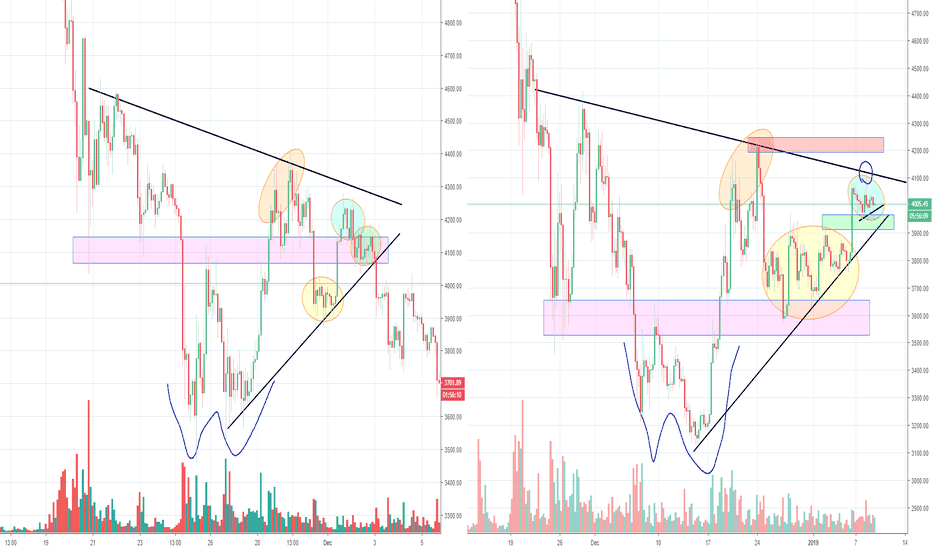

I posted something about this a few weeks ago. I said i would do some more research about this, but unfortunately i did not have the time to do so. I have been keeping an eye on it though. You can not see it clearly on the chart on the left, but the price difference between the Bitmex price and mark price, has been decreasing the past weeks, slightly more each day. If you remember from a few weeks ago, where i talked about ETH' being the new toy of the whales, well so far it seems like that has not changed yet. Because the price difference has been decreasing, i think these people have been closing their big short position step by step the past 2 weeks. It could be that it is coming to an end now even. The yellow circle is where it all started. This can also explain why the price did not make a big drop the past weeks as well. Because probably each time when the price was breaking the neckline and made a big drop and jump up, it was probably these people closing their shorts during those high volume moments. Picking the perfect time to do so. Why? Because they work with very high volumes and they need to make a project out of to close these big positions. If they simply close it, they will move the market. That's why they need to make sure the market moves towards their prices. They usually try to do this with short or long squeezes, preferably even with liquidations

If you look at the chart below, you can see the difference better:

This is what wrote about it a few weeks ago......

I had the feeling ETH has become the new toy of some whales and i think this might be a confirmation of that. Here we can see how ETH/BTC got shorted on Bitmex, since 03-Jan-2019, where we can see the mark price being much lower than the Bitmex price. In other words, it was getting shorted a lot. Together with the games that were being played (the educational post i did a week ago), it all falls into place now. With that short squeeze BTC did after that long period of sideways action around 3800.

Reason why i say this, is because the volume of ETH on Mex, has increased a lot the past months. It's maybe around 20% of what BTC is on Mex. So we are talking about 100/250 USD mil a day. I just noticed the difference between the mark price and btc price. To bad i did not look any sooner. I will try to research this a bit coming day or 2 and make a post about this. Think of it as the Okex trick some people did at 8.5K high of btc or what we saw at the 7.4K high, where it was quite obvious that Bitmex ruled back then.

So we can probably assume, that as long as the mark price does not get close to the Bitmex price again, of the ETH/BTC pair, these people are probably still short. I assume this, because these people probably have very big positions. So either they already closed it with the last drop (through liquidations) or they are still planning to make another big drop.

I am stil not sure about all this, have to look in to it a bit more, but from the first look, it does not look like it's a coincidence.

..........................................................

This was the BTC' analysis where i posted it for the first time.

If i can find the time, i will try to make a more detailed analysis about this, so we can prepare ourselves the next time they try this. As i mentioned back then, until this difference remains, we will probably not go up. But it's difficult to say if they closed it already or still have some to go. Why this difference appears, well that is simple. Because of the big position, you can see it like this. They have brought imbalance into the market, like their supply is/was way above average. So when they start to close their position, the demand will be higher than normal as well, making the difference between the future price and the mark price smaller.

If i see enough likes, i know there is enough interest to see a follow up on this.

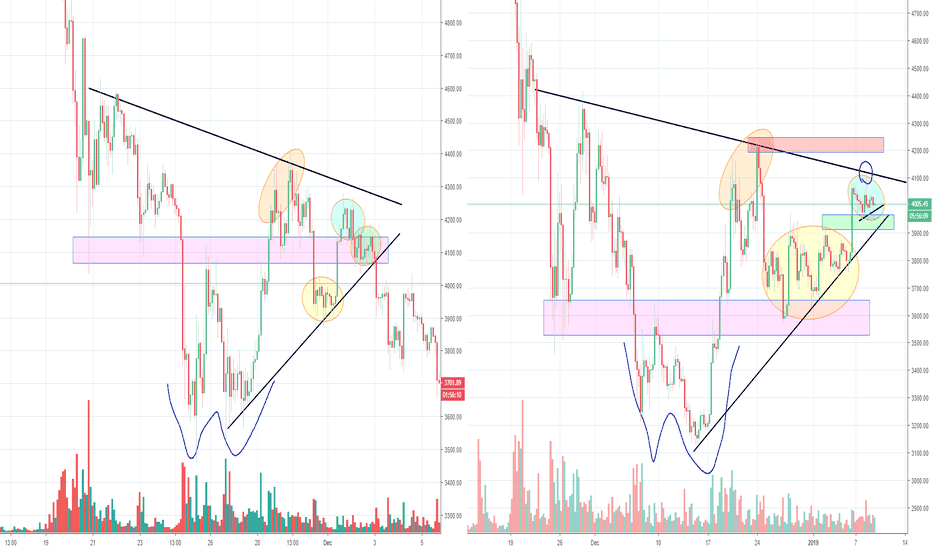

If you look at the chart below, you can see the difference better:

This is what wrote about it a few weeks ago......

I had the feeling ETH has become the new toy of some whales and i think this might be a confirmation of that. Here we can see how ETH/BTC got shorted on Bitmex, since 03-Jan-2019, where we can see the mark price being much lower than the Bitmex price. In other words, it was getting shorted a lot. Together with the games that were being played (the educational post i did a week ago), it all falls into place now. With that short squeeze BTC did after that long period of sideways action around 3800.

Reason why i say this, is because the volume of ETH on Mex, has increased a lot the past months. It's maybe around 20% of what BTC is on Mex. So we are talking about 100/250 USD mil a day. I just noticed the difference between the mark price and btc price. To bad i did not look any sooner. I will try to research this a bit coming day or 2 and make a post about this. Think of it as the Okex trick some people did at 8.5K high of btc or what we saw at the 7.4K high, where it was quite obvious that Bitmex ruled back then.

So we can probably assume, that as long as the mark price does not get close to the Bitmex price again, of the ETH/BTC pair, these people are probably still short. I assume this, because these people probably have very big positions. So either they already closed it with the last drop (through liquidations) or they are still planning to make another big drop.

I am stil not sure about all this, have to look in to it a bit more, but from the first look, it does not look like it's a coincidence.

..........................................................

This was the BTC' analysis where i posted it for the first time.

If i can find the time, i will try to make a more detailed analysis about this, so we can prepare ourselves the next time they try this. As i mentioned back then, until this difference remains, we will probably not go up. But it's difficult to say if they closed it already or still have some to go. Why this difference appears, well that is simple. Because of the big position, you can see it like this. They have brought imbalance into the market, like their supply is/was way above average. So when they start to close their position, the demand will be higher than normal as well, making the difference between the future price and the mark price smaller.

If i see enough likes, i know there is enough interest to see a follow up on this.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.