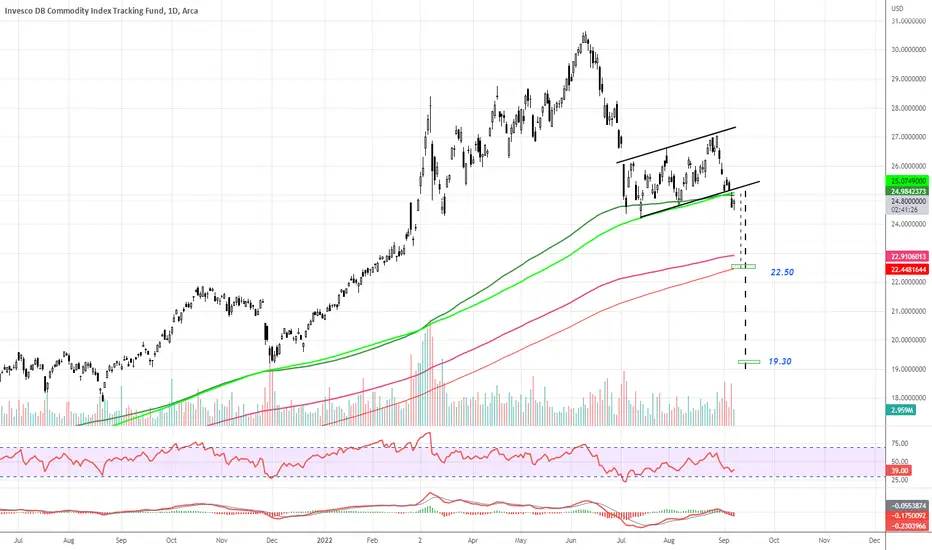

DBC - Invesco Deutsche Bank Commodity Index has closed and broken below both the rising channel and the 200 day moving average. Technically this is quite damaging and it will be interesting to see if we get follow through to the downside.

Crude oil and gasoline are major weights in this basket accounting for half of the weighting followed by gold at just over 6% and agriculture also having a decent weighting.

invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=DBC

Should the technical targets play out we could see approx $22.50 and $19.30. Two daily closes back above the 200dma and i'll most likely concede that this view is incorrect.

Crude oil and gasoline are major weights in this basket accounting for half of the weighting followed by gold at just over 6% and agriculture also having a decent weighting.

invesco.com/us/financial-products/etfs/product-detail?audienceType=Investor&ticker=DBC

Should the technical targets play out we could see approx $22.50 and $19.30. Two daily closes back above the 200dma and i'll most likely concede that this view is incorrect.

"If you do what you love, you'll never work a day in your life" - Marc Anthony

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

"If you do what you love, you'll never work a day in your life" - Marc Anthony

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.