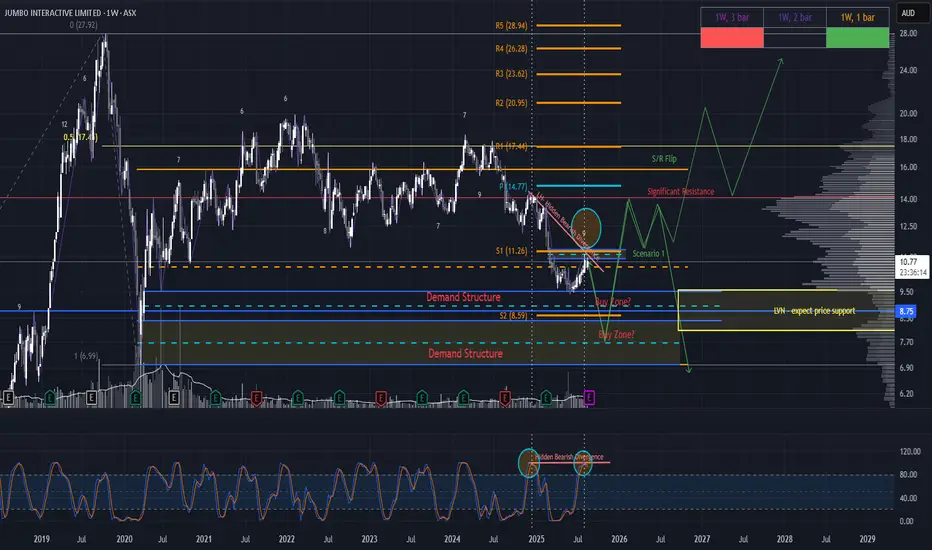

Jumbo Interactive (JIN) – Pre-Earnings Setup

JIN is primed for a classic retail shakeout, with the 26 August earnings release likely acting as a volatility catalyst. However, price action suggests the reaction could come ahead of the announcement, given the confluence of technical exhaustion signals.

Price Structure: Price has rallied for 9 consecutive bars, aligning with Gann’s reversal zone (7–10 bar swing rule). This rally is occurring on declining volume, into:

The yearly S1 pivot

A weekly fair value gap (FVG)

Hidden bearish divergence on the Stochastic RSI

Scenario Outlook: Expect a sharp reaction post-earnings (or sooner), targeting the Low Volume Node (LVN) or the Equilibrium of the monthly wick.

The ideal entry would be:

A closed daily dragonfly doji or bullish hammer candle in one of these two zones.

On elevated volume, signaling absorption and reversal

Profit Targets:

Initial TP: Macro 50% retracement ~$14 level or range high ~$16

Extended TP: Potential for a larger swing trade, contingent on a clean break above major resistance (S/R flip) with reaccumulation

Please note, arrows are not based on time analysis

JIN is primed for a classic retail shakeout, with the 26 August earnings release likely acting as a volatility catalyst. However, price action suggests the reaction could come ahead of the announcement, given the confluence of technical exhaustion signals.

Price Structure: Price has rallied for 9 consecutive bars, aligning with Gann’s reversal zone (7–10 bar swing rule). This rally is occurring on declining volume, into:

The yearly S1 pivot

A weekly fair value gap (FVG)

Hidden bearish divergence on the Stochastic RSI

Scenario Outlook: Expect a sharp reaction post-earnings (or sooner), targeting the Low Volume Node (LVN) or the Equilibrium of the monthly wick.

The ideal entry would be:

A closed daily dragonfly doji or bullish hammer candle in one of these two zones.

On elevated volume, signaling absorption and reversal

Profit Targets:

Initial TP: Macro 50% retracement ~$14 level or range high ~$16

Extended TP: Potential for a larger swing trade, contingent on a clean break above major resistance (S/R flip) with reaccumulation

Please note, arrows are not based on time analysis

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.