Educational breakdown based solely on chart structure

🔍 1. Chart Findings & Market Structure

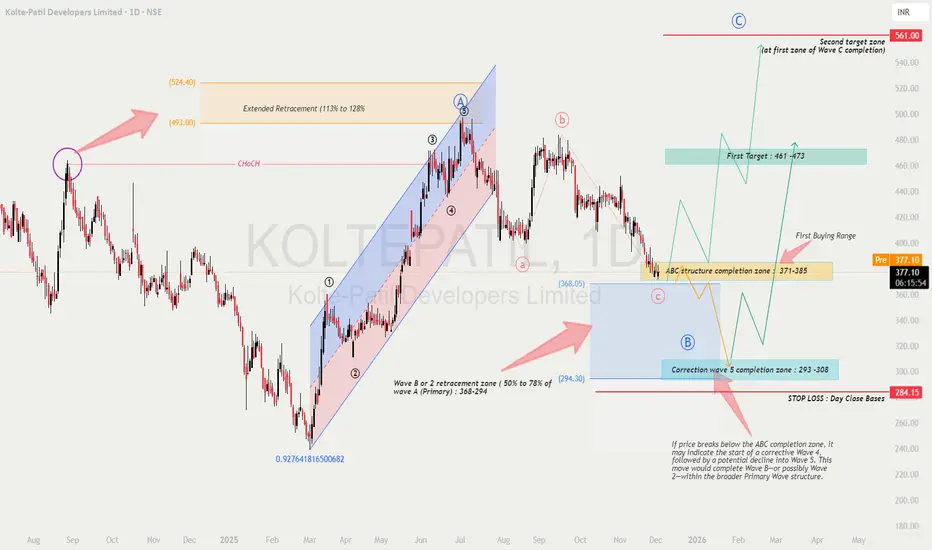

The chart shows a clear Elliott Wave progression, where the previous impulse (Primary Wave A) topped near ₹493–524, followed by a corrective ABC decline.

✔ Key Observations

Primary Wave A formed an impulsive rally inside a rising channel.

The price later broke structure (CHoCH) indicating loss of momentum.

Current price (₹377) is trading inside the ABC structure completion zone of ₹371–385, a critical decision area.

A deeper correction toward ₹293–308 remains possible if Wave C extends.

🎓 2. Educational Points (Why These Levels Matter)

📘 A. Extended Retracement Zone: 113–128%

The chart marks ₹493–524 as the extended retracement area, which often acts as:

A wave A termination area

Strong reversal zone

Liquidity grab region

This supports the idea that the major impulse from March–July is complete.

📘 B. Wave B / Wave 2 Retracement

A natural correction for Wave B or Wave 2 typically pulls back 50–78% of the previous impulse.

This gives the ₹368–294 broad range as the acceptable retracement.

📘 C. Completing Wave C (Corrective ABC)

Wave C generally equals Wave A or 1.272–1.618 extension of Wave A.

The chart’s projection supports a potential completion:

First zone: ₹371–385 (current test)

Final zone: ₹293–308 (if extended C-wave unfolds)

📉 3. Current Price Action Insight

Price is currently hovering near the ABC structure completion zone (₹371–385).

No strong bullish reversal candle is visible yet—indicating buyers are waiting for confirmation.

Price remains in a downward corrective structure, but nearing exhaustion.

This phase is ideal for planning, not rushing.

🔮 4. Future Prediction Based on Wave Theory

Two scenarios emerge:

🟦 Scenario 1: ABC Correction Completes at Current Levels (₹371–385)

If the current demand zone holds:

Price forms a wave B bottom and begins Primary Wave C upward.

Expected targets:

🎯 First Target: ₹461–473

🎯 Final Target: ₹561 (Primary Wave C completion zone)

🟥 Scenario 2: ABC Correction Extends to ₹293–308

If ₹371–385 fails:

Market enters the correction wave 5 completion zone (₹293–308).

From this demand block, a stronger bullish reversal is expected.

Long-term bullish structure remains intact if it stays above ₹284 (stop level).

🛒 5. Buying Strategy (Educated Approach)

🟩 FIRST BUYING RANGE: ₹371–385 (Conservative Entry)

Enter only if:

Strong bullish candle (engulfing / pin bar / OB reclaim)

RSI bullish divergence

Price closes above structure high (minor CHoCH)

🟦 SECOND BUYING RANGE: ₹293–308 (High-Value Entry)

A deeper correction provides:

Lower risk

Maximum R:R

Stronger probability of reversal

Use this zone if the first one fails.

⚖ 6. Risk–Reward Analysis

If entering at ₹371–385

Stop-Loss: Below ₹284 (daily close basis)

Upside Potential: Up to ₹561

Reward : Risk Ratio: Approx 3.5–4.2 R

If entering at ₹293–308

Stop-Loss: Below ₹284

Upside Potential: Up to ₹473–561

Reward : Risk Ratio: Approx 5–7 R (excellent)

🔐 7. Confirmation Strategies for Better Entries

Use any two or more of the following:

✔ 1. Market Structure Shift

Wait for a CHoCH above the last swing high inside the zone.

✔ 2. Volume Expansion

Rising green volume during rebound increases reliability.

✔ 3. Bullish Divergence (RSI or MACD)

Signals weakening sellers.

✔ 4. Break & Retest Method

Let price break a minor resistance

Enter on retest to confirm strength

✔ 5. Demand Zone Reaction

Look for:

Long tail candles

Absorption wicks

Order block reclaim

These indicate smart money interest.

🧠 8. Summary & View

The stock is in the final leg of a correction and is approaching highly reactive Fibonacci zones.

Structure favors a bullish wave (Primary Wave C) in the coming months if key support holds.

📌 First confirmation: Bounce from ₹371–385

📌 Strongest bullish case: Reversal from ₹293–308

📌 Invalidation: Close below ₹284

The long setup has strong wave logic, clean levels, and attractive R:R.

⚠️ Disclaimer

This analysis is for educational purposes only and reflects wave-structure interpretation based solely on the provided chart.

I am not a SEBI-registered analyst.

Please conduct your own research or consult your financial advisor before trading or investing.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.

Declinazione di responsabilità

Le informazioni e le pubblicazioni non sono intese come, e non costituiscono, consulenza o raccomandazioni finanziarie, di investimento, di trading o di altro tipo fornite o approvate da TradingView. Per ulteriori informazioni, consultare i Termini di utilizzo.