Quick Update

The upcoming week is poised to be critical for financial markets as President Donald Trump's so-called "Liberation Day" on April 2 approaches. On this date, the administration plans to implement new tariffs aimed at reducing the U.S. trade deficit by imposing reciprocal duties on imports from various countries.

As April 2 looms, the full impact of these tariffs remains uncertain, leaving markets and investors in a state of heightened anticipation.

- We may get clarity on the tariff situation on April 2, 2025.

- Universal tariff announcement of categories of imports may clarify US administration’s maximum tariff escalation approach.

- A phased out and unclear tariff approach may keep markets in limbo.

Economic Calendar

Keep an eye on the data docket, NFP and other key releases are due this week.

- Tuesday, Apri 1, 2025: ISM Manufacturing PMI, JOLTS Job Openings

- Wednesday April 2, 2025: ADP Employment Change, Factory Orders MoM

- Thursday April 3, 2025: Balance of Trade, Imports, Exports, ISM Services PMI, Initial Jobless Claims

- Friday, April 4, 2025: Non-Farm Payrolls, Unemployment rate, Average Hourly Earnings MoM,Average Hourly Earnings YoY, Fed Chair Powell Speech

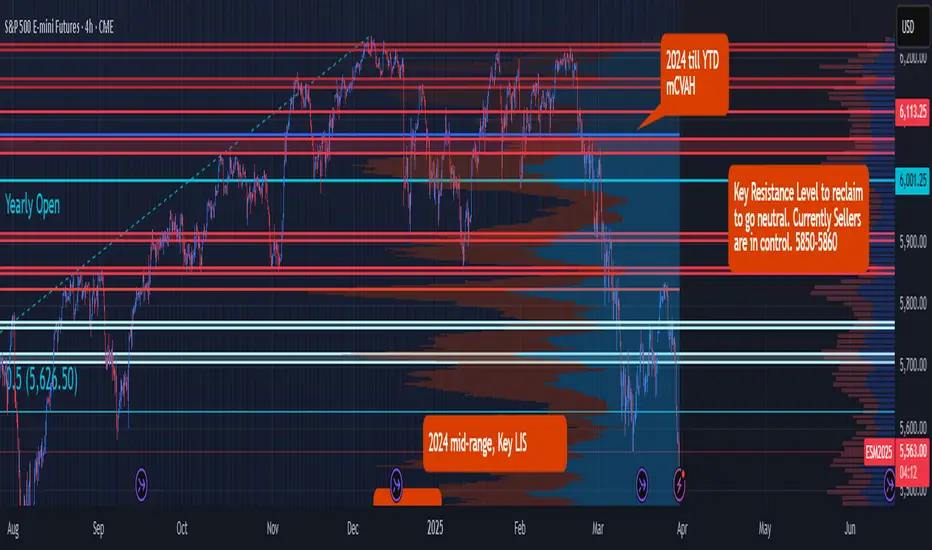

Key Levels to Watch:

- Yearly Open 2025: 6001.25

- Key Resistance: 5850- 5860

- LVN: 5770 -5760

- Neutral Zone: 5705-5720

- Key LIS Mid Range 2024: 5626.50

- 2024-YTD mCVAL: 5381

- 2022 CVAH: 5349.75

- August 5th, 2024 Low: 5306.75

- Scenario 1: Bold but Strategic Tariffs (Effective Use of Tariff to reduce trade deficit and raise revenue): In this scenario, we may see relief rally in ES futures, price reclaiming 2024 mid-range with a move higher towards key resistance level.

- Scenario 2: Maximum pressure, maximum tariff (All out trade war): In this scenario, we anticipate a sell-off with major support levels, such as 2024- YTD mCVAL, 2022 CVAH and August 5th, 2024 low as immediate downside targets.

- Scenario 3: Further delays in Tariff policy (A negotiating tool, with looming uncertainty): In this scenario, sellers remain in control and uncertainty persists, while we anticipate that rallies may be sold, market price action may remain choppy and range bound.

EdgeClear

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

EdgeClear

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

P: 773.832.8320

Derivatives trading involves a substantial risk of loss. Past performance is not indicative of future results. Any example trades are not inclusive of fees and commissions.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.