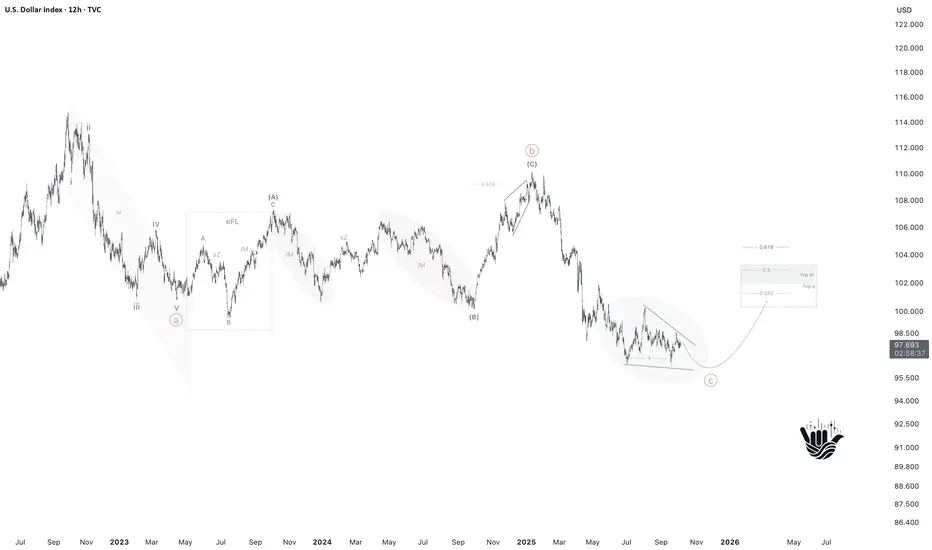

Previous roadmap played out well — time to refresh the view.

Global (1W)

DXY remains in an uptrend. Since 2008 we’ve built a textbook five-wave impulse.

DXY remains in an uptrend. Since 2008 we’ve built a textbook five-wave impulse.

Since 2022/2023 that impulse has been in correction — base read: a single zigzag (SimpleZ).

Base case: correction completes → trend resumes with new highs ahead.

Alternatives

Flat: push toward 114–115, then a deep pullback.

Double zigzag (W–X–Y): bounce first, then one more leg down.

Local (12H)

Finishing ABC where C likely prints an ending diagonal → expecting the down leg to terminate and a rising phase to begin (either corrective or impulsive).

Price Action

Imbalances below may still get tapped; we’re below a key level, but the core scenario is dollar strength ahead.

What’s your take? Which path do you favor — Base (new highs), Flat (114–115 then pullback), or W–X–Y (one more leg lower)?

Global (1W)

Since 2022/2023 that impulse has been in correction — base read: a single zigzag (SimpleZ).

Base case: correction completes → trend resumes with new highs ahead.

Alternatives

Flat: push toward 114–115, then a deep pullback.

Double zigzag (W–X–Y): bounce first, then one more leg down.

Local (12H)

Finishing ABC where C likely prints an ending diagonal → expecting the down leg to terminate and a rising phase to begin (either corrective or impulsive).

Price Action

Imbalances below may still get tapped; we’re below a key level, but the core scenario is dollar strength ahead.

What’s your take? Which path do you favor — Base (new highs), Flat (114–115 then pullback), or W–X–Y (one more leg lower)?

Trade attivo

DXY — Update

What changed

The bounds of the potential ending diagonal have expanded. Wave 4 extended to 0.786 of Wave 2 — still consistent with the character of the pattern.

Base case unchanged. I still expect one more iteration of USD weakness before a reversal. This could be a shallow retest of this year’s lows or a deeper break of them. The current market structure is bearish (lower highs/lows). Until that changes, it’s premature to talk about a trend reversal.

Key levels

Continuation zone for shorts: 98.7–99 — daily imbalance/FVG acting as resistance. A rejection here will reinforce the bearish scenario.

Full invalidation: 100. A sustained break above opens the door to a recount and alternatives.

PS As long as price is below 98.9, the priority remains trend shorts, aiming for a final leg lower.

📢 Free channels:

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

📢 Free channels:

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

🇺🇸 t.me/shakatrade1_618

🇷🇺 t.me/shakatrade_ru

🇷🇺 youtube.com/@shakatrade0618?si=k91J3cRnC0L90ejR

🔒 Pro Club:

🇺🇸 shakatrade.tilda.ws/

🇷🇺 shakatrade0618proclub.tilda.ws

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.