LEU is in short squeeze territory.

Float: ~15.8M shares

Short Interest: ~2.92M shares (~18.5% of float)

Days to Cover: 2.7–3.4 (based on avg. volume)

Cost to Borrow: >12% APR — elevated friction for short holding

Utilization: 100% — all lendable shares are actively short

Off-Exchange Volume: 52.9% of total daily volume

Average DP activity: trending higher last 5 sessions

Interpretation: Consistent dark pool action + volume spikes = institutional movement. Large buys may be being masked to avoid alerting retail and algos.

Call Volume Surge: ~12,380 contracts vs 3K avg

Put/Call Ratio: 0.6 — bullish bias

IV Rank: ~43%

IV Level: ~79.5% (historically high but not dangerous)

Unusual Flow: Deep OTM calls for July and August being loaded — $180, $200, $250

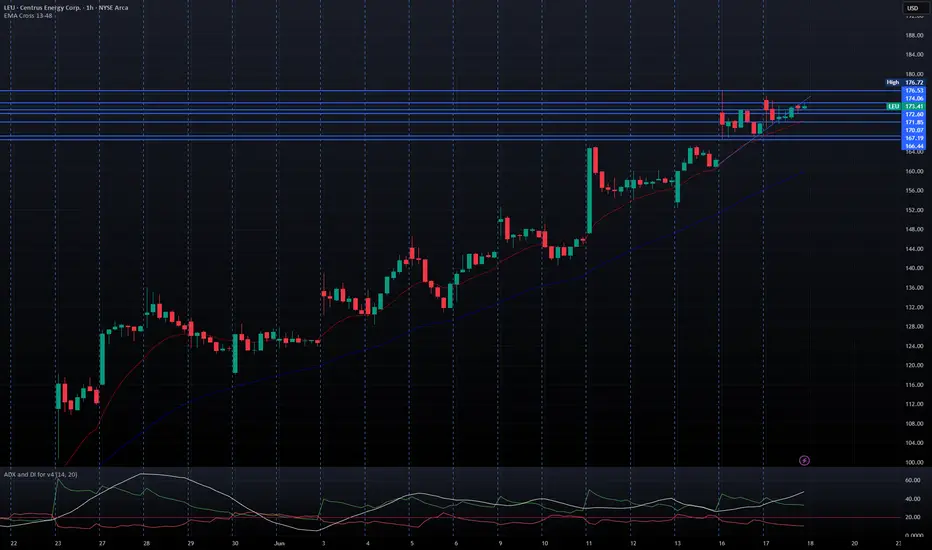

Current Price: $173.66

Today’s High: $175.65

Breakout Zone: $165–168 (just cleared)

Next Resistance: $180.50 → $186 → $195

Support: $167.20 → $161.80

Volume: Over 1.02M — first major 1M+ session since March

RSI: ~86 — hot but normal in short squeeze scenarios

MACD: Just crossed bullishly on daily

Entry: $170–172

Risk: Stop at $163

Target 1: $180

Target 2: $188–190

Stretch Target: $200+ on gamma ramp if momentum holds

Float: ~15.8M shares

Short Interest: ~2.92M shares (~18.5% of float)

Days to Cover: 2.7–3.4 (based on avg. volume)

Cost to Borrow: >12% APR — elevated friction for short holding

Utilization: 100% — all lendable shares are actively short

Off-Exchange Volume: 52.9% of total daily volume

Average DP activity: trending higher last 5 sessions

Interpretation: Consistent dark pool action + volume spikes = institutional movement. Large buys may be being masked to avoid alerting retail and algos.

Call Volume Surge: ~12,380 contracts vs 3K avg

Put/Call Ratio: 0.6 — bullish bias

IV Rank: ~43%

IV Level: ~79.5% (historically high but not dangerous)

Unusual Flow: Deep OTM calls for July and August being loaded — $180, $200, $250

Current Price: $173.66

Today’s High: $175.65

Breakout Zone: $165–168 (just cleared)

Next Resistance: $180.50 → $186 → $195

Support: $167.20 → $161.80

Volume: Over 1.02M — first major 1M+ session since March

RSI: ~86 — hot but normal in short squeeze scenarios

MACD: Just crossed bullishly on daily

Entry: $170–172

Risk: Stop at $163

Target 1: $180

Target 2: $188–190

Stretch Target: $200+ on gamma ramp if momentum holds

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.

Declinazione di responsabilità

Le informazioni ed i contenuti pubblicati non costituiscono in alcun modo una sollecitazione ad investire o ad operare nei mercati finanziari. Non sono inoltre fornite o supportate da TradingView. Maggiori dettagli nelle Condizioni d'uso.