GOLD PRICE ACTION ANALYSIS – June 11, 2025 🟡

Technical Breakdown & Bearish Scenario Ahead ⚠️📉

🔍 Overview:

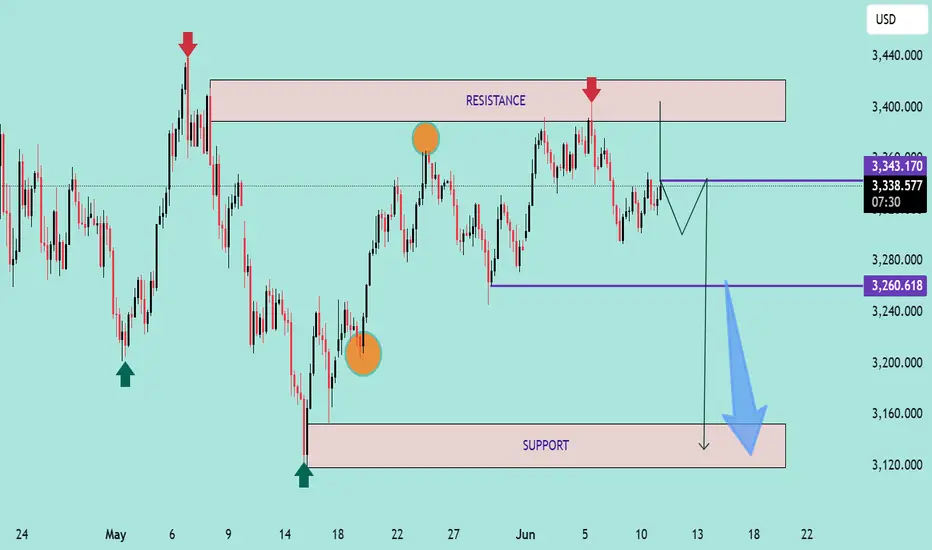

The chart presents a clear range-bound structure with strong horizontal resistance around the $3,400–$3,420 zone and support around the $3,120–$3,160 level. Price is currently trading near the upper range of the consolidation.

📊 Key Technical Levels:

🔴 Resistance Zone: $3,400 – $3,420

➤ Price has been rejected here multiple times (highlighted by red arrows and orange circles), showing strong supply pressure.

🟣 Intermediate Support: $3,260.618

➤ This level acted as a minor support and could be tested again if the current pullback deepens.

🟤 Major Support Zone: $3,120 – $3,160

➤ A key demand area where price previously bounced significantly.

📉 Bearish Setup:

A potential lower high is forming just below the resistance zone.

The projected path suggests a minor pullback to form a bearish retest, followed by a potential breakdown below $3,260.

If the $3,260 support is broken decisively, further downside toward the $3,120–$3,160 support is likely (blue arrow projection).

🔄 Bullish Scenario (Invalidation):

A breakout and strong close above $3,420 could invalidate the bearish structure.

In that case, price might attempt to target higher resistance levels beyond $3,440.

📌 Conclusion:

Gold remains in a range with a bearish bias unless the $3,420 resistance is breached.

🔽 Watch for confirmation below $3,260 for bearish continuation.

✅ For bulls, wait for a strong breakout above resistance with volume.

Technical Breakdown & Bearish Scenario Ahead ⚠️📉

🔍 Overview:

The chart presents a clear range-bound structure with strong horizontal resistance around the $3,400–$3,420 zone and support around the $3,120–$3,160 level. Price is currently trading near the upper range of the consolidation.

📊 Key Technical Levels:

🔴 Resistance Zone: $3,400 – $3,420

➤ Price has been rejected here multiple times (highlighted by red arrows and orange circles), showing strong supply pressure.

🟣 Intermediate Support: $3,260.618

➤ This level acted as a minor support and could be tested again if the current pullback deepens.

🟤 Major Support Zone: $3,120 – $3,160

➤ A key demand area where price previously bounced significantly.

📉 Bearish Setup:

A potential lower high is forming just below the resistance zone.

The projected path suggests a minor pullback to form a bearish retest, followed by a potential breakdown below $3,260.

If the $3,260 support is broken decisively, further downside toward the $3,120–$3,160 support is likely (blue arrow projection).

🔄 Bullish Scenario (Invalidation):

A breakout and strong close above $3,420 could invalidate the bearish structure.

In that case, price might attempt to target higher resistance levels beyond $3,440.

📌 Conclusion:

Gold remains in a range with a bearish bias unless the $3,420 resistance is breached.

🔽 Watch for confirmation below $3,260 for bearish continuation.

✅ For bulls, wait for a strong breakout above resistance with volume.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

JOIN MY TELEGRAM CHANNEL

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

t.me/StellarMarketAnalysis

JOIN MY RECOMMENTED BROKER REFFREL LINK

⤵️one.exnesstrack.net/a/uvd1etcgg1

PARTNER CODE⤵️

uvd1etcgg1

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.