at least Cumulative Long Liquidation Leverage($120,779-$119,957) before the FOMC Meeting Minutes start and could continue to rise or correct depending on the tone of the FOMC Meeting Minutes.

Note: You should note that these days, Bitcoin has a higher correlation with the SPX500( SPX) index than before, so if there is a sudden movement in Bitcoin, one of the reasons could be a sudden movement in the SPX500.

SPX) index than before, so if there is a sudden movement in Bitcoin, one of the reasons could be a sudden movement in the SPX500.

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin again!?

Cumulative Short Liquidation Leverage: $124,350-$123,244

Cumulative Short Liquidation Leverage: $126,813-$125,000

CME Gap: $111,355-$109,915

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Let’s quickly understand what it is and why it could shake the crypto market

What are FOMC Minutes?

They’re the detailed notes from the last Federal Reserve meeting, showing what members discussed about interest rates, inflation, and the economy.

Markets carefully read every line to find hints about future rate cuts or continued tightening.

Why does it matter for Bitcoin?

When the Fed turns dovish (hinting at lower rates), risk assets like Bitcoin usually rally But when the tone is hawkish (worried about inflation), investors move to cash or bonds, causing crypto to dip.

Let’s take a look at Bitcoin(

Before analyzing the chart, let’s quickly review what defines a strong uptrend:

1-Higher Lows(HL):

Each new low should form above the previous one, showing that buyers are stepping in earlier each time.

2-Higher Highs(HH):

Each new high should be higher than the last, confirming that bullish momentum is still in control.

3-Structure Respect:

The new low should not break below the previous high — if it does, it doesn’t necessarily mean the trend is over, but it indicates a weakening of the bullish structure.

Based on the points above, Bitcoin failed to form a new Higher Low(HL) during the past 24 hours, and the previous high was retested.

These signals indicate a loss of bullish momentum, suggesting that we might see at least a short-term correction from a technical perspective.

Bitcoin has already started to bounce back nicely from the Potential Reversal Zone (PRZ)[$128,000-$125,000] and is currently trading in a Heavy Resistance zone($124,474-$117,900).

In terms of Elliott Wave theory, it seems that with the formation of a Lower Low(LL), Bitcoin has completed at least a series of impulsive waves, and we can now expect corrective waves.

I expect Bitcoin to drop to at least Cumulative Long Liquidation Leverage($120,779-$119,957) before the FOMC Meeting Minutes start and could continue to rise or correct depending on the tone of the FOMC Meeting Minutes.

Note: You should note that these days, Bitcoin has a higher correlation with the SPX500(

Do you think this bullish move could lead to a new all-time high (ATH) for Bitcoin again!?

Cumulative Short Liquidation Leverage: $124,350-$123,244

Cumulative Short Liquidation Leverage: $126,813-$125,000

CME Gap: $111,355-$109,915

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analysis (BTCUSDT), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

Trade attivo

Trade was activated in Cumulative Short Liquidation Leverage: $124,350-$123,244Nota

So, I've been mentioning on recently in my posts that Bitcoin's latest rally, from around $109,000 up to about $126,000, didn't really come with a huge volume push. If you've paid attention to most of my recent posts, you'll see I've highlighted this point a few times.

And this kind of played out exactly as expected: once the news hit about tariffs from Trump on China, it basically triggered a bigger drop. In fact, last night we apparently saw one of the largest liquidation volumes in the history of the crypto market.

Also, just note that over the weekend—especially on Saturdays and Sundays—trading volumes typically drop a lot. So the likelihood that Bitcoin revisits that shadow area—like the one we saw around $102,000 in the spot market and even near $101,000 in the futures market—is quite low just because of that low weekend volume.

So if you're planning to trade, either stick to lower timeframes or just wait until the market gets back to its normal rhythm.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

🎁Get a 20% Discount on your trading FEE on BYBIT:👉partner.bybit.com/b/PEJMANZWIN

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

🎁Get a 20% Bonus & 30% Discount on LBANK exchange(NO KYC)👉lbank.one/join/uBythQd

Pubblicazioni correlate

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.