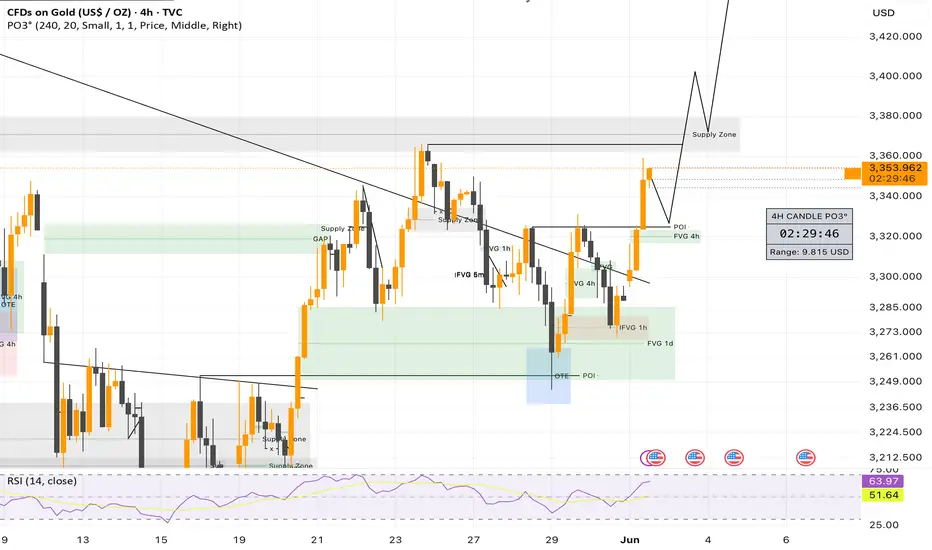

🏪 1. Market Structure

Gold has reignited its bullish momentum this week.

- Clean breakout of the bearish trendline that had been capping prices for several sessions.

- Rally followed a retest of a 1H IFVG and the OTE zone (retested last week) + POI.

📍 2. Key Technical Zone

- Price is now approaching a crucial Supply Zone around $3,360–$3,380, which represents the next resistance barrier.

🧠 3. Sentiment & Behavior

- The structure resembles an Accumulation → Clear Breakout → Retest → Expansion sequence.

- The 4H RSI is climbing without being overbought, suggesting continuation potential.

🎯 4. Probable Scenario

- As long as price stays above $3,320, the bullish scenario remains intact. 🚀

- If the Supply Zone is cleared, the next target lies near $3,450–$3,500, with potential extension to a fresh ATH. 🏆

✅ Conclusion

Gold has regained short-term control. The structural breakout + intraday bullish momentum support a northward push.

🔔 Remain vigilant for macro catalysts (US inflation data, geopolitical tensions) that could propel gold even higher this week. 🌍

Gold has reignited its bullish momentum this week.

- Clean breakout of the bearish trendline that had been capping prices for several sessions.

- Rally followed a retest of a 1H IFVG and the OTE zone (retested last week) + POI.

📍 2. Key Technical Zone

- Price is now approaching a crucial Supply Zone around $3,360–$3,380, which represents the next resistance barrier.

🧠 3. Sentiment & Behavior

- The structure resembles an Accumulation → Clear Breakout → Retest → Expansion sequence.

- The 4H RSI is climbing without being overbought, suggesting continuation potential.

🎯 4. Probable Scenario

- As long as price stays above $3,320, the bullish scenario remains intact. 🚀

- If the Supply Zone is cleared, the next target lies near $3,450–$3,500, with potential extension to a fresh ATH. 🏆

✅ Conclusion

Gold has regained short-term control. The structural breakout + intraday bullish momentum support a northward push.

🔔 Remain vigilant for macro catalysts (US inflation data, geopolitical tensions) that could propel gold even higher this week. 🌍

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.