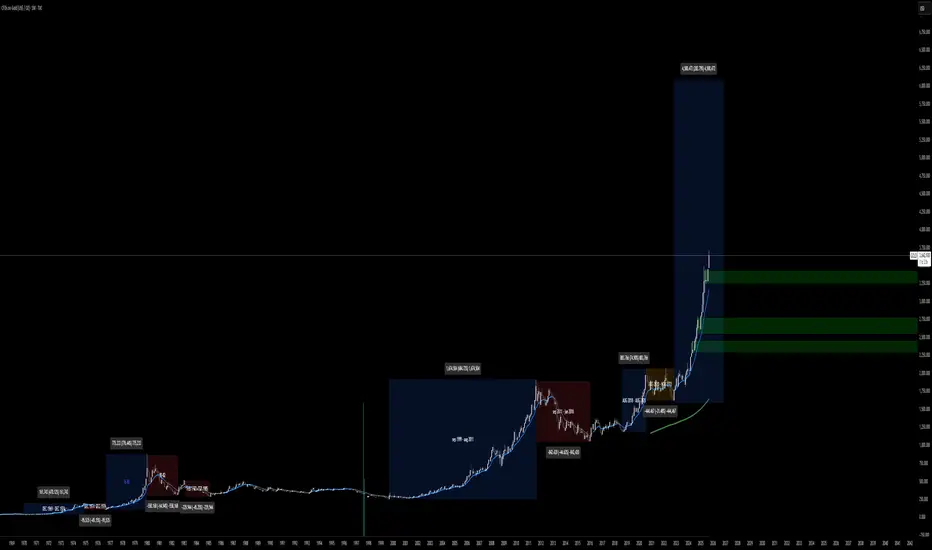

Looking at gold’s historical price action, one thing is clear: every major bull cycle has been followed by extended consolidations before the next explosive leg higher. The current chart structure mirrors past accumulation and breakout phases, but on a much larger scale.

Historic Cycles: Gold has repeatedly shown 5–10x expansions from cyclical lows. The late 1970s, early 2000s, and the post-2018 rally all followed similar exponential patterns.

Consolidation Complete: After the 2011–2015 correction and the 2020–2022 choppiness, gold has broken out decisively, confirming new momentum.

Exponential Curve: The long-term logarithmic growth channel suggests we are in the steepest phase of the curve — the parabolic extension.

📈 Projection: If gold continues following its historical rhythm, we are on track for a powerful multi-year rally that could extend until November 2026. The trajectory points toward several thousand dollars higher per ounce, with new all-time highs unfolding over the next 12–24 months.

💡 Why Now?

Central bank demand is at record highs.

Real interest rates remain structurally pressured.

Geopolitical instability and currency debasement narratives continue to push safe-haven demand.

Supply growth is stagnant, with major new mines years away from production.

Conclusion:

Gold is no longer just creeping higher — it’s breaking into a new exponential phase. The technicals and fundamentals are aligned for a bullish supercycle, and if history repeats, the blow-off could run until late 2026 before any major top forms.

Historic Cycles: Gold has repeatedly shown 5–10x expansions from cyclical lows. The late 1970s, early 2000s, and the post-2018 rally all followed similar exponential patterns.

Consolidation Complete: After the 2011–2015 correction and the 2020–2022 choppiness, gold has broken out decisively, confirming new momentum.

Exponential Curve: The long-term logarithmic growth channel suggests we are in the steepest phase of the curve — the parabolic extension.

📈 Projection: If gold continues following its historical rhythm, we are on track for a powerful multi-year rally that could extend until November 2026. The trajectory points toward several thousand dollars higher per ounce, with new all-time highs unfolding over the next 12–24 months.

💡 Why Now?

Central bank demand is at record highs.

Real interest rates remain structurally pressured.

Geopolitical instability and currency debasement narratives continue to push safe-haven demand.

Supply growth is stagnant, with major new mines years away from production.

Conclusion:

Gold is no longer just creeping higher — it’s breaking into a new exponential phase. The technicals and fundamentals are aligned for a bullish supercycle, and if history repeats, the blow-off could run until late 2026 before any major top forms.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.